- Home

- Sickle Cell Disease Treatment Market

Sickle Cell Disease Treatment Market Research Report 2023

- Published Date: May, 2023 | Report ID: CLS-1938 | No of pages: 250 | Format:

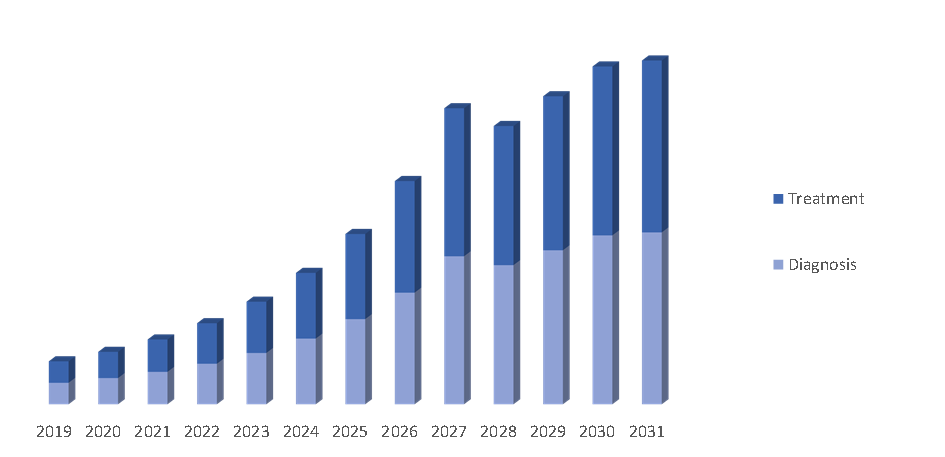

Sickle Cell Disease Treatment Market by Drug Type (Hydroxyurea, Oxybryta, Adakveo and Others), by Disease Type (Sickle Cell Anemia, HbSC and Others), by Route of Administration (Oral and Parenteral), by Distribution Channel (Hospitals Pharmacies, Drug Stores and Retail Pharmacies and Online Providers): Global Opportunity Analysis and Industry Forecast, 2022-2031

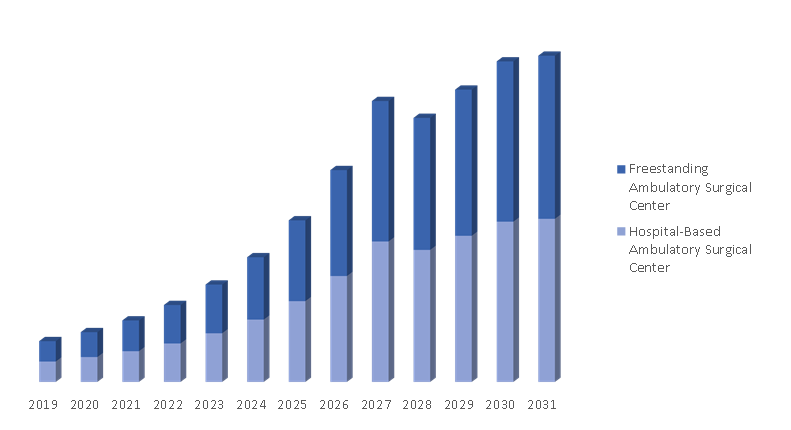

The Sickle Cell Disease Treatment market was valued at $1.25 billion in 2022. It is projected to grow at a CAGR of 4.5% from 2023 to 2031 and reach more than $1.75 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

The Sickle Cell Disease Treatment Market is projected to experience significant growth and transformation, driven by various factors. Advancements in research and development have led to the introduction of innovative therapies that enhance patient management and improve quality of life. Disease-modifying treatments like hydroxyurea have demonstrated effectiveness in reducing complications associated with sickle cell disease.

Increasing awareness of the disease among healthcare professionals and the general population has resulted in higher diagnosis rates and early intervention, leading to improved patient outcomes. Efforts to enhance screening and access to specialized care further contribute to market growth. Collaborations between pharmaceutical companies, research institutions, and healthcare providers are fostering innovation in the development of targeted therapies. Drugs such as Oxybryta and Adakveo are specifically designed to address key aspects of sickle cell disease and enhance patient well-being.

The market is also witnessing a shift towards personalized medicine, where treatments are tailored based on individual genetic profiles and clinical characteristics. This personalized approach is expected to drive the demand for precision therapies in the future. Despite these positive trends, challenges related to treatment accessibility persist, particularly in low-resource settings and regions with limited healthcare infrastructure. Ensuring affordable and equitable distribution of effective therapies remains a critical focus.

Sickle Cell Disease Treatment Overview

Sickle cell disease is a genetic blood disorder characterized by abnormal red blood cells that have a crescent or "sickle" shape. This condition affects millions of people worldwide, with a higher prevalence in certain regions, particularly sub-Saharan Africa, the Middle East, and parts of India. The treatment landscape for sickle cell disease has evolved over the years, aiming to manage symptoms, prevent complications, and improve patients' quality of life. The primary goals of treatment include reducing pain episodes, preventing organ damage, and minimizing the risk of infections.

The Sickle Cell Disease Treatment market is driven by various factors that contribute to its growth and development. One significant driver is the increasing awareness and diagnosis of sickle cell disease among healthcare professionals and the general population. Over the years, efforts to raise awareness about the disease have led to improved diagnosis rates, allowing for early detection and intervention. This early detection is crucial in managing the disease and preventing complications, driving the demand for effective treatments.

Advancements in research and development have also played a vital role in driving the Sickle Cell Disease Treatment market. Ongoing research efforts have resulted in the development of innovative treatment options that aim to improve symptoms and prevent complications associated with sickle cell disease. For example, the introduction of targeted therapies such as Oxbryta (voxelotor) and Adakveo (crizanlizumab) has shown promising results in managing the disease and enhancing patient outcomes. These drugs specifically target the underlying mechanisms of sickle cell disease, providing more effective treatment options.

Collaborations and partnerships between pharmaceutical companies, research institutions, and healthcare providers have also contributed to the growth of the market. These collaborations foster the exchange of knowledge, resources, and expertise, enabling the development of new therapies and ensuring access to effective treatments for patients. For instance, in 2019, Global Blood Therapeutics entered into a collaboration with Syros Pharmaceuticals to develop novel therapies for sickle cell disease.

Government initiatives and support have played a crucial role in driving advancements in the field of sickle cell disease treatment. Governments have implemented policies aimed at improving healthcare infrastructure, increasing access to healthcare services, and promoting research and development in the field. Supportive policies and funding for research have helped advance treatment options and drive market growth. For example, the National Institutes of Health (NIH) in the United States has provided funding for research on sickle cell disease and supports clinical trials for innovative treatments.

Patient advocacy groups and organizations have been instrumental in driving the Sickle Cell Disease Treatment market. These groups raise awareness about the disease, support research efforts, and advocate for better access to treatments for individuals with sickle cell disease. Their efforts have led to increased funding for research, improved healthcare policies, and the development of patient-centric approaches in the market.

The Sickle Cell Disease Treatment market is driven by significant unmet medical needs. Sickle cell disease is a chronic condition with limited curative treatments, leading to a demand for better disease management options. This creates opportunities for the development of novel therapies that can address the specific challenges of the disease. The market is witnessing advancements such as gene therapy and gene editing techniques, which hold promise in providing curative treatments for sickle cell disease.

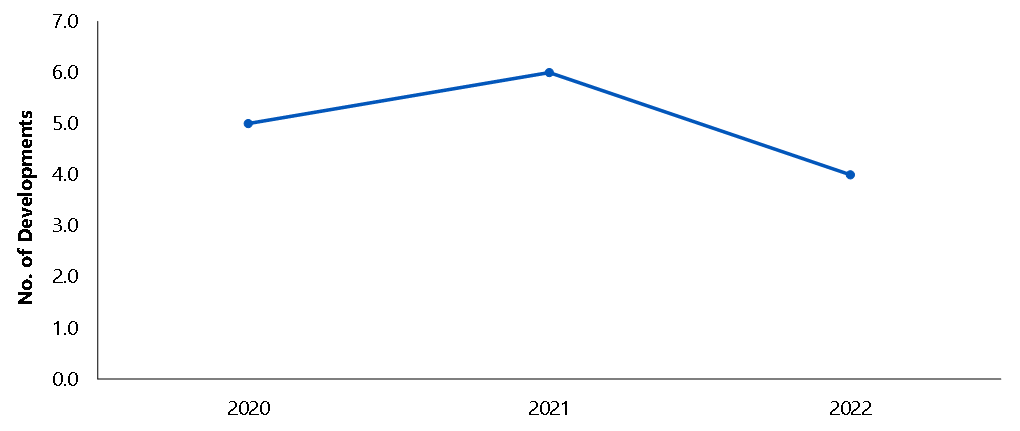

New product launches to flourish in the market

The Sickle Cell Disease Treatment market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Sickle Cell Disease Treatment market are:

- In December 2021, the U.S. Food and Drug Administration (FDA) approved a drug called Oxbryta (voxelotor) for the treatment of sickle cell disease in patients aged 4 up to 11 years. Oxbryta works by restoring the proper form of red blood cells, reducing damage to the body's tissues and red cells. To assess the efficacy and safety of Oxbryta in this age group, a phase 2 trial was conducted. The trial involved 45 sickle cell disease patients aged four to eleven years. The results of the trial likely provided important insights into the drug's effectiveness and safety profile in this specific patient population.

- According to the data updated by clinicaltrials.gov in February 2023, there are currently 58 ongoing and active clinical trials for blood transfusion in sickle cell disease. This significant number of clinical trials indicates a strong focus on exploring the potential benefits and effectiveness of blood transfusion as a treatment option for sickle cell disease.

Segment Overview:

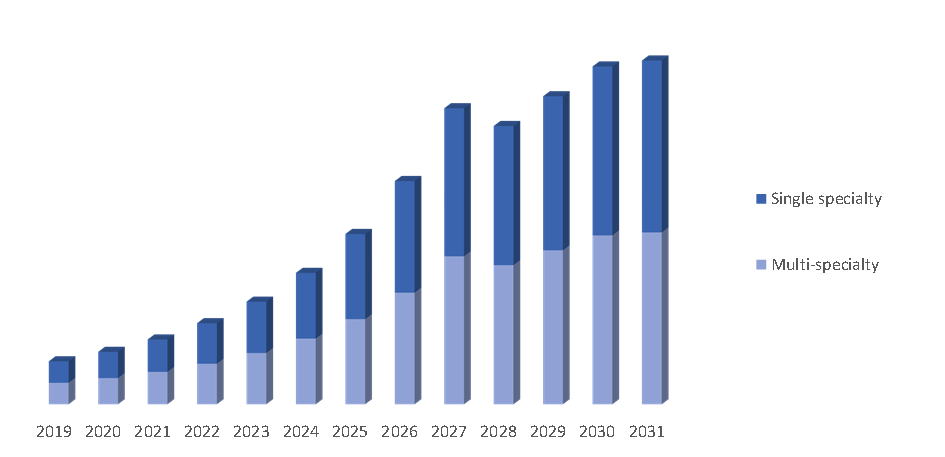

By Drug Type: The Sickle Cell Disease Treatment market is divided into Hydroxyurea, Oxybryta, Adakveo and Others. Hydroxyurea is a disease-modifying treatment that has demonstrated efficacy in reducing complications associated with sickle cell disease. Oxybryta and Adakveo are targeted therapies that aim to address specific aspects of the disease and improve patients' lives. The market offers a range of treatment options to cater to the diverse needs of individuals with sickle cell disease.

By Disease Type: The Sickle Cell Disease Treatment market is segmented by Sickle Cell Anemia, HbSC and Others. Sickle Cell Anemia is the most common and severe form of sickle cell disease. HbSC refers to a milder form of the disease. The segmentation allows for a targeted approach in developing and providing treatments tailored to specific disease types, ensuring effective management and improved outcomes for patients.

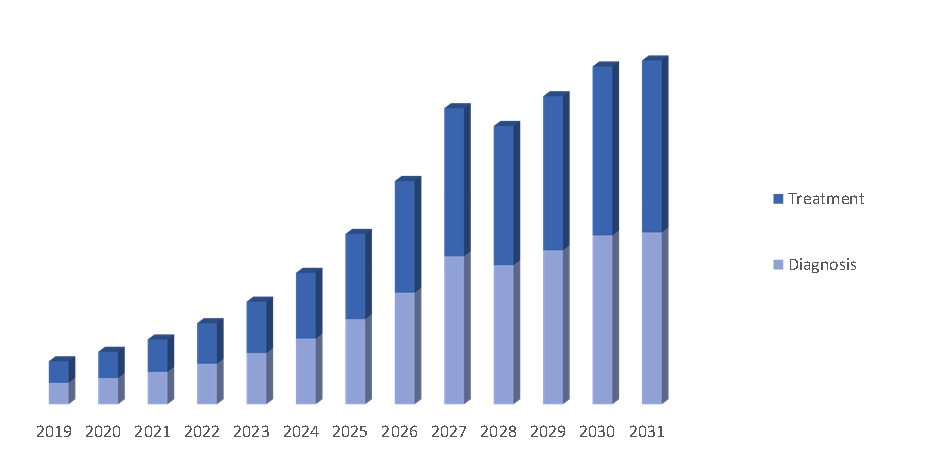

By Route of Administration: The Sickle Cell Disease Treatment market is segmented by Oral and Parenteral. Oral administration involves taking medications by mouth, such as tablets or capsules. Parenteral administration refers to the delivery of treatments through non-oral routes, such as injections or infusions. This segmentation allows healthcare providers to choose the most suitable route of administration for each patient, considering factors like convenience, effectiveness, and individual needs.

By Distribution Channel: The Sickle Cell Disease Treatment market is segmented by Hospitals Pharmacies, Drug Stores and Retail Pharmacies and Online Providers. Hospitals pharmacies cater to patients receiving treatment in hospital settings. Drug stores and retail pharmacies serve as convenient locations for patients to access their medications. Online providers offer the option of purchasing treatments remotely. This segmentation ensures that treatments for sickle cell disease are available through various channels, providing accessibility and convenience for patients.

By Region:

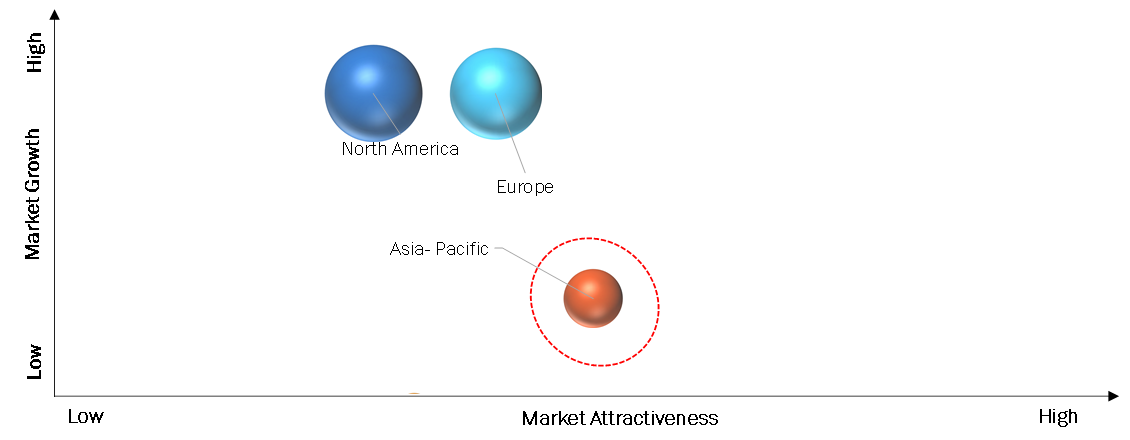

The North American Sickle Cell Disease Treatment market is characterized by a range of therapies aimed at addressing the needs of individuals living with sickle cell disease. One example of a widely used treatment in the region is hydroxyurea. This medication has demonstrated efficacy in reducing pain episodes, hospitalizations, and the need for blood transfusions in patients with sickle cell disease. Ongoing clinical trials and research in the region contribute to the development of new and innovative treatment approaches. These studies aim to explore the potential of gene therapies, gene editing techniques, and other advanced treatments that may further revolutionize the management and potential cure for sickle cell disease.

The Asia Pacific (APAC) Sickle Cell Disease Treatment market is witnessing significant growth and development. With a growing population and increasing awareness about sickle cell disease, there is a rising demand for effective treatment options in the region. Access to therapies such as hydroxyurea, Oxbryta (voxelotor), and Adakveo (crizanlizumab) is expanding, improving patient outcomes. Ongoing research and clinical trials in the APAC region contribute to the advancement of treatment approaches, offering hope for better management of sickle cell disease.

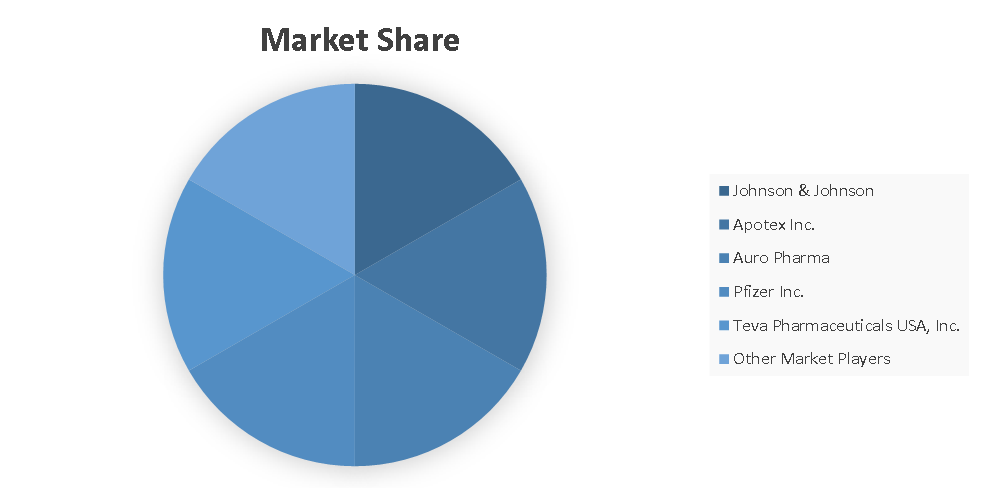

Competitive analysis and profiles of the major players in the Sickle Cell Disease Treatment market, such as Agios Pharmaceuticals, Bristol Myers Squibb Company, CRISPR Therapeutics, Editas Medicine, Emmaus Life Sciences, Inc., Global Blood Therapeutics, Inc., Medunic USA, Inc., Novartis AG, Novo Nordisk and Vifor Pharma. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Sickle Cell Disease Treatment market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Drug Type, Route of Administration, Disease Type, Distribution Channel and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, LAMEA |

|

Companies Covered |

|

Key Segments Covered

Drug Type:

- Hydroxyurea

- Oxybryta

- Adakveo

- Others

Distribution Channel:

- Hospitals Pharmacies

- Drug Stores and Retail Pharmacies

- Online Providers

Type:

- Sickle Cell Anemia

- HbSC

- Others

Route of Administration:

- Oral

- Parenteral

Region

- North America

U.S.

Canada

Mexico

- Europe

Germany

UK

France

Italy

Spain

Rest of Europe

- Asia-Pacific

China

Japan

South Korea

India

Australia

Rest of Asia-Pacific

- LAMEA

Latin America

Middle East

Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Drug Type trends

- By Disease Type trends

- By Route of Administration trends

- By Distribution Channel trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Sickle Cell Disease Treatment Market, by Drug Type

- Hydroxyurea

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Oxybryta

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Adakveo

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hydroxyurea

- Sickle Cell Disease Treatment Market, by Disease Type

- Sickle Cell Anemia

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- HbSC

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Sickle Cell Anemia

- Sickle Cell Disease Treatment Market, by Route of Administration

- Oral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Parenteral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Oral

- Sickle Cell Disease Treatment Market, by Distribution Channel

- Hospitals Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Drug Stores

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Retail Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Online Providers

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospitals Pharmacies

- Sickle Cell Disease Treatment Market, by Region

- North America

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- LAMEA

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Africa

- Market size and forecast, by Drug Type, 2022-2031

- Market size and forecast, by Disease Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Distribution Channel, 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Agios Pharmaceuticals

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Bristol Myers Squibb Company

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- CRISPR Therapeutics

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Editas Medicine

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Emmaus Life Sciences, Inc.

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Global Blood Therapeutics, Inc.

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Medunic USA, Inc.

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novartis AG

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novo Nordisk

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Vifor Pharma

- Business overview

- Financial performance

- Treatment Stage portfolio

- Recent strategic moves & developments

- SWOT analysis

- Agios Pharmaceuticals

Segmentation

Key Segments Covered

Drug Type:

- Hydroxyurea

- Oxybryta

- Adakveo

- Others

Distribution Channel:

- Hospitals Pharmacies

- Drug Stores and Retail Pharmacies

- Online Providers

Type:

- Sickle Cell Anemia

- HbSC

- Others

Route of Administration:

- Oral

- Parenteral

Region

- North America

U.S.

Canada

Mexico

- Europe

Germany

UK

France

Italy

Spain

Rest of Europe

- Asia-Pacific

China

Japan

South Korea

India

Australia

Rest of Asia-Pacific

- LAMEA

Latin America

Middle East

Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.