- Home

- Guillain Barre Syndrome Gbs Market

Guillain-Barre Syndrome (GBS) Market Research Report 2023

- Published Date: May, 2023 | Report ID: CLS-1935 | No of pages: 250 | Format:

Guillain-Barre Syndrome (GBS) Market by Therapeutics (Intravenous Immunoglobulin, Plasma Exchange and Others), by Route of Administration (Oral and Parenteral), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

The Guillain-Barre Syndrome (GBS) market was valued at $500 million in 2022. It is projected to grow at a CAGR of 5.2% from 2023 to 2031 and reach more than $610 million by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

Guillain-Barre Syndrome (GBS) is a rare neurological disorder characterized by muscle weakness, numbness, and tingling sensations in the limbs that can progress to paralysis and respiratory failure. The market for GBS treatment is expected to grow in the coming years due to the increasing prevalence of the disease, which is estimated to affect approximately 1-2 people per 100,000.

The current treatment for GBS includes supportive care such as mechanical ventilation, intravenous immunoglobulin (IVIG), and plasma exchange. IVIG is the most widely used treatment option, accounting for a significant portion of the market share. The market for GBS treatment is expected to grow due to the increasing prevalence of the disease, coupled with advancements in medical technology and the development of new treatment options. However, high treatment costs and limited reimbursement options for patients may hinder market growth. Moreover, several pharmaceutical companies are investing in the development of new treatments for GBS, which is expected to further drive market growth. In addition, the growing focus on early diagnosis and prompt treatment of GBS is expected to boost the market's growth potential.

Guillain-Barre Syndrome (GBS) Overview

Guillain-Barre Syndrome (GBS) is a rare autoimmune disorder that affects the peripheral nervous system, resulting in muscle weakness, numbness, and tingling sensations in the limbs that can progress to paralysis and respiratory failure. The exact cause of GBS is unknown, but it is believed to be triggered by a viral or bacterial infection or as a side effect of certain vaccines. GBS affects people of all ages, genders, and ethnicities, but it is more common in males and in people over the age of 50. The symptoms of GBS typically begin with weakness and tingling sensations in the legs, which then spread to the arms and upper body. The condition can progress quickly and can result in complete paralysis, requiring hospitalization and intensive medical care.

One of the main drivers of the GBS market is the increasing prevalence of the disease worldwide. This can be attributed to factors such as improved diagnosis, increased awareness, and aging populations. As the population ages, the prevalence of GBS is expected to increase, particularly in developed countries. The increasing prevalence of GBS is expected to drive demand for treatments and diagnostic tools for the condition.

Another driver of the GBS market is advancements in medical technology, including new diagnostic tools and treatments. Advances in medical technology have improved the accuracy and speed of diagnosis, enabling patients to receive timely and appropriate treatment. Additionally, new immunoglobulin therapies are becoming more targeted and efficient in treating GBS, with better outcomes and fewer side effects. For instance, the use of high-dose immunoglobulin therapy has been shown to significantly improve outcomes in patients with GBS.

The development of new treatment options is another driver of the GBS market. Several pharmaceutical companies are investing in the development of new treatments for GBS, which is expected to further drive market growth. These treatments include novel immunomodulatory drugs and gene therapies, which have shown promising results in early clinical trials. The development of new treatments for GBS will provide patients with more options for managing their condition and may help to reduce the burden of the disease.

The increasing healthcare spending in both developed and developing countries is also expected to drive the growth of the GBS market. As healthcare spending increases, more resources can be allocated towards the development of new treatments and diagnostic tools for GBS. This will enable more patients to receive timely and effective treatment for GBS, improving outcomes and quality of life for patients with the condition. Finally, the growing focus on early diagnosis and prompt treatment of GBS is expected to boost the market's growth potential. Early diagnosis and treatment can help to reduce the severity of symptoms and improve outcomes for patients. As a result, healthcare providers and patients are increasingly aware of the importance of early detection and treatment of GBS. This growing awareness is expected to increase demand for diagnostic tools and treatments for GBS.

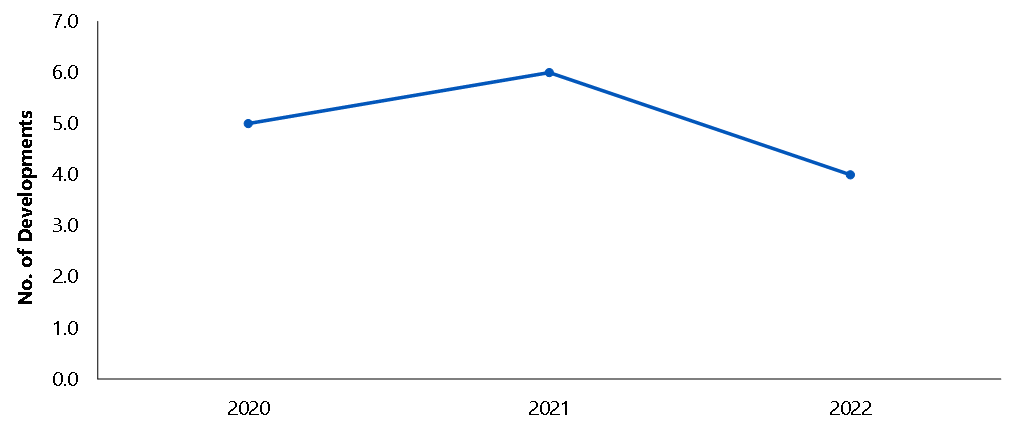

New product launches to flourish in the market

The Guillain-Barre Syndrome (GBS) market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Guillain-Barre Syndrome (GBS) market are:

- In December 2020, Grifols, a Spanish pharmaceutical company, received FDA approval for a new subcutaneous immunoglobulin therapy for GBS called Flebogamma DIF. This therapy is administered under the skin and has been shown to be effective in treating GBS patients who are unable to tolerate intravenous immunoglobulin therapy.

- In September 2020, Momenta Pharmaceuticals, an American biotechnology company, announced positive results from a Phase 2/3 clinical trial of their novel immunomodulatory drug, nipocalimab, for the treatment of GBS. The drug showed significant improvement in muscle strength and function compared to placebo in patients with GBS. Momenta Pharmaceuticals plans to move forward with further clinical trials and regulatory submissions for nipocalimab.

Segment Overview:

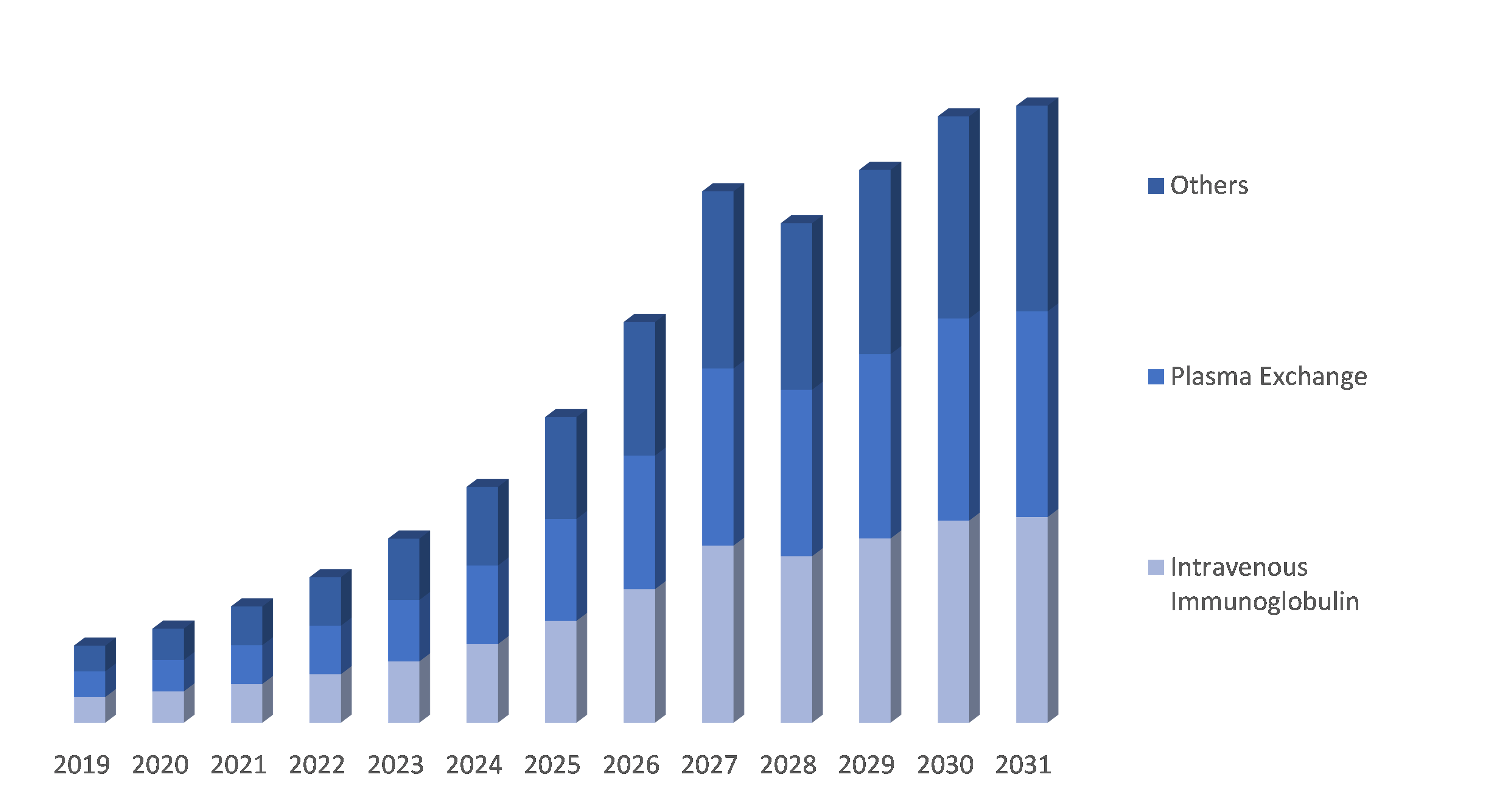

By Therapeutics: The Guillain-Barre Syndrome (GBS) market is divided into Intravenous Immunoglobulin, Plasma Exchange and Others. IVIG is the most commonly used therapy for GBS and involves the administration of immunoglobulin through an intravenous infusion. Plasma exchange involves the removal and replacement of the patient's blood plasma. Other therapies for GBS may include corticosteroids, pain management medications, and physical therapy. The choice of therapy depends on the patient's individual condition and medical history.

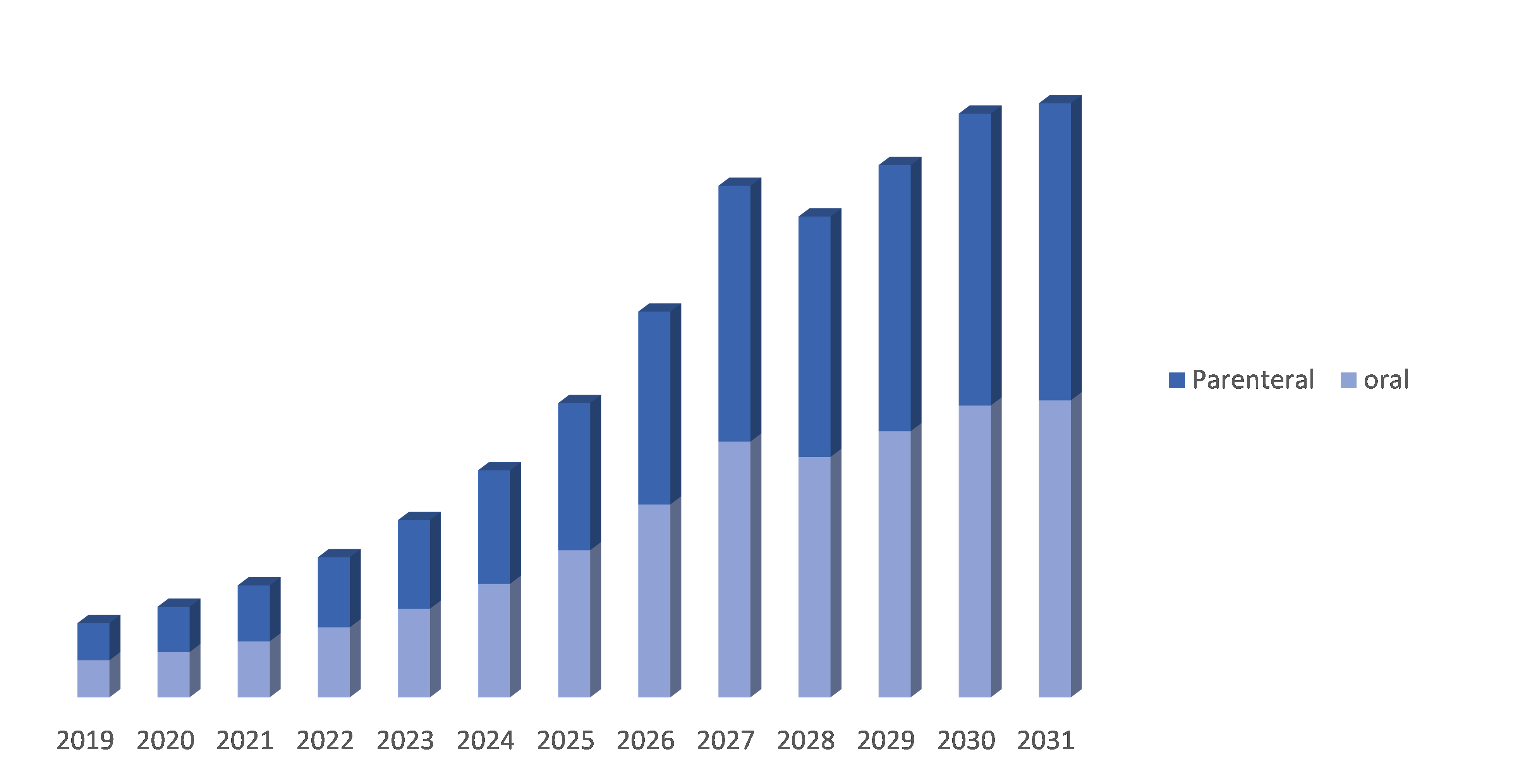

By Route of Administration: The Guillain-Barre Syndrome (GBS) market is segmented by Oral and Parenteral. These two categories represent the different ways in which treatments for GBS can be administered to patients. The oral route involves the ingestion of medications or therapies, typically in the form of tablets or capsules. On the other hand, the parenteral route refers to the administration of treatments through non-oral means, such as injections or intravenous infusions. This segmentation allows healthcare professionals to choose the most appropriate route of administration based on the specific needs and conditions of GBS patients.

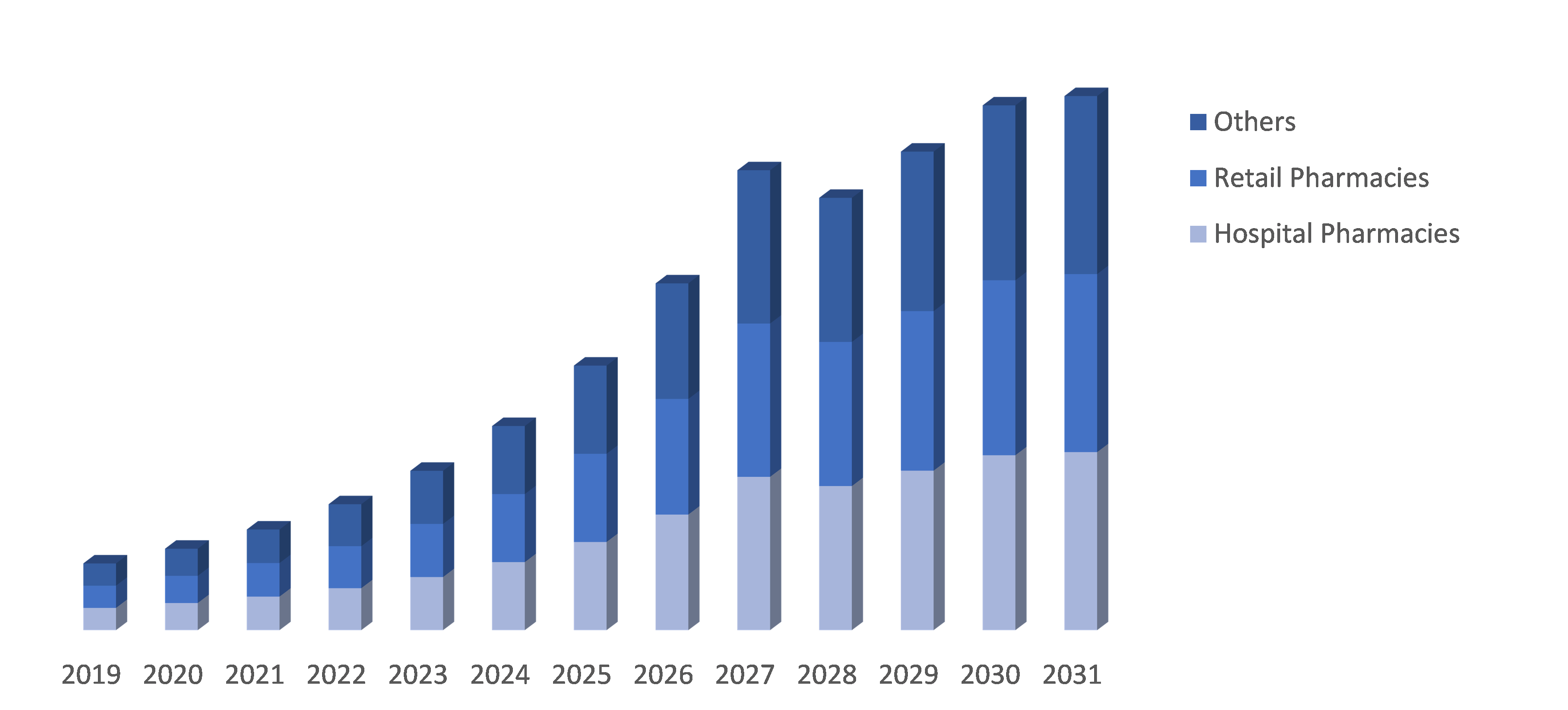

By Distribution Channel: The Guillain-Barre Syndrome (GBS) market is segmented by Hospital Pharmacies, Retail Pharmacies and Others. Hospital pharmacies play a significant role in providing medications and treatments for GBS within healthcare facilities. Retail pharmacies serve as accessible points of distribution for GBS treatments in community settings. The "others" category encompasses alternative distribution channels, such as specialty clinics or online pharmacies. This segmentation ensures that GBS patients have convenient access to the necessary medications and therapies through various distribution channels.

By Region:

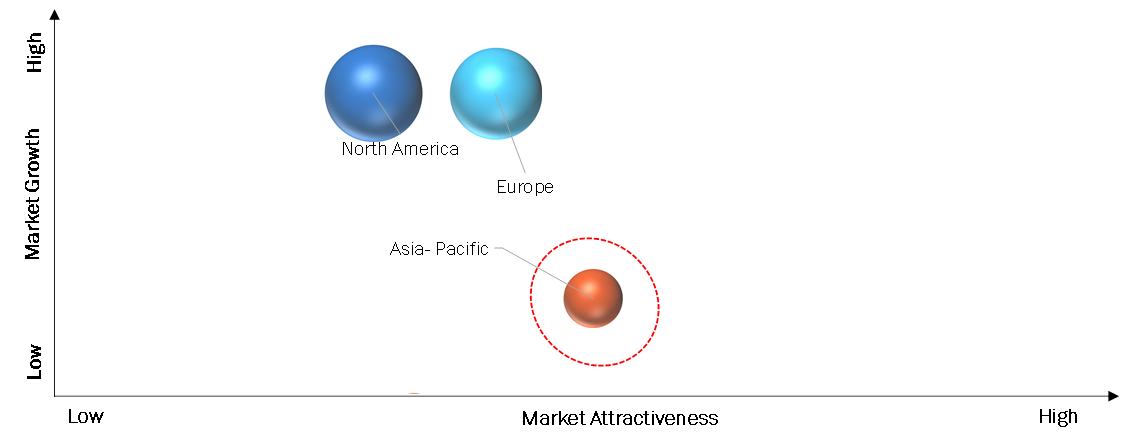

The North American Guillain-Barre Syndrome (GBS) market refers to the market for treatments and therapies related to GBS in North America. GBS is a neurological disorder that affects the peripheral nervous system. The North American market for GBS is robust and driven by factors such as a high prevalence of GBS cases, advanced healthcare infrastructure, and a focus on research and development. Major pharmaceutical companies in North America are actively engaged in developing innovative therapies for GBS. The market is segmented based on factors such as route of administration, distribution channels, and patient demographics. Additionally, collaborations between healthcare providers, researchers, and advocacy groups contribute to advancing GBS treatment options in the region.

The Asia Pacific (APAC) Guillain-Barre Syndrome (GBS) market pertains to the market for GBS treatments and therapies in the Asia Pacific region. GBS is a neurological disorder affecting the peripheral nervous system. The APAC market for GBS is influenced by factors such as a large population, increasing awareness of neurological disorders, and improving healthcare infrastructure. The market is characterized by the presence of both local and multinational pharmaceutical companies actively involved in research and development of GBS treatments. The market segmentation includes factors such as route of administration, distribution channels, and patient demographics specific to the APAC region. Collaboration between healthcare stakeholders, government initiatives, and advancements in medical technology contribute to the growth of the APAC GBS market.

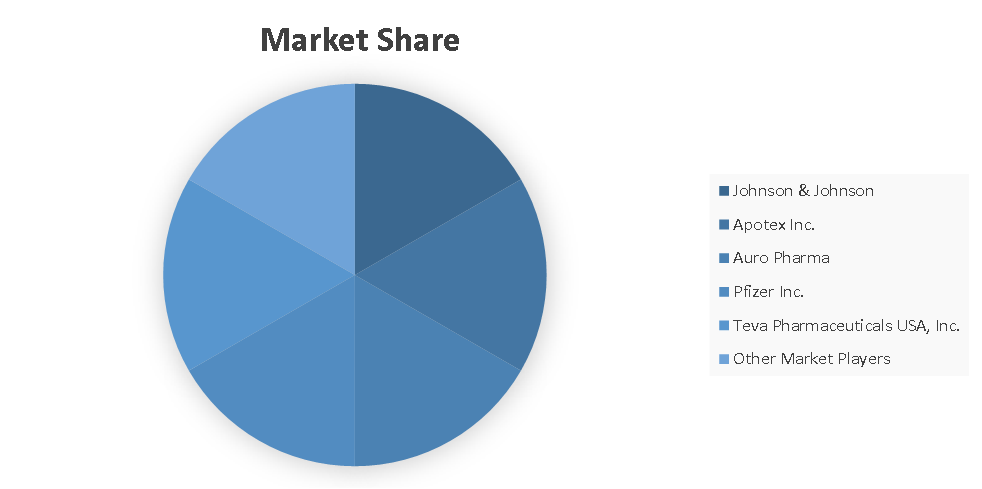

Competitive analysis and profiles of the major players in the Guillain-Barre Syndrome (GBS) market, such as Grifols S.A., CSL Limited, Octapharma AG, Kedrion Biopharma Inc., Takeda Pharmaceutical Company Limited, Shire (now part of Takeda), Pfizer Inc., Sanofi, Biogen Inc. and Novartis International AG. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Guillain-Barre Syndrome (GBS) market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By specialty type, modality and services, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, LAMEA |

|

Companies Covered |

|

Key Segments Covered

Therapeutics

- Intravenous Immunoglobulin

- Plasma Exchange

- Others

Route of Administration

- Oral

- Parenteral

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Region

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

LAMEA

- Latin America

- Middle East

- Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Therapeutics trends

- By Route of Administration trends

- By Distribution Channel

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Guillain-Barre Syndrome (GBS) Market, by Therapeutics

- Intravenous Immunoglobulin

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Plasma Exchange

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Intravenous Immunoglobulin

- Guillain-Barre Syndrome (GBS) Market, by Route of Administration

- Oral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Parenteral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Oral

- Guillain-Barre Syndrome (GBS) Market, by Distribution Channel

- Hospital Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Retail Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospital Pharmacies

- Guillain-Barre Syndrome (GBS) Market, by Region

- North America

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Asia Pacific

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- LAMEA

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Africa

- Market size and forecast, by Therapeutics, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

- Company profiles

- Grifols S.A

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- CSL Limited

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Octapharma AG

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Kedrion Biopharma Inc.

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Takeda Pharmaceutical Company Limited

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Shire (now part of Takeda)

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Pfizer Inc.

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Sanofi

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Biogen Inc.

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novartis International AG

- Business overview

- Financial performance

- Therapeutics portfolio

- Recent strategic moves & developments

- SWOT analysis

- Grifols S.A

Segmentation

Guillain-Barre Syndrome (GBS) Market by Therapeutics (Intravenous Immunoglobulin, Plasma Exchange and Others), by Route of Administration (Oral and Parenteral), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Others

Key Segments Covered

Therapeutics

- Intravenous Immunoglobulin

- Plasma Exchange

- Others

Route of Administration

- Oral

- Parenteral

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Region

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

LAMEA

- Latin America

- Middle East

- Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.