- Home

- Australia Home Healthcare Market

Australia Home Healthcare Market Analysis 2023

- Published Date: June, 2023 | Report ID: CLS-1942 | No of pages: 250 | Format:

Australia Home Healthcare Market Analysis by Product (Therapeutic Products, Testing, Screening, and Monitoring Products and Mobility Care Products), by Service (Skilled Nursing, Rehabilitation Therapy, Hospice & Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy and Pregnancy Care), by Indication (Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases & Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders and Other Indications): Global Opportunity Analysis and Industry Forecast, 2022-2031

The Australia Home Healthcare market was valued at $XX million in 2022. It is projected to grow at a CAGR of XX% from 2023 to 2031 and reach more than $XX million by the end of 2031

Analysts’ Viewpoint by Cognate Lifesciences

The Australia home healthcare market is experiencing significant growth and is poised for further expansion in the coming years. Several factors are driving this growth. Firstly, the aging population in Australia is increasing, leading to a greater demand for healthcare services delivered in the home setting.

Additionally, there is a rising prevalence of chronic diseases, such as cancer, respiratory diseases, and diabetes, which require long-term care and management. This has created a need for therapeutic products, testing and monitoring devices, and skilled nursing services that can be provided in the comfort of patients' homes. Furthermore, advancements in medical technology have made it possible to deliver complex treatments and therapies at home, making home healthcare a viable and cost-effective alternative to traditional hospital or clinic-based care.

The Australia home healthcare market is also benefiting from the shift towards personalized and patient-centric healthcare. Patients prefer the convenience and familiarity of receiving care in their own homes, and home healthcare services cater to this demand by providing tailored care plans and individualized attention. Moreover, the COVID-19 pandemic has accelerated the adoption of home healthcare services as it allows for social distancing and reduces the burden on healthcare facilities.

Australia Home Healthcare Overview

Home healthcare in Australia encompasses a wide range of medical and non-medical services delivered to individuals in the comfort of their own homes. It includes skilled nursing care, rehabilitation therapy, hospice and palliative care, and unskilled care services.

The Australia home healthcare market is driven by several key factors that contribute to its growth and development. One of the primary drivers is the aging population in the country. Australia, like many developed nations, is experiencing a demographic shift with a significant proportion of older adults. As people age, there is an increased need for healthcare services, including medical care, chronic disease management, and assistance with daily activities. Home healthcare provides a viable solution for meeting these needs, as it allows older adults to receive the necessary care and support in the familiar and comfortable environment of their own homes.

Another driver of the home healthcare market is the prevalence of chronic diseases. Chronic conditions such as cardiovascular diseases, diabetes, respiratory disorders, and cancer are increasingly common in Australia. These conditions often require ongoing healthcare services and management. Home healthcare enables patients with chronic diseases to receive regular monitoring, medication management, and disease management support in their homes, leading to improved outcomes and quality of life.

Patient preference for home-based care is another significant driver. Many individuals prefer to receive healthcare services in the comfort and privacy of their own homes. Home healthcare allows patients to maintain their independence and receive personalized care tailored to their specific needs. It provides a sense of familiarity and convenience, which can enhance patient satisfaction and overall well-being.

Advancements in medical technology have also contributed to the growth of the home healthcare market. Innovations such as remote monitoring devices, telehealth services, and wearable health technology have made it possible to deliver complex medical treatments and monitoring in home settings. These technologies facilitate remote consultations, real-time data monitoring, and efficient communication between patients and healthcare providers. They not only improve access to care but also enable proactive and preventive approaches to healthcare.

Government support is a crucial driver for the home healthcare market in Australia. The government has implemented various policies and initiatives to promote and support home-based care. This includes funding programs, reimbursement schemes, and incentives aimed at encouraging the provision of home healthcare services. Government support helps to create a favorable environment for the growth of the home healthcare sector and ensures accessibility and affordability of these services to a broader population.

The COVID-19 pandemic has further accelerated the adoption of home-based care. The need for social distancing and infection control measures has highlighted the importance of home healthcare in reducing the risk of exposure to the virus. Telehealth and remote monitoring solutions have gained prominence during the pandemic, allowing patients to receive virtual consultations and monitoring from the safety of their homes. The pandemic has brought to the forefront the value and effectiveness of home healthcare in managing healthcare needs during challenging times.

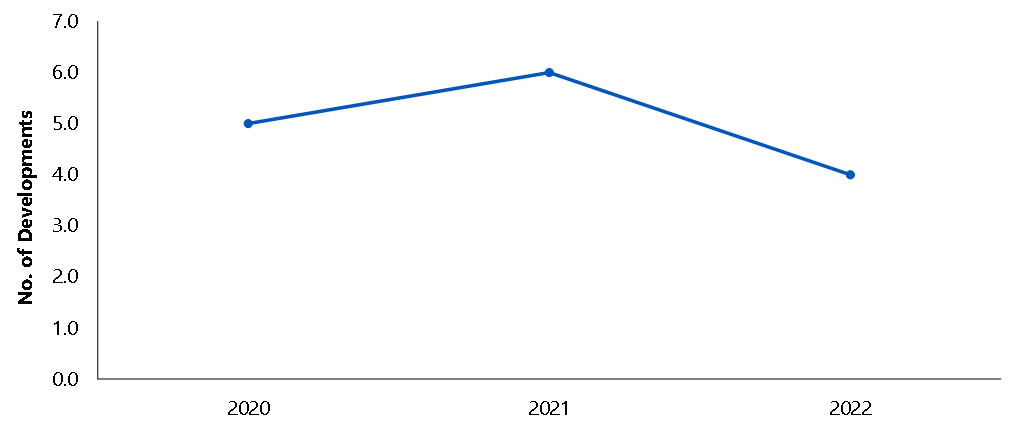

New product launches to flourish in the market

The Telemedicine market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Telemedicine market are:

- BrightStar Care and Home Care Assistance (May 2021): BrightStar Care and Home Care Assistance, two leading providers of in-home senior care services, announced their merger. The companies have formed a new company called BrightStar Care Home Care Assistance. This strategic alliance brings together their expertise and resources to offer a comprehensive range of services, including home health care, assisted living, and post-acute care.

- Kindred Healthcare and Signify Health (June 2021): Kindred Healthcare, a provider of home health and hospice services, announced the acquisition of Signify Health, a digital health platform. This acquisition enables Kindred to expand its home health care services and leverage Signify Health's data-driven insights to enhance patient care and outcomes.

- Providence St. Joseph Health and CareMore Health (July 2021): Providence St. Joseph Health, a healthcare system, announced the acquisition of CareMore Health, a home health provider specializing in care for the elderly. This strategic alliance expands Providence St. Joseph's presence in home health care and post-acute care, allowing them to provide comprehensive and integrated care to patients.

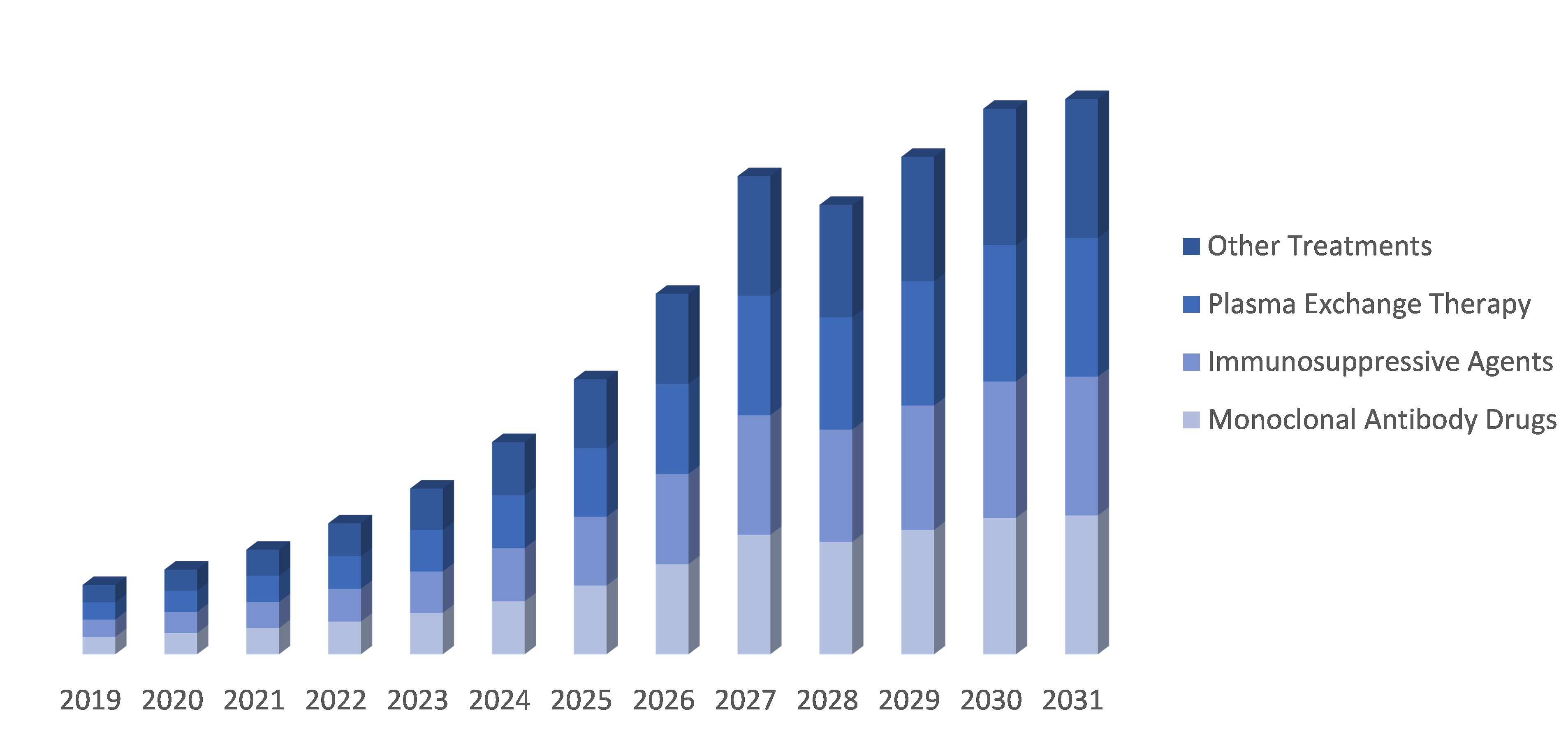

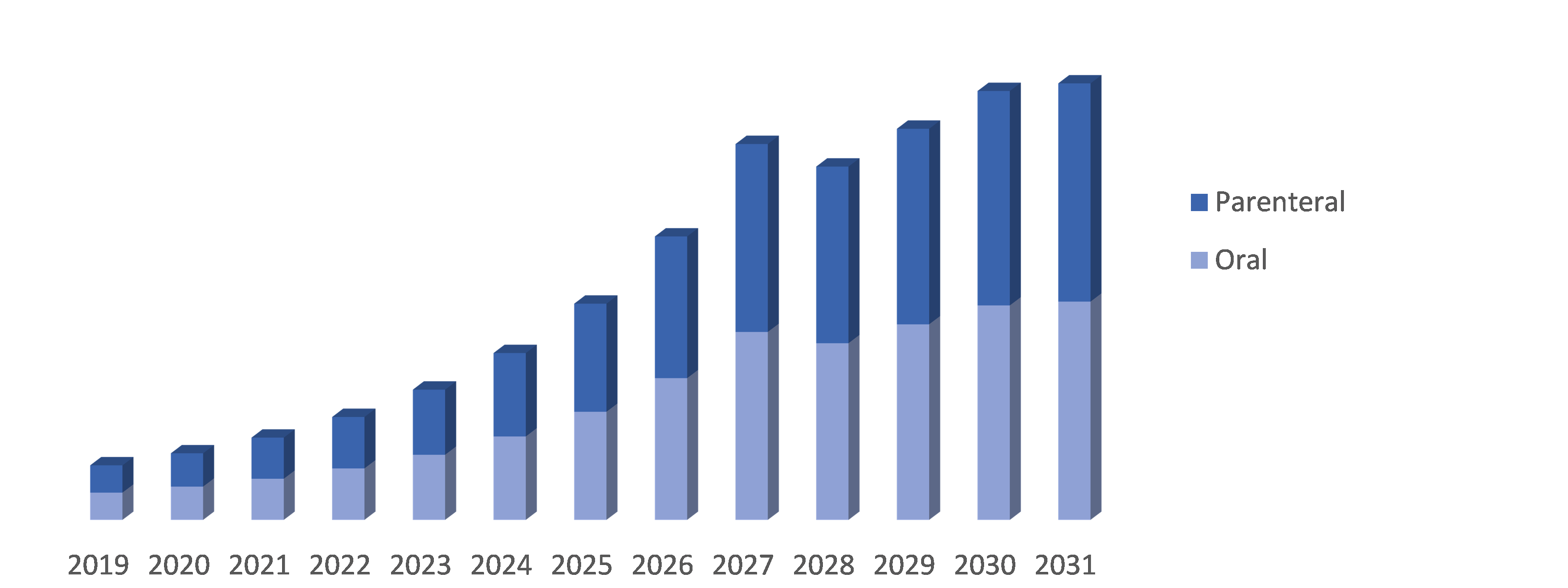

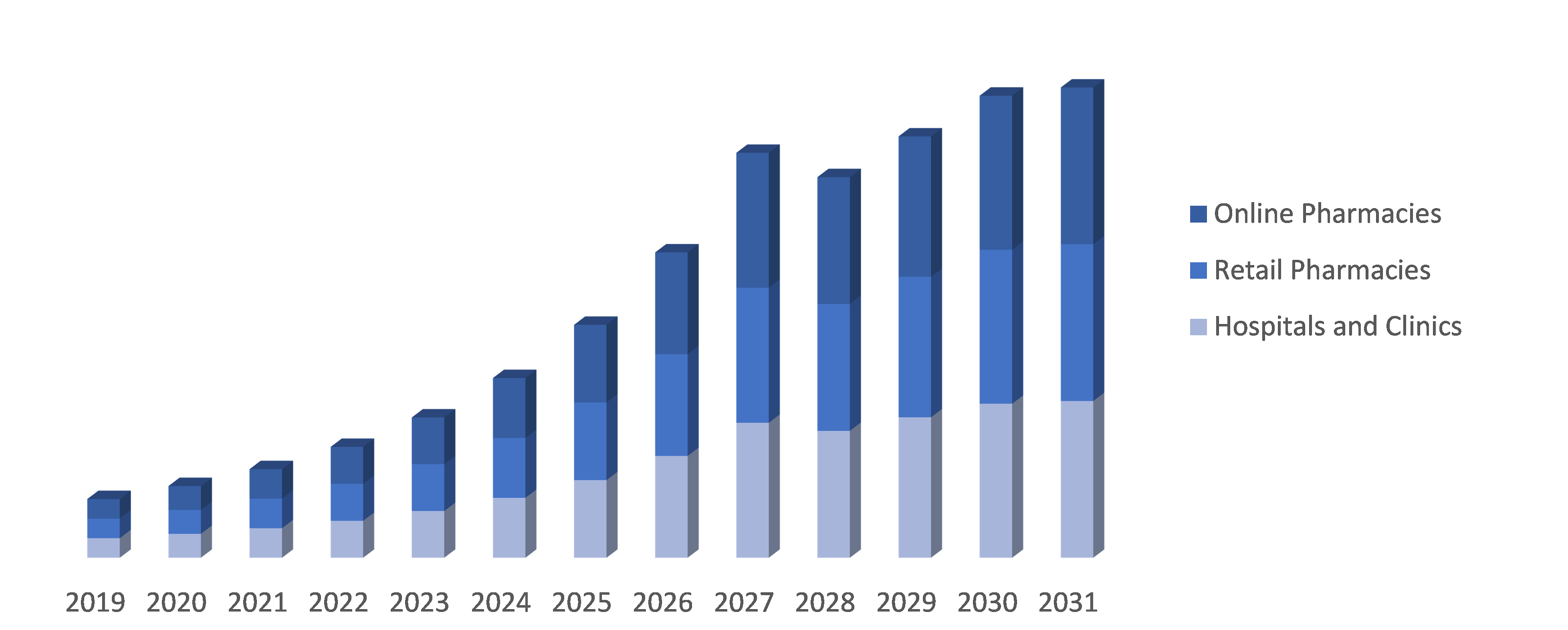

Segment Overview:

By Component: The Australia Home Healthcare market is divided into Therapeutic Products, Testing, Screening, and Monitoring Products and Mobility Care Products.

By Service: The Australia Home Healthcare market is segmented into Skilled Nursing, Rehabilitation Therapy, Hospice & Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy and Pregnancy Care.

By Indication: The Telemedicine market is segmented into Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases & Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders and Other Indications

Competitive analysis and profiles of the major players in the Australia Home Healthcare market, such as McKesson Medical-Surgical Inc., Fresenius Medical Care, Medline Industries, Inc., Medtronic PLC, 3M Healthcare, Baxter International Inc., B. Braun Melsungen AG, Arkray, Inc., F. Hoffmann-La Roche AG and Becton, Dickinson And Company. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Australia Home Healthcare market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Products, Services, Indication and Region |

|

Regions Covered |

Australia |

|

Companies Covered |

|

Key Segments Covered

By Product:

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

By Service:

- Skilled Nursing

- Rehabilitation Therapy

- Hospice & Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

By Indication:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases & Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Other Indications

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Component trends

- By Services trends

- By Indication trends

- By End-user trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Australia Home Healthcare Market, by Product

- Therapeutic Products

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Testing, Screening, and Monitoring Products

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mobility Care Products

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Therapeutic Products

- Australia Home Healthcare Market, by Services

- Skilled Nursing

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rehabilitation Therapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospice & Palliative Care

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Unskilled Care

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Respiratory Therapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Infusion Therapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Pregnancy Care

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Skilled Nursing

- Australia Home Healthcare Market, by Indication

- Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Respiratory Diseases

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Movement Disorders

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Cardiovascular Diseases & Hypertension

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Pregnancy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Wound Care

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diabetes

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hearing Disorders

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Other Indications

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Cancer

- Company profiles

- McKesson Medical-Surgical Inc.

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Fresenius Medical Care

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Medline Industries, Inc.

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Medline Industries, Inc.

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- 3M Healthcare

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Baxter International Inc.

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- B. Braun Melsungen AG

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Arkray, Inc.

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- F. Hoffmann-La Roche AG

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- Becton, Dickinson And Company

- Business overview

- Financial performance

- Component portfolio

- Recent strategic moves & developments

- SWOT analysis

- McKesson Medical-Surgical Inc.

Segmentation

Key Segments Covered

By Product:

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

By Service:

- Skilled Nursing

- Rehabilitation Therapy

- Hospice & Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

By Indication:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases & Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Other Indications

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.