- Home

- Animal Diagnostics Market

Animal Diagnostics Market by Product (Consumables, Reagents & Kits and Instruments & Devices), by Species (Cattle, Canine, Feline, Caprine, Equine, Ovine, Porcine, Avian, and Others), by Testing Type (Analytical Services, Diagnostic Imaging, Bacteriology, Pathology, Molecular Diagnostics, Immunoassays, Parasitology, Serology, and Virology) By Disease Type (Infectious Diseases, Non-Infectious Diseases, Hereditary, Congenital and Acquired Diseases, General Ailments, Structural and Functional Diseases) By End-use (Laboratories, Veterinary Hospitals and Clinics, Point-Of-Care/In-House Testing, Research Institutes and Universities): Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: December, 2023 | Report ID: CLS-2024 | No of pages: 250 | Format:

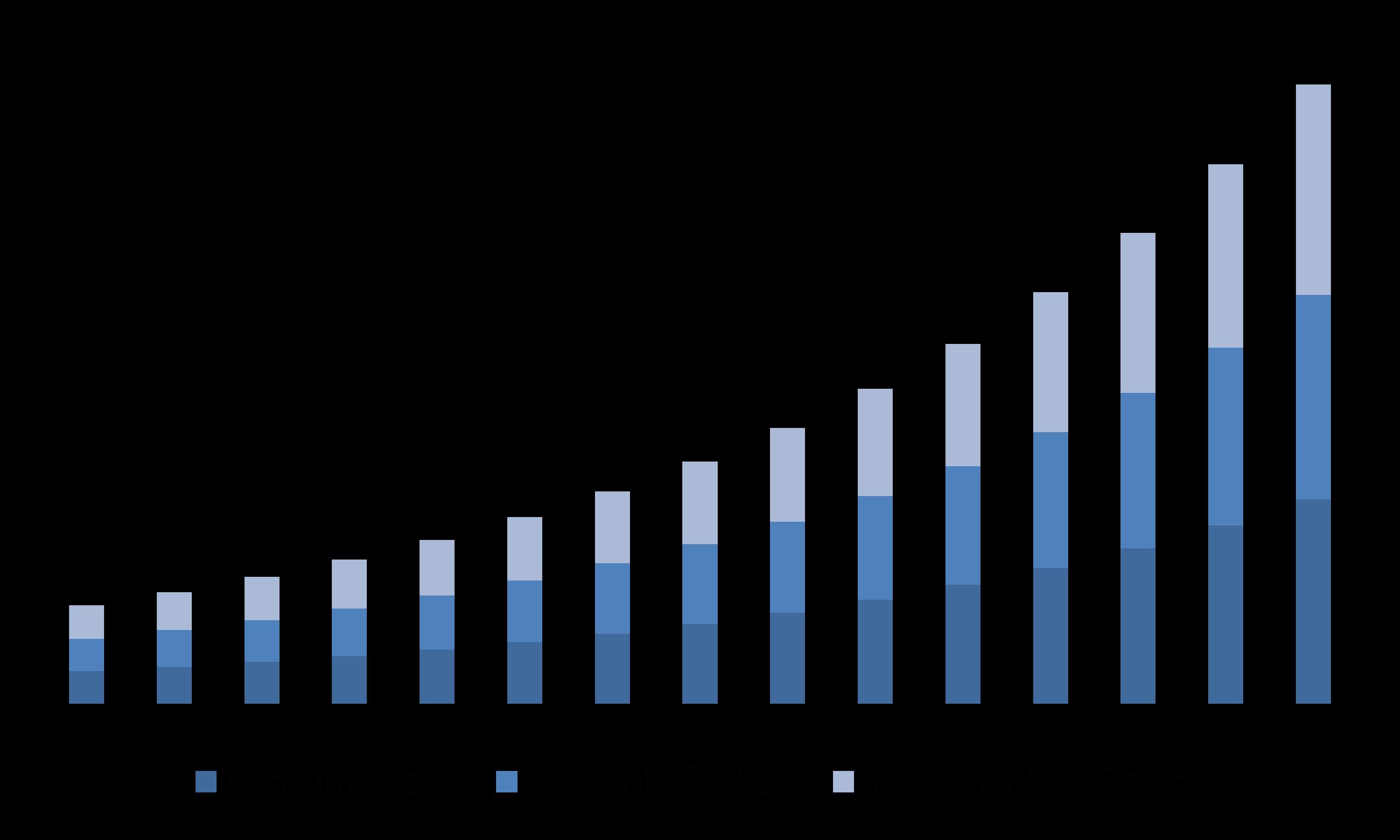

The Animal Diagnostics market was valued at $7.1 billion in 2022. It is projected to grow at a CAGR of 11.3% from 2023 to 2031 and reach more than $17.4 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Animal Diagnostics market is expected to see significant growth in the coming years.

Industry experts foresee a remarkable expansion of the global Animal Diagnostics market in the years to come, driven by a convergence of compelling factors. The rising prevalence of animal diseases, fueled by intensive farming practices, global trade, and climate change, is propelling the demand for effective diagnostic solutions. Moreover, the growing demand for companion animals, including pets and service animals, is directly translating into an increased need for animal diagnostics to ensure their well-being and prevent the spread of zoonotic diseases.

Furthermore, the adoption of precision medicine, a tailored approach to healthcare based on individual characteristics, in veterinary care is driving the demand for advanced diagnostic tools that can provide accurate and personalized diagnoses for animal patients. Additionally, there is a growing awareness among animal owners and breeders regarding the importance of animal health and preventive measures, fueling the demand for routine animal diagnostics to enable early detection and treatment of potential health issues. Finally, technological advancements in areas such as molecular diagnostics, genomics, and imaging are revolutionizing the animal diagnostics landscape, leading to the development of more accurate, efficient, and non-invasive diagnostic tools.

Animal Diagnostics Overview

The global animal diagnostics market is experiencing significant growth and transformation, driven by a confluence of factors that underscore the increasing importance of animal health. With a growing awareness of zoonotic diseases and the interconnection between human and animal health, the demand for advanced and reliable diagnostic tools for animals has risen substantially. This market encompasses a wide range of diagnostic techniques, including immunodiagnostics, molecular diagnostics, clinical biochemistry, and hematology, tailored to diverse species such as companion animals, livestock, and poultry. The rise in pet ownership, coupled with a surge in livestock production, has fueled the need for precise and timely diagnostic solutions to ensure the well-being of animals and mitigate the risk of disease transmission. Additionally, technological advancements, such as the integration of point-of-care testing and the development of novel diagnostic platforms, contribute to the market's expansion. As veterinary care standards continue to evolve and regulatory frameworks emphasize animal welfare, the animal diagnostics market is poised for sustained growth, providing essential support for effective disease management and preventive healthcare in the global veterinary landscape.

The COVID-19 pandemic has significantly impacted the animal diagnostics market, introducing a complex interplay of challenges and opportunities. While the initial phases of the pandemic saw disruptions in the supply chain and manufacturing processes due to lockdowns and restrictions, the market later witnessed a surge in demand for diagnostic solutions. The heightened awareness of zoonotic diseases and the need for effective animal health management drove increased adoption of diagnostic tools across veterinary clinics, research laboratories, and farms. Additionally, the pandemic accelerated trends such as telemedicine and remote monitoring in veterinary care, influencing the development of innovative diagnostic technologies. However, economic uncertainties, financial constraints, and logistical challenges persisted, affecting the overall market dynamics. As the world navigates through the post-pandemic recovery phase, the animal diagnostics market is expected to rebound with renewed emphasis on preventive healthcare for animals, stricter biosecurity measures, and continued advancements in diagnostic technologies. The industry is likely to witness a sustained focus on research and development to address emerging health threats in animal populations, fostering resilience and adaptability in the evolving landscape of veterinary diagnostics.

New product launches to flourish in the market

The Animal Diagnostics market is expected to see several new product launches in the coming years. Some of the key product launches expected in the Animal Diagnostics market are:

- Zoetis SpectruDx Parasite & Giardia Real-Time PCR - The Zoetis SpectruDx Parasite & Giardia Real-Time PCR is a comprehensive and innovative diagnostic tool that revolutionizes the detection of parasites and giardia in dogs and cats. This advanced test employs real-time PCR technology to accurately identify a wide range of parasitic pathogens, including giardia, cryptosporidium, toxoplasma, and various intestinal worms. With its rapid turnaround time of just 45 minutes, the SpectruDx Parasite & Giardia Real-Time PCR empowers veterinarians to make timely and informed treatment decisions, ensuring optimal patient care and well-being. The test's high sensitivity allows for the detection of even low levels of parasitic infection, enabling early intervention and prevention of potential complications.

- Heska VetScan iQ Analyzer - In September 2023, Heska launched VetScan iQ Analyzer. It provides a comprehensive and rapid point-of-care solution for complete blood count (CBC) and chemistry panel analysis in dogs and cats. This innovative analyzer empowers veterinarians to make timely and informed treatment decisions, ensuring optimal patient care and well-being. At the heart of the VetScan iQ Analyzer lies its cutting-edge technology, enabling the generation of accurate and reliable results within a remarkable turnaround time of just 5 minutes. This rapid turnaround time is instrumental in expediting the diagnostic process, allowing veterinarians to promptly assess patient health status and initiate appropriate treatment measures.

Segment Overview:

By Product: The Animal Diagnostics market is divided into consumables, reagents & kits and instruments & devices. The consumables, reagents & kits segment is the dominating segment of the Animal Diagnostics market. This segment is expected to hold a market share of over 55% in 2022. The growth of this segment is being driven by the increasing demand for routine animal diagnostics, the growing prevalence of animal diseases, and the rising adoption of point-of-care diagnostic devices. Factors driving the growth of the consumables, reagents & kits segment are increasing demand for routine animal diagnostics, growing prevalence of animal diseases, and rising adoption of point-of-care diagnostic devices. Animal owners are becoming increasingly aware of the importance of preventive care for their pets. This is leading to an increase in the demand for routine animal diagnostics, such as blood tests and fecal exams. Additionally, the prevalence of animal diseases is on the rise. This is due to a number of factors, including intensive farming practices, global trade, and climate change. The increasing prevalence of animal diseases is driving the demand for diagnostic tests to detect and diagnose these diseases.

Analysis by Cognate Lifesciences

By Species: The Animal Diagnostics market is segmented by Cattle, Canine, Feline, Caprine, Equine, Ovine, Porcine, and Avian. The canine segment holds the largest market share in the Animal Diagnostics market, accounting for approximately 35% of the global revenue in 2023. This dominance stems from several factors which include high prevalence of companion animals, susceptibility to various diseases, growing awareness of animal health, and significant advancements in diagnostic tools and techniques. The porcine segment, on the other hand, is poised for the fastest growth due to the expanding swine industry, the need for zoonotic disease prevention, and technological innovations. These trends are expected to shape the future landscape of the Animal Diagnostics market.

Analysis by Cognate Lifesciences

By Testing Type: The Animal Diagnostics market is segmented by analytical services, diagnostic imaging, bacteriology, pathology, molecular diagnostics, immunoassays, parasitology, serology, and virology. Immunoassays dominate the Animal Diagnostics market due to their versatility, ease of use, cost-effectiveness, and technological advancements. These assays employ antibodies to detect the presence or absence of specific antigens or antibodies in biological samples, providing rapid and reliable results. Their simplicity and affordability make them widely accessible to veterinary clinics and animal owners, enabling timely diagnosis and treatment decisions. Additionally, immunoassays encompass a broad range of applications, including detecting antibodies for infectious diseases, measuring hormone levels, and identifying allergies. Molecular diagnostics, on the other hand, is poised for the fastest growth in the Animal Diagnostics market, driven by its ability to provide precision diagnosis and early disease detection. These techniques target the genetic material of pathogens or genetic abnormalities, enabling accurate identification of diseases and disorders even at early stages, before clinical signs manifest. This early detection capability is crucial for effective treatment and improved patient outcomes. Moreover, molecular diagnostics is expanding its applications beyond pathogen detection, encompassing genetic testing for breed identification, susceptibility to certain diseases, and antimicrobial resistance profiling.

Analysis by Cognate Lifesciences

By Disease Type: The animal diagnostics market is segmented by infectious diseases, non-infectious diseases, hereditary, congenital and acquired diseases, general ailments, structural and functional diseases. Infectious diseases dominate the Animal Diagnostics market due to their high prevalence, zoonotic disease prevention concerns, and technological advancements. Animals are susceptible to a wide range of infectious diseases, including bacterial, viral, and parasitic infections. These diseases pose significant threats to animal health and productivity, necessitating effective diagnostic solutions. Several infectious diseases in animals, such as rabies and avian influenza, can transmit to humans, making zoonotic disease prevention a critical public health concern. Accurate and timely diagnosis of infectious diseases in animals is essential for controlling zoonotic outbreaks.

Analysis by Cognate Lifesciences

By End-use: The Animal Diagnostics market is segmented into laboratories, veterinary hospitals and clinics, point-of-care/in-house testing, research institutes and universities. The Animal Diagnostics market is witnessing a significant shift towards point-of-care (POC) or in-house testing, a trend that is poised to revolutionize animal healthcare. POC testing involves performing diagnostic tests directly at the point of patient care, such as veterinary clinics or animal shelters, rather than relying on external laboratories. This shift is fueled by several compelling factors that are transforming animal diagnostic practices and enhancing patient outcomes. The rapid growth of POC testing is transforming the Animal Diagnostics market, empowering veterinarians to provide faster, more comprehensive and accessible diagnostic services. As POC technology continues to evolve, it is poised to play an even more prominent role in safeguarding animal health and well-being worldwide.

Analysis by Cognate Lifesciences

By Region:

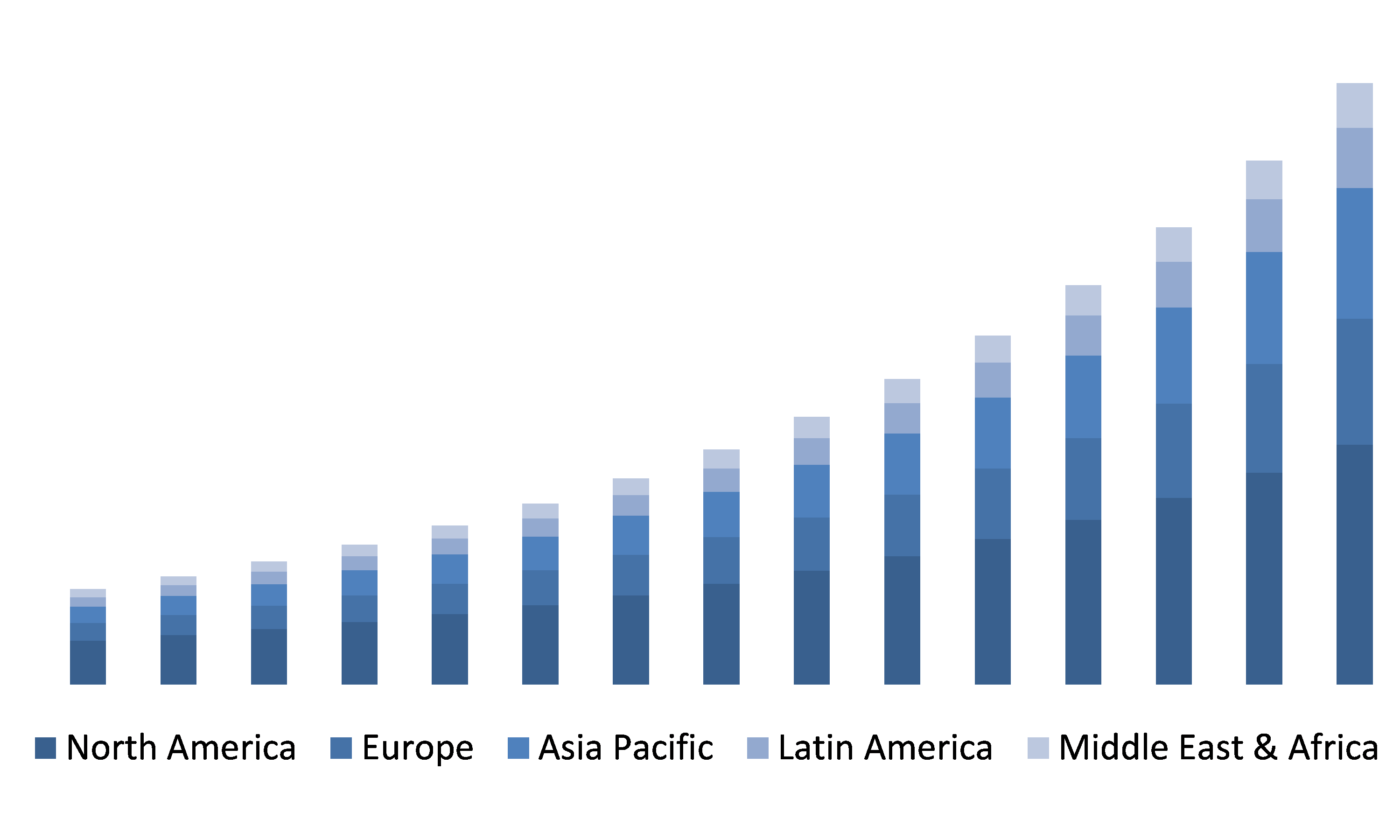

North America stands as the leading region in the Animal Diagnostics market, capturing over 45% of the global revenue in 2022. This dominance is attributed to a confluence of factors that have propelled the growth of animal healthcare in the region. A significant rise in veterinary healthcare expenditure is a key driver of market growth in North America. This increase can be attributed to several factors. The prevalence of pet ownership in North America is exceptionally high, with an estimated 85 million households owning at least one pet. This widespread pet ownership translates into a substantial demand for veterinary services and diagnostic testing. Pet owners are becoming increasingly aware of the importance of preventive care and regular checkups for their pets. This growing awareness drives the demand for routine diagnostic testing, contributing to the overall market growth. North America boasts a well-established veterinary infrastructure, with a network of sophisticated veterinary practices equipped with advanced diagnostic technologies. This enables veterinarians to provide comprehensive diagnostic services to their patients. The region is expected to remain at the forefront of animal healthcare, setting global standards for diagnostic innovation and patient care.

The Asia Pacific region is poised to witness the fastest growth in the Animal Diagnostics market, with a projected CAGR of over 13% during the forecast period. This remarkable growth trajectory can be attributed to a combination of socioeconomic and demographic factors that are transforming the landscape of animal healthcare in the region. The rapid expansion of the middle class across Asia Pacific is driving a significant increase in disposable income among pet owners. This growing affluence translates into a greater willingness to invest in the health and well-being of their pets, leading to increased demand for veterinary services and diagnostic testing. Governments across Asia Pacific are implementing initiatives to promote animal health and welfare. These initiatives include funding for veterinary research, education programs for pet owners, and support for animal shelters. Additionally, animal welfare organizations play a crucial role in promoting responsible pet ownership and advocating for animal welfare.

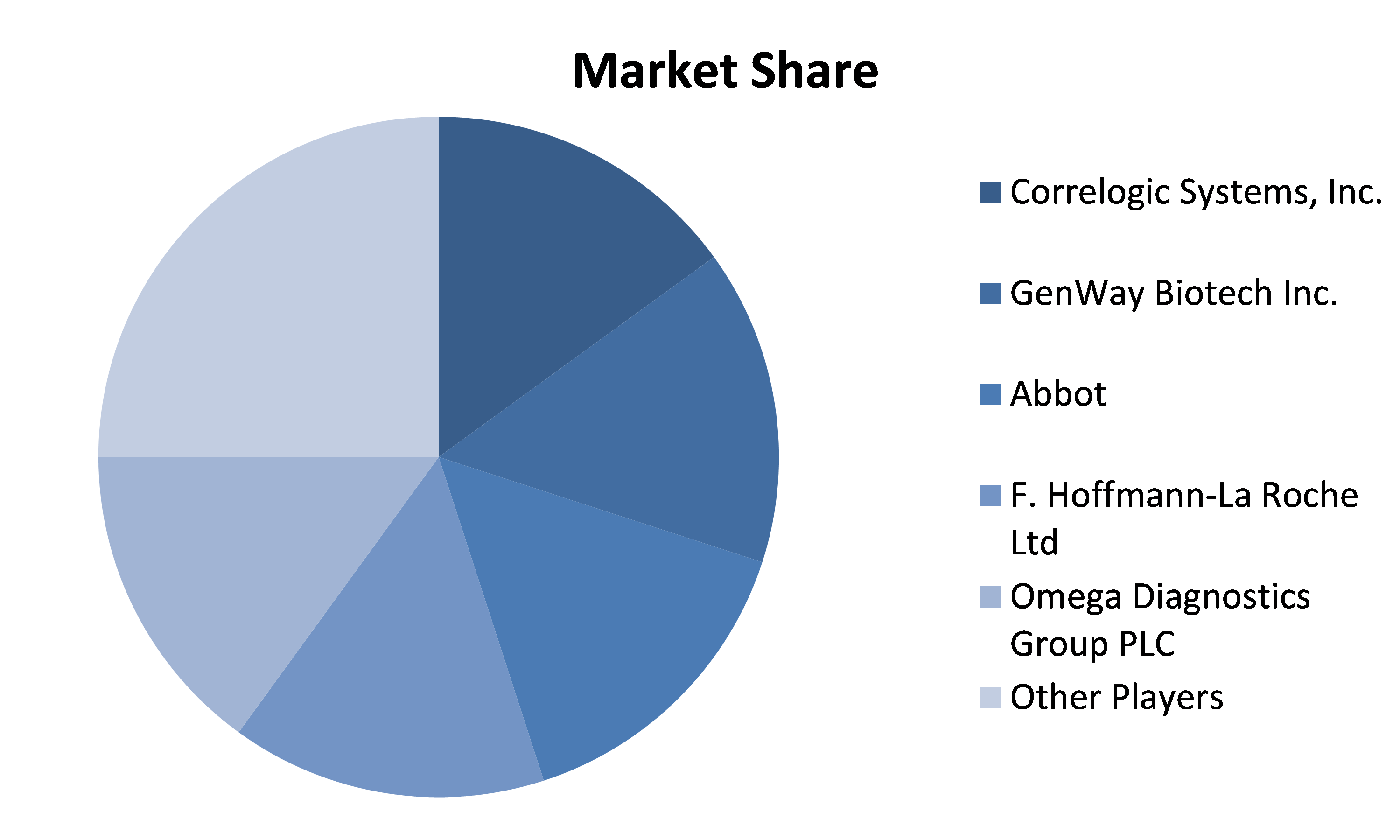

Competitive analysis and profiles of the major players in the Animal Diagnostics market, such as Zoetis Heska Corp.,

IDEXX Laboratories Inc., Agrolabo S.p.A., IDvet, Virbac, Thermo Fisher Scientific Inc., Neogen Corp., Covetrus, iM3Vet Pty Ltd.. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Animal Diagnostics market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By product, species, testing type, disease type, end-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

|

Key Segments Covered

Product

- Consumables

- Reagents & Kits

- Instruments & Devices

Species

- Cattle

- Canine

- Feline

- Caprine

- Equine

- Ovine

- Porcine

- Avian

- Others

Testing Type

- Analytical Services

- Diagnostic Imaging

- Bacteriology

- Pathology

- Molecular Diagnostics

- Immunoassays

- Parasitology

- Serology

- Virology

Disease Type

- Infectious Diseases

- Non-Infectious Diseases

- Hereditary, Congenital and Acquired Diseases

- General Ailments

- Structural and Functional Diseases

End-use

- Laboratories

- Veterinary Hospitals and Clinics

- Point-Of-Care/In-House Testing

- Research Institutes and Universities

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

Rest of Middle East & Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Product trends

- By Species trends

- By Testing Type trends

- By Disease Type trends

- By End-use trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Aesthetic Medicine Market, by Product

- Consumables Reagents & Kits

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Reagents & Kits

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Instruments & Devices

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Consumables Reagents & Kits

- Aesthetic Medicine Market, by Species

- Cattle

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Feline

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Caprine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Equine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Ovine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Porcine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Avian

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Cattle

- Aesthetic Medicine Market, by Testing Type

- Analytical Services

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diagnostic Imaging

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Bacteriology

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Pathology

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Molecular Diagnostics

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Immunoassays

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Parasitology

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Serology

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Virology

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Analytical Services

- Aesthetic Medicine Market, by Disease Type

- Infectious Diseases

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Non-Infectious Diseases

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hereditary, Congenital and Acquired Diseases

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- General Ailments

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Structural and Functional Diseases

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Infectious Diseases

- Aesthetic Medicine Market, by End-use

- Laboratories

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Veterinary Hospitals and Clinics

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Point-Of-Care/In-House Testing

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Research Institutes and Universities

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Laboratories

- Aesthetic Medicine Market, by Region

- North America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Brazil

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Argentina

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UAE

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Saudi Arabia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Israel

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- South Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

- Market size and forecast, by Testing Type , 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by End-use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Species, 2022-2031

-

Segmentation

Key Segments Covered

Product

Consumables Reagents & Kits Instruments & Devices

Species

Cattle Canine Feline Caprine Equine Ovine

Testing Type

Disease Type

End-use

Region

- Porcine

- Avian

- Others

- Analytical Services

- Diagnostic Imaging

- Bacteriology

- Pathology

- Molecular Diagnostics

- Immunoassays

- Parasitology

- Serology

- Virology

- Infectious Diseases

- Non-Infectious Diseases

- Hereditary, Congenital and Acquired Diseases

- General Ailments

- Structural and Functional Diseases

- Laboratories

- Veterinary Hospitals and Clinics

- Point-Of-Care/In-House Testing

- Research Institutes and Universities

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.