- Home

- Assisted Reproductive Technology Market

Assisted Reproductive Technology Market by Product (Instrument, Accessory & Disposable, and Reagent & Media), Technology (In Vitro-Fertilization, Artificial Insemination, and Others), and End User (Fertility Clinic, Hospital, Surgical Center, and Clinical Research Institute): Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: December, 2023 | Report ID: CLS-2026 | No of pages: 250 | Format:

The Assisted Reproductive Technology market was valued at $ 3.4 billion in 2022. It is projected to grow at a CAGR of 19.4% from 2023 to 2031 and reach more than $12.9 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Assisted Reproductive Technology market is expected to see significant growth in the coming years. A key driver is the escalating prevalence of infertility, attributed to factors like delayed family planning and lifestyle changes. As individuals and couples face challenges in conceiving naturally, there's a growing demand for advanced reproductive solutions. Technological advancements play a pivotal role, with continuous innovations in in vitro fertilization (IVF) techniques, embryo selection technologies, and cryopreservation methods enhancing the effectiveness of ART procedures. Moreover, increasing awareness and societal acceptance of fertility treatments contribute to a broader demographic seeking these interventions.

Government initiatives and favorable regulations, coupled with rising investments and mergers and acquisitions in the ART sector, further fuel market growth. Ethical considerations and legal frameworks also shape the industry's trajectory. Thus, these interconnected factors create a favorable environment for the global Assisted Reproductive Technology market, pointing towards a promising future characterized by technological advancements, demographic shifts, and increased accessibility to fertility treatments.

Assisted Reproductive Technology Overview

The Assisted Reproductive Technology (ART) market is poised for substantial growth globally. Fueled by escalating infertility rates, technological advancements, and changing demographics, the industry is witnessing a surge in demand for advanced reproductive solutions. Increasing maternal age, coupled with societal acceptance and awareness, contributes to a growing pool of individuals seeking ART procedures, particularly in vitro fertilization (IVF) techniques. Government support and favorable regulations, alongside significant investments and mergers and acquisitions in the sector, further propel market expansion. Ethical considerations and legal frameworks also shape the landscape. Thus, the ART market is characterized by a confluence of factors, including medical advancements, societal trends, and regulatory dynamics, driving it toward a promising future with heightened accessibility and effectiveness of fertility treatments.

The increasing acceptance of ART in society, driven by the adoption of more advanced technologies, is poised to propel the demand for ART procedures. These technologies, such as Pre-implantation Genetic Testing (PGT), Endometrial Receptivity Analysis Testing (ERA), Magnetic Activated Cell Sorting (MACS), and time-lapse imaging of embryos, offer enhanced reproductive capabilities and improved success rates for couples struggling with infertility. In the United States, according to the Centers for Disease Control and Prevention (CDC's) 2019 Fertility Clinic Success Rates Report, approximately 330,773 ART procedures were conducted at 448 fertility clinics, resulting in 77,998 live births and 83,946 live-born infants. This data underscores the significant role ART plays in addressing infertility and fulfilling the desire for parenthood. Furthermore, rising awareness about the causes and treatment of infertility is expected to further fuel the growth of the ART industry. As more individuals become informed about the various factors contributing to infertility and the available treatment options, the demand for ART procedures is likely to increase.

Various organizations, including the American Society for Reproductive Medicine (ASRM) and the Society for Assisted Reproductive Technology (SART), are actively engaged in raising awareness about infertility treatment options, striving to empower individuals seeking parenthood. Additionally, the ART industry is undergoing a wave of innovative research, particularly in the field of culture media. For instance, CooperSurgicals has pioneered the development of culture media enriched with Granulocyte-macrophage Colony-Stimulating Factor (GM-CSF), which is believed to provide essential nutrients for embryo development and enhance the communication between the embryo and the endometrium, thereby creating a more conducive environment for successful implantation. The collaboration of industry stakeholders, coupled with cutting-edge research and advancements in technology, is poised to significantly impact the ART landscape, offering hope and improved outcomes for couples seeking to fulfill their parental aspirations.

New product launches to flourish in the market

The Assisted Reproductive Technology market is expected to see several new product launches in the coming years. Some of the key product launches expected in the Assisted Reproductive Technology market are:

- CooperSurgicals - In 2022, CooperSurgicals launched its new Geri and Gavi devices, as well as its Gems complete culture medium suite. These products are designed to improve the safety and efficacy of ART procedures. The Geri device is a non-invasive embryo transfer device that is designed to improve embryo survival rates and reduce the risk of complications. The Gavi device is a new embryo culture dish that is designed to improve embryo development and implantation rates. The Gems complete culture medium suite is a new line of culture media that is designed to support embryo development and optimize embryo selection.

Merck - In 2023, Merck launched its new EmbryoGlue+ device, which is designed to improve embryo adhesion rates during IVF procedures. The EmbryoGlue+ device is a hyaluronan-based culture medium that helps embryos adhere to the uterine lining, increasing the chances of successful implantation and pregnancy. Hyaluronan is a natural substance found in the extracellular matrix, which plays a crucial role in cell adhesion and communication.

Segment Overview:

By Product: The Assisted Reproductive Technology market is divided into instrument, accessory & disposable, and reagent & media. The largest growing segment of the Assisted Reproductive Technology market is Reagent & Media. The growing prevalence of infertility and the rising desire for parenthood have fueled the demand for ART procedures, including in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and frozen embryo transfer (FET). This increased demand for ART procedures has translated into a higher demand for the reagents and media that are essential for these procedures. The growth of reagent & media in the ART market is driven by a combination of increasing demand, technological advancements, personalized medicine approaches, rising costs, regulatory requirements, emerging technologies, patient preferences, competitive dynamics, and globalization trends. These factors are propelling the development and adoption of innovative reagents and media, which are further enhancing the effectiveness of ART procedures and the likelihood of successful pregnancies.

By Technology: The Assisted Reproductive Technology market is segmented by In Vitro-Fertilization, Artificial Insemination, and Others. Among the three segments of the Assisted Reproductive Technology (ART) market, in vitro fertilization (IVF) is the largest and fastest-growing segment. IVF is the most advanced and effective ART procedure, and it is the most commonly used treatment for infertility. In vitro fertilization (IVF) is the most advanced and effective assisted reproductive technology (ART) procedure, and it is the most commonly used treatment for infertility. IVF involves combining sperm and egg in a laboratory dish to create an embryo, which is then transferred to the woman's uterus. IVF has a higher success rate than other ART procedures, such as artificial insemination (AI), which involves placing sperm directly into the woman's uterus. The demand for IVF is expected to continue to grow in the coming years, as more and more couples struggle with infertility.

By Technology: The Assisted Reproductive Technology market is segmented by In Vitro-Fertilization, Artificial Insemination, and Others. Among the three segments of the Assisted Reproductive Technology (ART) market, in vitro fertilization (IVF) is the largest and fastest-growing segment. IVF is the most advanced and effective ART procedure, and it is the most commonly used treatment for infertility. In vitro fertilization (IVF) is the most advanced and effective assisted reproductive technology (ART) procedure, and it is the most commonly used treatment for infertility. IVF involves combining sperm and egg in a laboratory dish to create an embryo, which is then transferred to the woman's uterus. IVF has a higher success rate than other ART procedures, such as artificial insemination (AI), which involves placing sperm directly into the woman's uterus. The demand for IVF is expected to continue to grow in the coming years, as more and more couples struggle with infertility.

By End User: The Assisted Reproductive Technology market is segmented by fertility clinic, hospital, surgical center, and clinical research institute. Among the end-user segments of the Assisted Reproductive Technology (ART) market, fertility clinics are expected to remain the largest and fastest-growing segment, holding a market share of 40.5% and a CAGR of 19% during the forecast period from 2023 to 2031. This dominance is primarily attributed to the increasing prevalence of infertility, the surge in demand for ART procedures, and the growing number of fertility clinics worldwide. Fertility clinics play a crucial role in providing ART services, offering comprehensive evaluations, consultations, and treatment plans tailored to individual patient needs. The rising demand for ART procedures, particularly IVF, is driving the growth of fertility clinics as more couples seek specialized care for infertility issues. Fertility clinics are expected to maintain their dominance as the largest and fastest-growing segment of the ART market, driven by the increasing prevalence of infertility, the growing demand for ART procedures, and the expansion of fertility clinic services worldwide. Hospitals, surgical centers, and clinical research institutes also play complementary roles in the ART landscape, contributing to the overall growth and advancement of this field.

By End User: The Assisted Reproductive Technology market is segmented by fertility clinic, hospital, surgical center, and clinical research institute. Among the end-user segments of the Assisted Reproductive Technology (ART) market, fertility clinics are expected to remain the largest and fastest-growing segment, holding a market share of 40.5% and a CAGR of 19% during the forecast period from 2023 to 2031. This dominance is primarily attributed to the increasing prevalence of infertility, the surge in demand for ART procedures, and the growing number of fertility clinics worldwide. Fertility clinics play a crucial role in providing ART services, offering comprehensive evaluations, consultations, and treatment plans tailored to individual patient needs. The rising demand for ART procedures, particularly IVF, is driving the growth of fertility clinics as more couples seek specialized care for infertility issues. Fertility clinics are expected to maintain their dominance as the largest and fastest-growing segment of the ART market, driven by the increasing prevalence of infertility, the growing demand for ART procedures, and the expansion of fertility clinic services worldwide. Hospitals, surgical centers, and clinical research institutes also play complementary roles in the ART landscape, contributing to the overall growth and advancement of this field.

By Region:

Europe held the largest revenue share in the Assisted Reproductive Technology (ART) market in 2022, accounting for over 36.98% of the global market. This dominance stems from a combination of factors, including a rising infertility rate, increasing awareness about fertility treatments, technological advancements, and supportive government initiatives. Notably, according to the European Society of Human Reproduction and Embryology, infertility affects approximately 25 million individuals in the European Union, the highest global prevalence. North America is expected to exhibit significant growth in the ART market over the forecast period. This growth is driven by positive patient outcomes associated with ART procedures. The region's strong healthcare infrastructure, growing demand for personalized medicine, and increasing acceptance of ART treatments further contribute to the projected growth trajectory.

The United States and Asia Pacific are two key regions demonstrating significant adoption and growth of assisted reproductive technology (ART) procedures. In the United States, ART has played a crucial role in helping couples overcome infertility challenges, with 2.1% of infants born through ART interventions. Among the states, Massachusetts leads the way with the highest ART utilization rate of 5.5%, followed by the District of Columbia at 5.0% and New Jersey at 4.4%. In Asia Pacific, Japan is at the forefront of ART advancements, with 458,101 ART cycles performed in 2019, resulting in approximately 60,598 neonate births. The country boasts a robust ART infrastructure, with 624 registered ART facilities and 598 actively providing ART treatments in 2019.

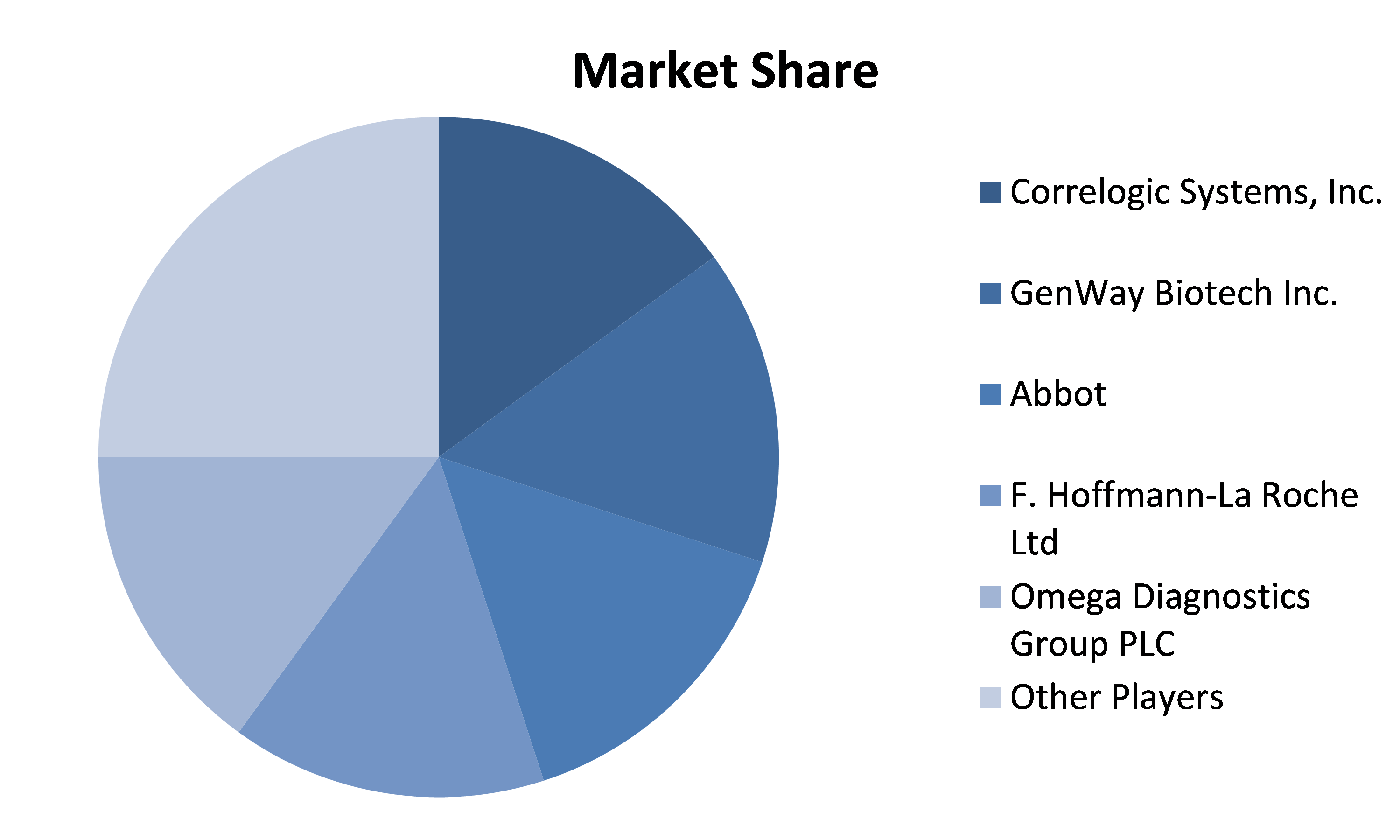

Competitive analysis and profiles of the major players in the Assisted Reproductive Technology market, such as Bloom IVF Centre, Microm U.K. Ltd., FUJIFILM Irvine Scientific, Cosmos Biomedical Ltd., CooperSurgical, Inc., Cryolab Ltd., Bloom IVF Centre, Ferring B.V., Merck KGaA, European Sperm Bank, and Vitrolife AB . Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Assisted Reproductive Technology market. For instance, In July 2021, Hamilton Thorne Ltd., a global provider of ART research, acquired IVFTECH ApS (IVFtech) and its associated firm, K4 Technology ApS. IVFtech specializes in providing laminar flow workstations and high-capacity incubators for the ART market. This acquisition strengthens Hamilton Thorne's portfolio and enhances its ability to support fertility clinics with advanced ART equipment.

Competitive analysis and profiles of the major players in the Assisted Reproductive Technology market, such as Bloom IVF Centre, Microm U.K. Ltd., FUJIFILM Irvine Scientific, Cosmos Biomedical Ltd., CooperSurgical, Inc., Cryolab Ltd., Bloom IVF Centre, Ferring B.V., Merck KGaA, European Sperm Bank, and Vitrolife AB . Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Assisted Reproductive Technology market. For instance, In July 2021, Hamilton Thorne Ltd., a global provider of ART research, acquired IVFTECH ApS (IVFtech) and its associated firm, K4 Technology ApS. IVFtech specializes in providing laminar flow workstations and high-capacity incubators for the ART market. This acquisition strengthens Hamilton Thorne's portfolio and enhances its ability to support fertility clinics with advanced ART equipment.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By product, technology, technology, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

|

Key Segments Covered

Product

- Instrument

- Accessory & Disposable

- Reagent & Media

Technology

- In Vitro-Fertilization

- Artificial Insemination

- Others

End User

- Fertility Clinic

- Hospital

- Surgical Center

- Clinical Research Institute

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Product trends

- By Technology trends

- By End-user trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Assisted Reproductive Technology Market, by Product

- Instrument

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Accessory & Disposable

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Reagent & Media

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Instrument

- Assisted Reproductive Technology Market, by Technology

- In Vitro-Fertilization

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Artificial Insemination

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- In Vitro-Fertilization

- Assisted Reproductive Technology Market, by End-user

- Fertility Clinic

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospital

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Surgical Center

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Clinical Research Institute

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Fertility Clinic

- Assisted Reproductive Technology Market, by Region

- North America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Brazil

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Argentina

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UAE

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Saudi Arabia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Israel

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- South Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Technology, 2022-2031

- Market size and forecast, by End-user , 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Cosmos Biomedical Ltd.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Cosmos Biomedical Ltd.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- CooperSurgical, Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- FUJIFILM Irvine Scientific

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Cryolab Ltd.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Vitrolife AB

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- European Sperm Bank

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Bloom IVF Centre

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Merck KGaA

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Ferring B.V.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Other Prominent Players

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Cosmos Biomedical Ltd.

Segmentation

Key Segments Covered

Product

- Instrument

- Accessory & Disposable

- Reagent & Media

Technology

- In Vitro-Fertilization

- Artificial Insemination

- Others

End User

- Fertility Clinic

- Hospital

- Surgical Center

- Clinical Research Institute

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.