- Home

- Aadc Deficiency Market

AADC Deficiency Market : Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: May, 2023 | Report ID: CLS-1931 | No of pages: 250 | Format:

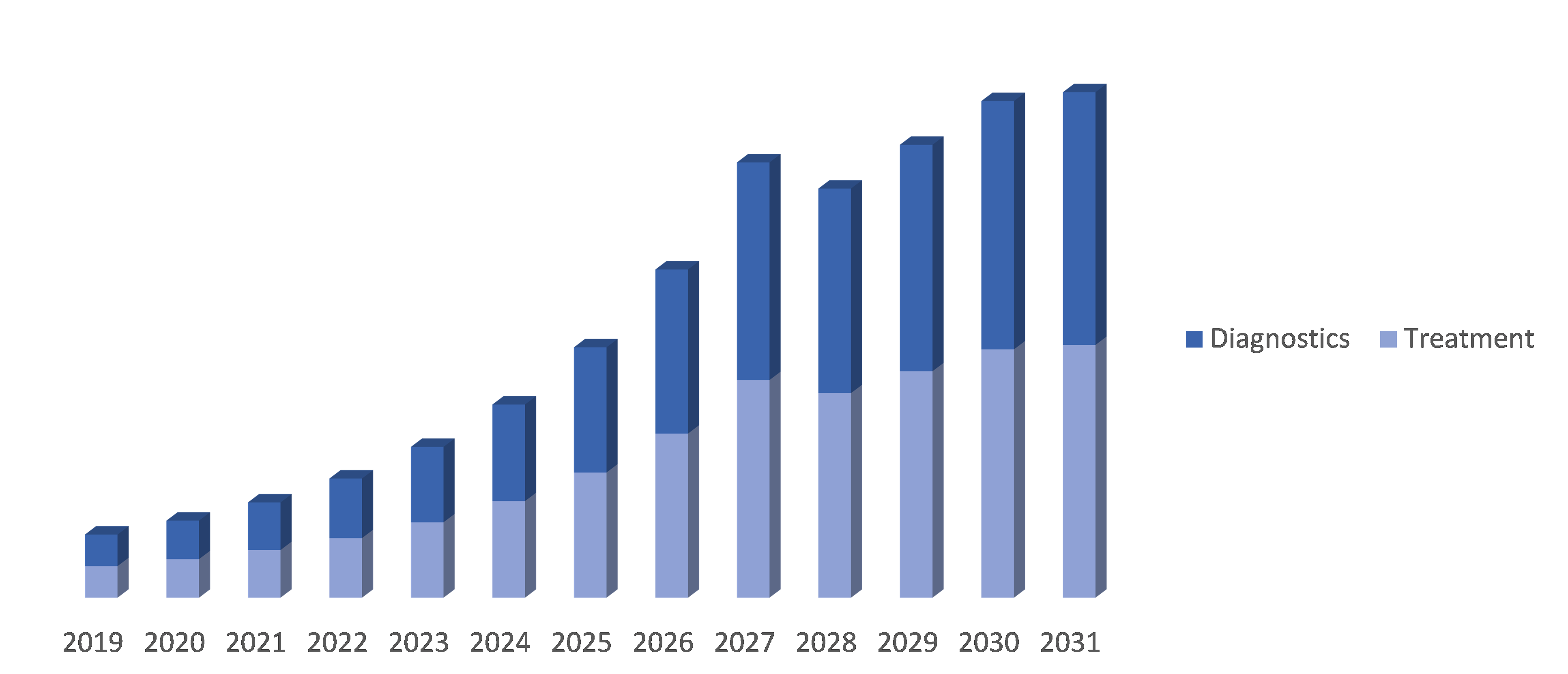

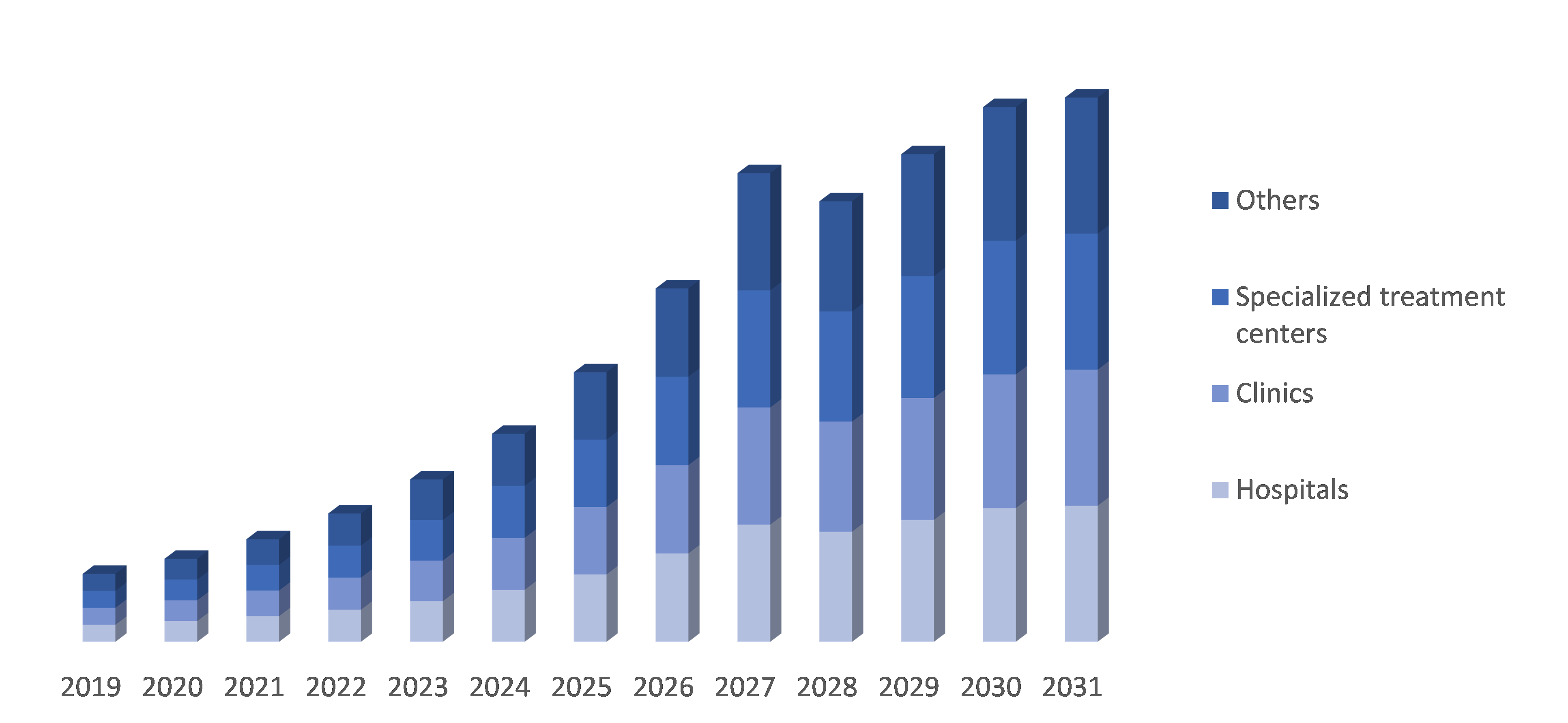

AADC Deficiency Market by Treatment and Diagnostics (Treatment {Gene therapy, Enzyme replacement therapy, Symptomatic treatment and Combination therapy} Diagnostics {Genetic testing, Biochemical testing, Enzyme activity testing and Others}), by End-users (Hospitals, Clinics, Specialized treatment centers and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

The AADC Deficiency market was valued at $XX million in 2022. It is projected to grow at a CAGR of 12.2% from 2023 to 2031 and reach more than XX million by the end of 2031.

Analysts’ Viewpoint

AADC deficiency is a rare genetic disorder that affects the production of neurotransmitters in the brain. Although the disorder is extremely rare, it can have a significant impact on the lives of affected individuals and their families. From an analyst's viewpoint, AADC deficiency represents an area of high unmet medical need, as there are currently no effective treatments available to address the underlying cause of the disorder. While symptomatic treatment can help manage some of the symptoms associated with the disorder, it is not a cure and does not address the underlying genetic defect.

The rarity of the disorder also presents challenges for diagnosis and treatment, as many healthcare providers may be unfamiliar with the disorder and its symptoms. Increased awareness and education among healthcare providers and the public could help improve diagnosis and treatment outcomes for affected individuals.

From a research perspective, there is a need for continued investigation into the underlying genetic and molecular mechanisms of AADC deficiency, as well as the development of targeted treatments that address the root cause of the disorder. Gene therapy and enzyme replacement therapy represent promising avenues of research that could potentially lead to more effective treatments in the future.

AADC Deficiency Overview

AADC deficiency, also known as aromatic L-amino acid decarboxylase deficiency, is a rare genetic disorder that affects the production of neurotransmitters in the brain. It is caused by mutations in the DDC gene, which provides instructions for making the enzyme aromatic L-amino acid decarboxylase (AADC). This enzyme is necessary for the synthesis of several neurotransmitters, including dopamine, serotonin, and norepinephrine. AADC deficiency is an extremely rare disorder, and its prevalence is difficult to determine due to the small number of reported cases. It is estimated to affect approximately 1 in 100,000 to 1 in 2,000,000 individuals worldwide. However, the prevalence may be higher in certain populations, such as in Taiwan where the prevalence is estimated to be around 1 in 19,000 individuals.

One of the key drivers of market growth is the increasing awareness of rare diseases, including AADC deficiency, among the medical community and the general public. As awareness of the disorder grows, more cases are being diagnosed, leading to earlier treatment and improved outcomes for patients. This trend is expected to continue as healthcare professionals become more familiar with the disorder and its symptoms.

Advances in research are also expected to drive market growth for AADC deficiency. Ongoing research into the genetic and molecular mechanisms of the disorder is leading to the development of new and more effective treatments. Gene therapy and enzyme replacement therapy are two promising areas of research that could potentially lead to breakthrough treatments for AADC deficiency. As these treatments are developed and brought to market, the demand for AADC deficiency treatments is expected to increase.

Regulatory incentives are another driver of market growth for AADC deficiency. Regulatory agencies, such as the FDA and EMA, offer incentives for the development of treatments for rare diseases, including AADC deficiency. These incentives include orphan drug status, which can provide financial and regulatory benefits to companies developing treatments for rare diseases. These incentives are expected to encourage more companies to invest in the development of treatments for AADC deficiency, leading to more options for patients and increased market growth.

Finally, growing investment by pharmaceutical companies and venture capitalists in the development of treatments for rare diseases is expected to drive market growth for AADC deficiency. This investment is expected to lead to the development of new and more effective treatments for AADC deficiency in the future, further increasing demand for treatments and driving market growth.

New product launches to flourish in the market

January 2021 - Taysha Gene Therapies announced the initiation of a Phase 1/2 clinical trial of its investigational gene therapy, TSHA-120, for the treatment of AADC deficiency. January 2020 - MeiraGTx Holdings announced the initiation of a Phase 1/2 clinical trial of its investigational gene therapy, AAV9-Slc6a19, for the treatment of AADC deficiency. In August 2020 - Axovant Gene Therapies announced the initiation of a Phase 2 clinical trial of its investigational gene therapy, AXO-AAV-NTN, for the treatment of AADC deficiency.

Segment Overview:

By Treatment and Diagnostics: The AADC Deficiency market is divided into Treatment {Gene therapy, Enzyme replacement therapy, Symptomatic treatment and Combination therapy} and Diagnostics {Genetic testing, Biochemical testing, Enzyme activity testing and Others. The increasing awareness and understanding of the disorder among healthcare professionals and the general public have led to earlier diagnosis and improved management. The development of various diagnostic tests, such as genetic testing and biochemical testing, has helped in accurate diagnosis and monitoring of the disease progression. Additionally, the availability of treatment options, including gene therapy, enzyme replacement therapy, symptomatic treatment, and combination therapy, has further fuelled the market growth.

By End-user: The AADC Deficiency market is segmented by end-user, with Hospitals, Clinics, Specialized treatment centers and others. These end-users play a vital role in the diagnosis, treatment, and management of AADC deficiency patients. Hospitals and specialized treatment centers are expected to have a significant share in the market due to the availability of advanced diagnostic and treatment options. Clinics and other healthcare facilities also play a crucial role in the early diagnosis and management of AADC deficiency, especially in regions with limited access to specialized treatment centers.

By Region:

The North American market for AADC deficiency is expected to grow significantly in the coming years. The region has a well-developed healthcare infrastructure and a high level of awareness about rare diseases, including AADC deficiency. Additionally, there is ongoing research and development of new treatments for the disorder, which is expected to drive market growth. The region also has regulatory incentives for the development of treatments for rare diseases, including AADC deficiency. The growing investment by pharmaceutical companies and venture capitalists in the development of treatments for rare diseases is also expected to contribute to the growth of the market in North America.

The Asia Pacific AADC Deficiency market is expected to grow significantly in the coming years due to factors such as improving healthcare infrastructure, increasing awareness about rare diseases, and rising investments by pharmaceutical companies in the region. Additionally, the high prevalence of the disorder in some countries, such as China and Japan, is expected to drive market growth. The availability of advanced diagnostic and treatment options, such as gene therapy and enzyme replacement therapy, is also expected to boost market growth. However, the lack of reimbursement policies and the high cost of treatment could potentially hinder market growth in some countries in the region.

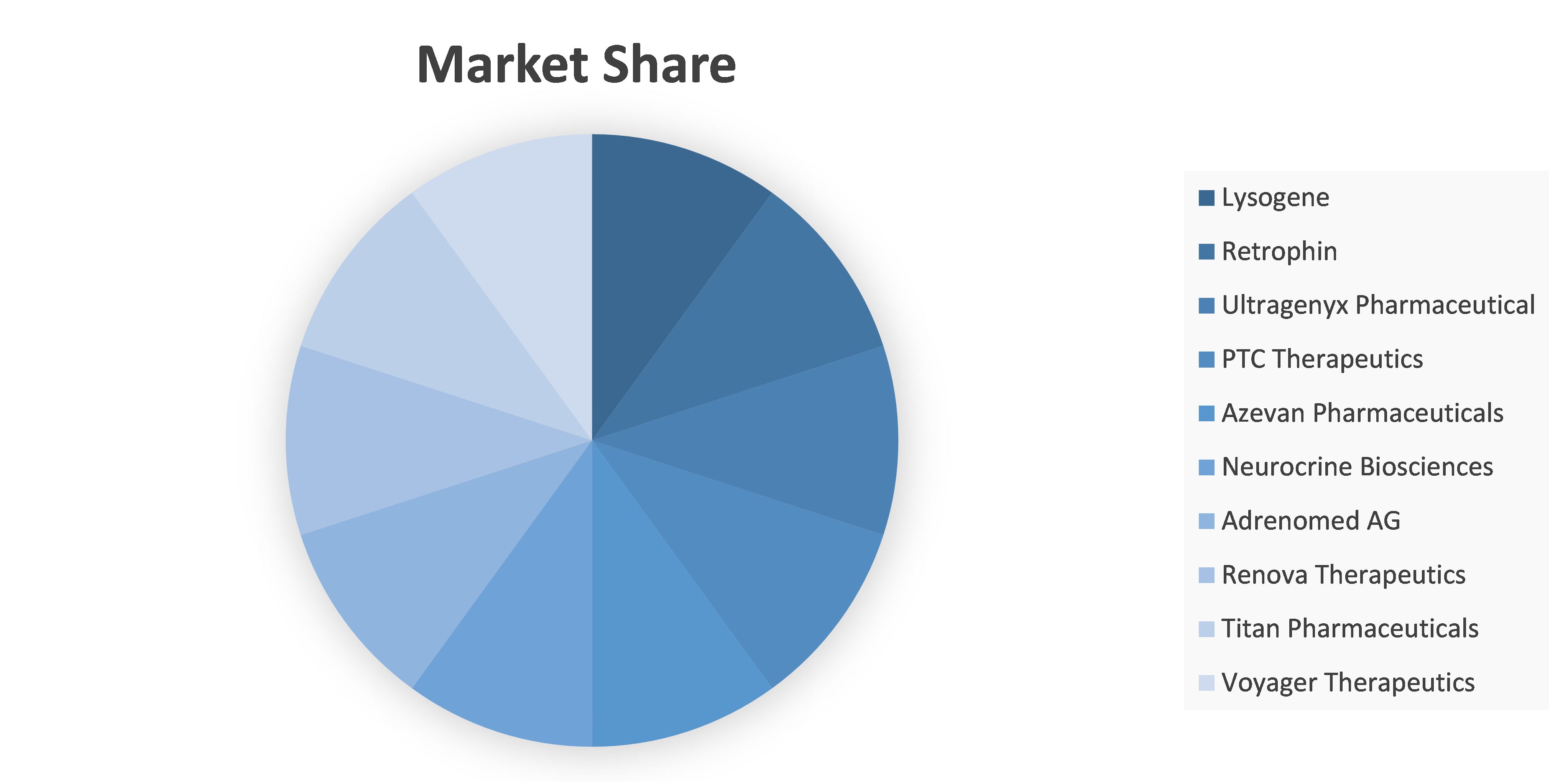

Competitive analysis and profiles of the major players in the AADC Deficiency market, such as Lysogene, Retrophin, Ultragenyx Pharmaceutical, PTC Therapeutics, Azevan Pharmaceuticals, Neurocrine Biosciences, Adrenomed AG, Renova Therapeutics, Titan Pharmaceuticals and Voyager Therapeutics. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the AADC Deficiency market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Treatment & Diagnostics, and End-user, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, LAMEA |

|

Companies Covered |

|

Key Segments Covered

Treatment & Diagnostics

- Treatment

- Gene therapy

- Enzyme replacement therapy

- Symptomatic treatment

- Combination therapy

- Diagnostics

- Genetic testing

- Biochemical testing

- Enzyme activity testing

- Others

End-user

- Hospitals

- Clinics

- Specialized treatment centers

- Others

Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Treatment & Diagnostics

- By End-User trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- AADC Deficiency Market, by Treatment & Diagnostics & Diagnostics

- Treatment & Diagnostics

- Gene therapy

- Enzyme replacement therapy

- Symptomatic Treatment & Diagnostics

- Combination therapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diagnostics

- Genetic testing

- Biochemical testing

- Enzyme activity testing

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Treatment & Diagnostics

- AADC Deficiency Market, by End-User

- Hospitals

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Clinics

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Specialized Treatment & Diagnostics centers

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospitals

- AADC Deficiency Market, by Region

- North America

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- LAMEA

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Africa

- Market size and forecast, by Treatment & Diagnostics, 2022-2031

- Market size and forecast, by End-User , 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Lysogene

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Retrophin

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Ultragenyx Pharmaceutical

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- PTC Therapeutics

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Azevan Pharmaceuticals

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Neurocrine Biosciences

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Adrenomed AG

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Renova Therapeutics

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Titan Pharmaceuticals

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Voyager Therapeutics

- Business overview

- Financial performance

- Treatment & Diagnostics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Lysogene

Segmentation

Key Segments Covered

Treatment & Diagnostics

- Treatment

- Gene therapy

- Enzyme replacement therapy

- Symptomatic treatment

- Combination therapy

- Diagnostics

- Genetic testing

- Biochemical testing

- Enzyme activity testing

- Others

End-user

- Hospitals

- Clinics

- Specialized treatment centers

- Others

Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.