- Home

- Ambulatory Surgical Centers Market

Ambulatory Surgical Centers Market Research Report 2023

- Published Date: May, 2023 | Report ID: CLS-1933 | No of pages: 250 | Format:

Ambulatory Surgical Centers Market by Modality (Hospital-Based Ambulatory Surgical Center and Freestanding Ambulatory Surgical Center), by Speciality Type (Multi-specialty and Single specialty), by Service (Diagnosis and Treatment): Global Opportunity Analysis and Industry Forecast, 2022-2031

The Ambulatory Surgical Centers market was valued at $50.5 billion in 2022. It is projected to grow at a CAGR of 4.5% from 2023 to 2031 and reach more than $90 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Ambulatory Surgical Centers (ASCs) market is expected to see significant growth in the coming years. This growth is being driven by several factors, including an increasing demand for outpatient surgical procedures, technological advancements, and a focus on patient-centered care. ASCs offer a range of benefits over traditional hospital-based surgeries, including shorter wait times, reduced costs, and a more comfortable environment for patients. This has led to an increase in demand for ASCs, particularly for routine procedures such as cataract surgery, colonoscopies, and joint replacements.

In addition to increasing demand, the ASCs market is also being driven by technological advancements that have made it possible to perform more complex procedures in an outpatient setting. This has expanded the range of procedures that can be performed in ASCs, driving demand for these facilities. Governments around the world are also recognizing the cost-saving benefits of ASCs and are providing support for their development. This has led to an increase in the number of ASCs, particularly in emerging markets. Overall, industry analysts are bullish on the ASCs market, with many predicting significant growth in the coming years. However, there are also challenges that must be addressed, including concerns around patient safety and regulatory compliance. As the market continues to evolve, stakeholders will need to work together to address these challenges and ensure that ASCs can continue to provide safe, high-quality care to patients.

Ambulatory Surgical Centers Overview

Ambulatory Surgical Centers (ASCs) are facilities that offer same-day surgical procedures to patients who do not require overnight hospitalization. These centers are also known as outpatient surgery centers or same-day surgery centers. ASCs offer a range of surgical procedures, including orthopedic surgeries, ophthalmic surgeries, gastrointestinal surgeries, plastic surgeries, and more. Patients can often undergo these procedures in a more comfortable and convenient environment than in a hospital, and at a lower cost. ASCs are regulated by state and federal laws and must meet certain standards of safety and quality. They are staffed by a team of healthcare professionals, including surgeons, nurses, anesthesiologists, and other support staff, who are dedicated to providing high-quality care in a safe and comfortable environment.

ASCs have emerged as a preferred option for patients seeking surgical procedures due to several unique drivers. One key driver is patient preference, as ASCs offer a more convenient, personalized, and comfortable experience compared to traditional hospital-based surgeries. For instance, patients can avoid long wait times and overnight stays, which can be especially challenging for patients with limited mobility or those requiring specialized care. Moreover, ASCs are generally smaller and more focused on specific specialties, such as orthopedics or ophthalmology, allowing for more personalized attention and care.

Another significant driver of the ASC market is cost savings. Compared to traditional hospitals, ASCs generally have lower overhead costs and shorter patient stays, resulting in lower costs for both patients and insurers. For example, a study by the Ambulatory Surgery Center Association found that ASCs typically save patients and insurers between 30-50% on the cost of surgery compared to hospital-based surgeries. This cost savings has made ASCs an attractive option for patients seeking elective surgeries, such as cataract surgery, which may not be covered by insurance.

Advances in medical technology have also contributed to the growth of the ASC market, enabling more complex surgeries to be performed in these facilities. For instance, minimally invasive surgical techniques, such as laparoscopy and arthroscopy, have made many surgical procedures less invasive and easier to perform in an outpatient setting. Moreover, technological advancements in anesthesia and pain management have reduced the need for overnight stays and improved patient comfort.

Government support has also played a significant role in the development of the ASC market. Governments around the world have recognized the benefits of ASCs and are providing funding for the construction and operation of these facilities. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) has expanded coverage for ASC procedures and established quality standards for these facilities to ensure patient safety.

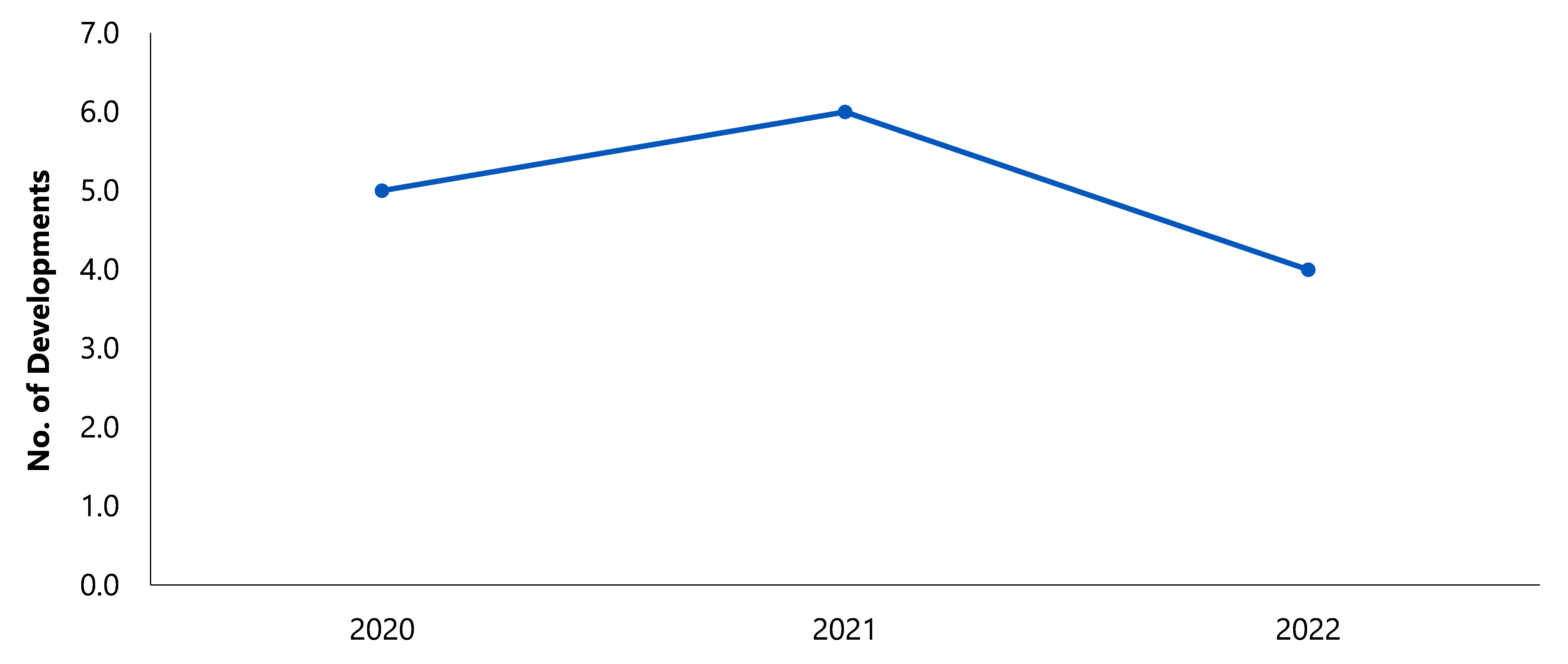

New product launches to flourish in the market

The Ambulatory Surgical Centers market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Ambulatory Surgical Centers market are:

- Hologic's Brevera breast biopsy system - This system was launched in 2020 and provides a faster, more efficient, and less invasive way to perform breast biopsies in ASCs. The system is designed to help increase patient comfort and reduce procedure time.

- Stryker's Mako robotic-arm assisted surgery system - This system was launched in 2019 and is used in ASCs for total knee replacement surgeries. The system provides real-time imaging and helps surgeons to plan and execute more accurate and efficient procedures.

- ConMed's OrthoFuzion navigated drilling system - This system was launched in 2021 and provides navigation guidance for drilling during orthopedic procedures in ASCs. The system helps to improve accuracy and reduce procedure time, while also reducing radiation exposure for patients and surgical staff.

Segment Overview:

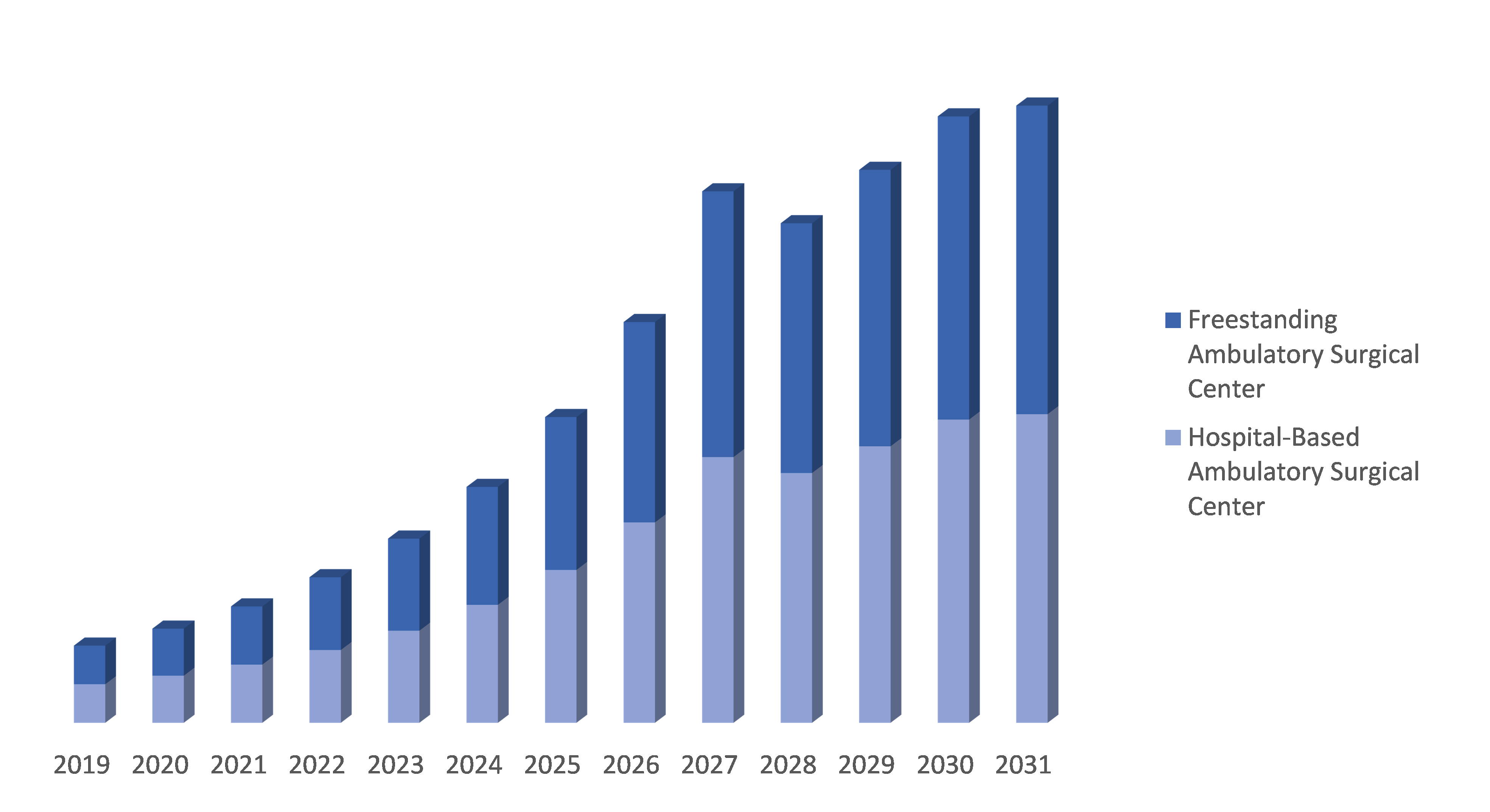

By Modality: The Ambulatory Surgical Centers market is divided into Hospital-Based Ambulatory Surgical Center and Freestanding Ambulatory Surgical Center. Hospital-Based Ambulatory Surgical Centers, which are located within a hospital and are often operated by the hospital itself, and Freestanding Ambulatory Surgical Centers, which are standalone facilities that specialize in outpatient procedures. Both types offer a range of surgical procedures and aim to provide patients with high-quality care in a convenient and efficient setting.

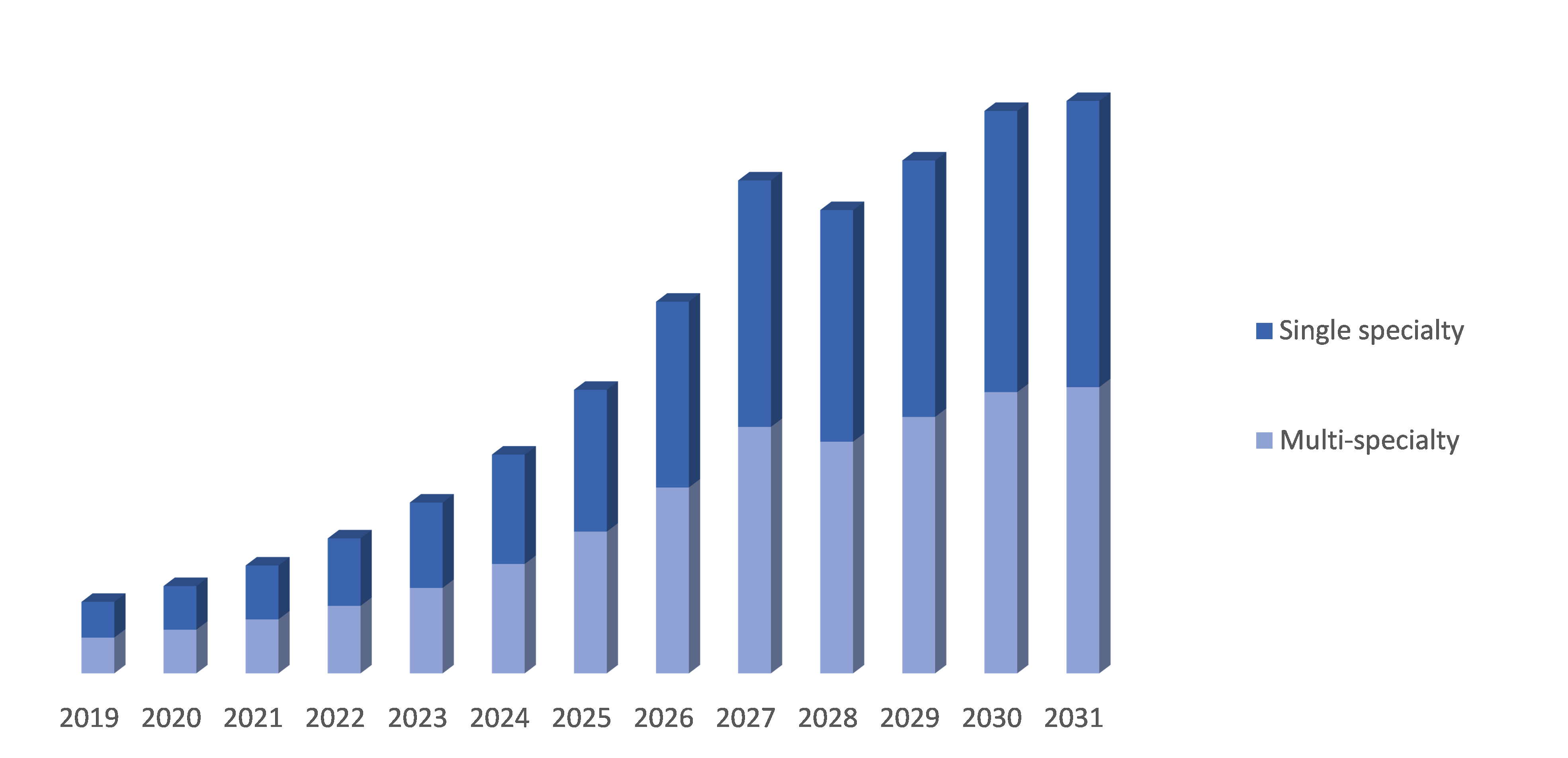

By Speciality Type: The Ambulatory Surgical Centers market is segmented by Multi-specialty and Single specialty. Multi-specialty centers offer a variety of procedures across different medical specialties, such as orthopedics, ophthalmology, and gastroenterology. Single specialty centers, on the other hand, specialize in one or a limited number of medical specialties, such as dermatology or plastic surgery. This segmentation allows for more targeted services and can help providers better meet the needs of their patients.

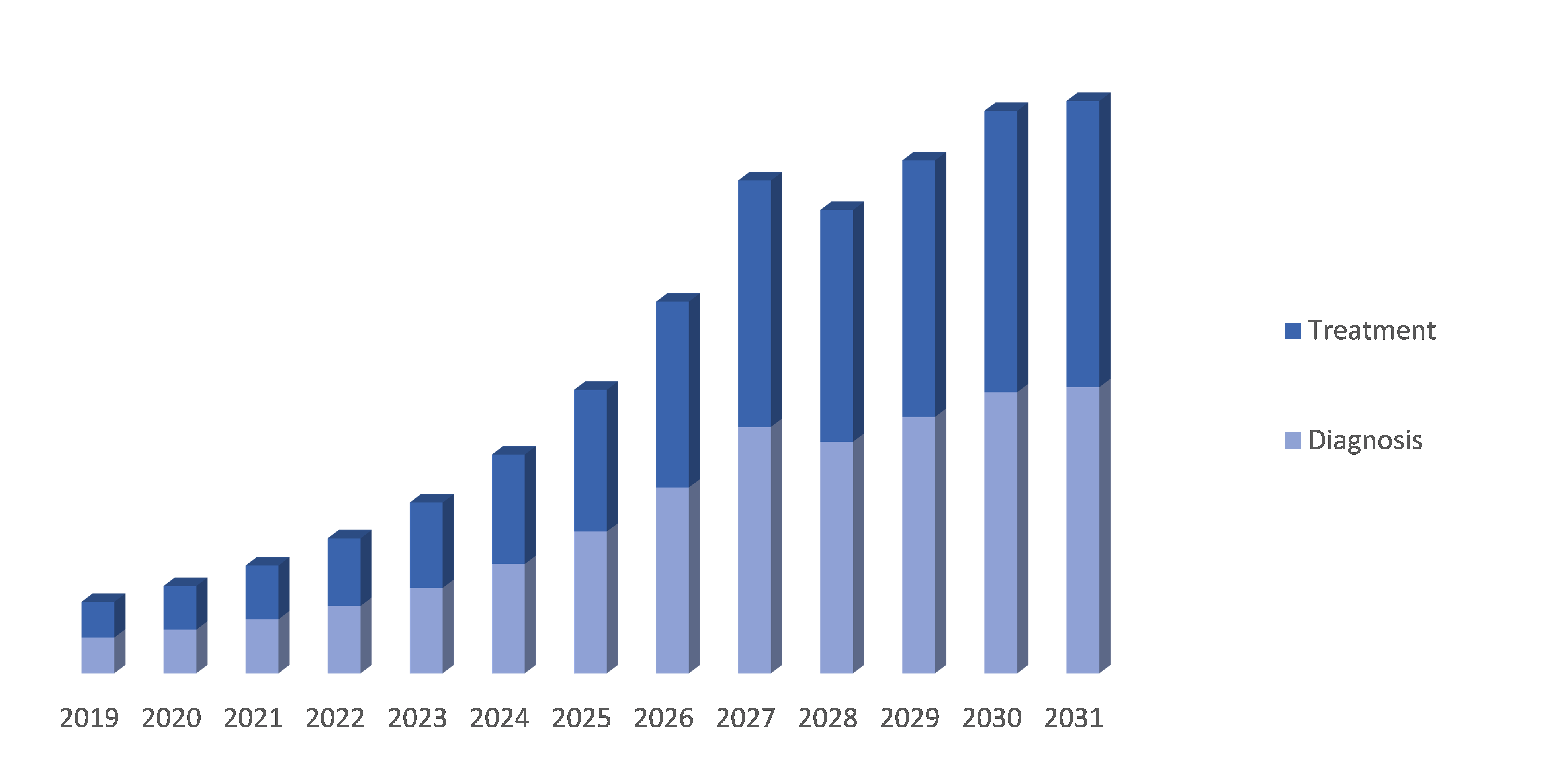

By Service: The Ambulatory Surgical Centers market is segmented by Diagnosis and Treatment. The Diagnosis segment includes procedures such as endoscopy, colonoscopy, and biopsy. The Treatment segment includes procedures such as orthopedic, ophthalmic, and cardiovascular surgeries. These segments are further categorized into various sub-segments based on the specific procedure or condition being treated. This segmentation allows healthcare providers and ASCs to better understand the needs of patients and offer targeted, specialized care.

By Region:

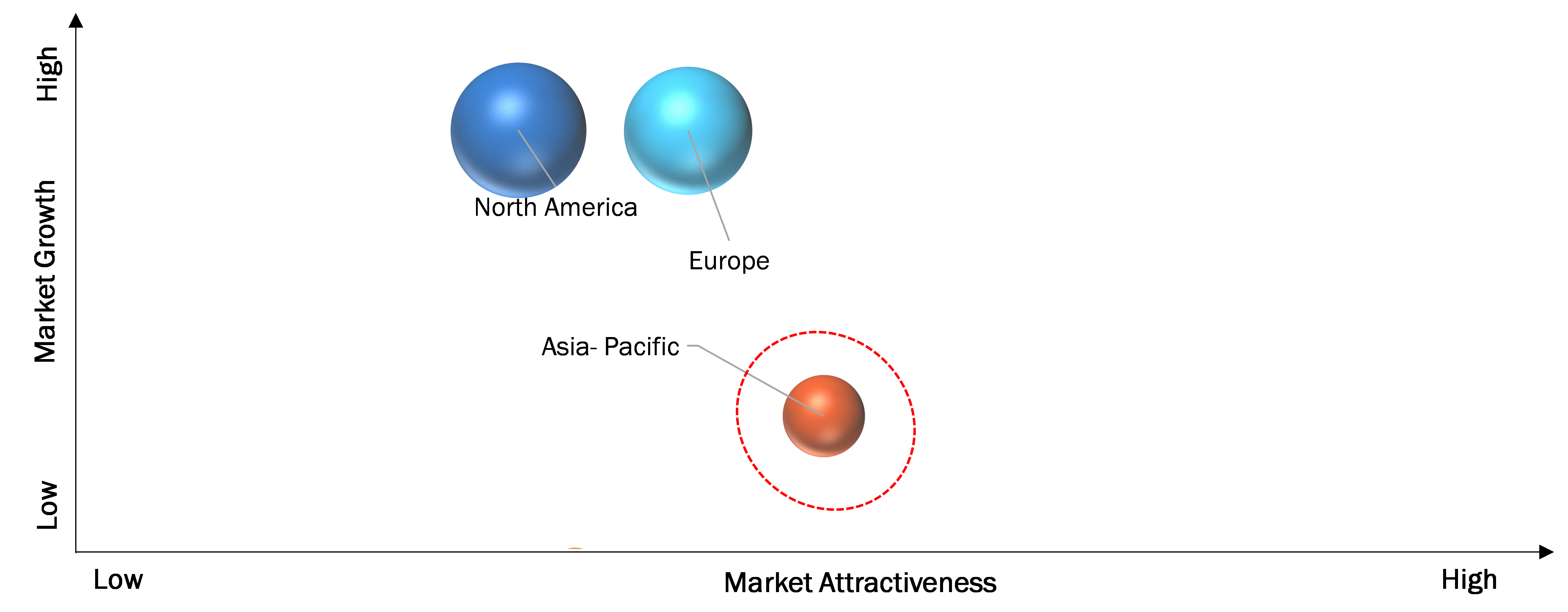

The North American Ambulatory Surgical Centers (ASC) market is a rapidly growing segment of the healthcare industry. ASCs provide same-day surgical care, allowing patients to return home the same day as their procedure. This market is driven by several factors, including the increasing demand for more efficient and cost-effective healthcare services, the aging population, and advancements in medical technology. The market is highly competitive and is dominated by key players such as UnitedHealth Group, Tenet Healthcare Corporation, and Envision Healthcare. The market is expected to continue to grow in the coming years, driven by the increasing demand for outpatient procedures and the trend towards value-based care.

The Asia Pacific (APAC) Ambulatory Surgical Centers (ASC) market is a rapidly growing segment of the healthcare industry. This market is driven by the increasing demand for more accessible and cost-effective healthcare services, rising healthcare expenditures, and growing awareness among patients. The market is highly competitive and is dominated by key players such as Nueterra Capital, Terveystalo Healthcare, and Apollo Health and Lifestyle. The market is expected to continue to grow in the coming years, driven by the increasing adoption of ASCs in emerging economies and the trend towards value-based care.

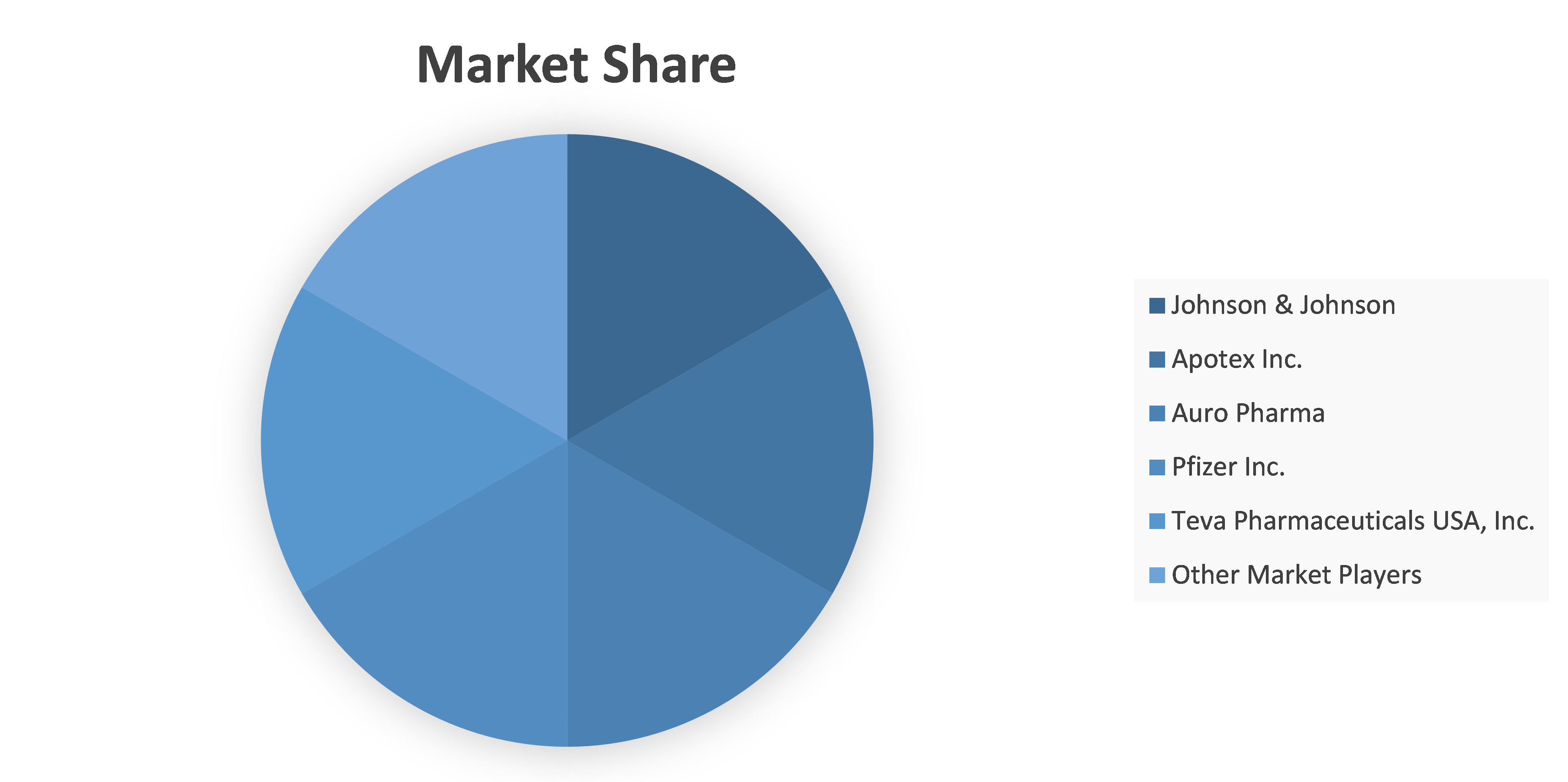

Competitive analysis and profiles of the major players in the Ambulatory Surgical Centers market, such as Envision Healthcare, TH Medical, MEDNAX Services Inc., TeamHealth, UnitedHealth Group, QHCCS, LLC, Surgery Partners, NOVENA GLOBAL HEALTHCARE GROUP, INC., CHSPSC, LLC, Terveystalo, SurgCenter, Healthway Medical Group and Prospect Medical Systems. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Ambulatory Surgical Centers market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By specialty type, modality and services, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, LAMEA |

|

Companies Covered |

|

Key Segments Covered

Modality

- Hospital-Based Ambulatory Surgical Center

- Freestanding Ambulatory Surgical Center

Speciality Type

- Multi-specialty

- Single specialty

Service

- Diagnosis

- Treatment

Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Modality trends

- By Speciality Type trends

- By Service trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Ambulatory Surgery Center Market, by Modality

- Hospital-Based Ambulatory Surgical Center

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Freestanding Ambulatory Surgical Center

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospital-Based Ambulatory Surgical Center

- Ambulatory Surgery Center Market, by Speciality Type

- Multi-specialty

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Single specialty

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Multi-specialty

- Ambulatory Surgery Center Market, by Service

- Diagnosis

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Treatment

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diagnosis

- Ambulatory Surgery Center Market, by Region

- North America

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- LAMEA

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Africa

- Market size and forecast, by Modality, 2022-2031

- Market size and forecast, by Speciality Type, 2022-2031

- Market size and forecast, by Service , 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Envision Healthcare

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- TH Medical

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- MEDNAX Services Inc.

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- TeamHealth

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- UnitedHealth Group

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- QHCCS, LLC

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- Surgery Partners

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- NOVENA GLOBAL HEALTHCARE GROUP, INC.

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- CHSPSC, LLC

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- Terveystalo

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- Other Prominent Players

- Business overview

- Financial performance

- Modality portfolio

- Recent strategic moves & developments

- SWOT analysis

- Envision Healthcare

Segmentation

Key Segments Covered

Modality

- Hospital-Based Ambulatory Surgical Center

- Freestanding Ambulatory Surgical Center

Speciality Type

- Multi-specialty

- Single specialty

Service

- Diagnosis

- Treatment

Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.