- Home

- United States Alzheimer Drugs Market

United States Alzheimer Drugs Market Analysis 2023

- Published Date: May, 2023 | Report ID: CLS-1939 | No of pages: 250 | Format:

U.S. Alzheimer Drugs Market Analysis by Drug Class (Donepezil, Galantamine, Rivastigmine, Memantine and Others), by Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Stores and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

The U.S. Alzheimer Drugs market was valued at $XX million in 2022. It is projected to grow at a CAGR of XX% from 2023 to 2031 and reach more than $XX million by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

The U.S. Alzheimer's drugs market has been witnessing significant growth in recent years, driven by the rising prevalence of Alzheimer's disease and the increasing aging population. Alzheimer's disease is a progressive neurological disorder that affects memory, thinking, and behavior, and the demand for drugs to manage its symptoms is on the rise.

Analysts believe that the market for Alzheimer's drugs in the U.S. will continue to expand due to several factors. Firstly, there is a growing awareness among healthcare providers and patients regarding early diagnosis and treatment of Alzheimer's disease. This awareness has led to an increased diagnosis rate and subsequent demand for drugs that can slow down disease progression or alleviate symptoms.

Ongoing research and development efforts are focused on discovering new and more effective drugs for Alzheimer's treatment. Pharmaceutical companies are investing heavily in clinical trials and exploring novel therapeutic approaches, including targeting the underlying disease mechanisms. These advancements are expected to bring innovative drugs to the market, further driving market growth. Moreover, the healthcare infrastructure in the U.S., including hospitals, retail pharmacies, and online stores, provides easy accessibility to Alzheimer's drugs. The availability of these drugs through multiple distribution channels ensures convenient access for patients across the country.

U.S. Alzheimer Drugs Overview

In the United States, Alzheimer's drugs play a crucial role in the management of Alzheimer's disease, a progressive neurological disorder affecting millions of individuals. These drugs aim to slow down the progression of the disease, alleviate symptoms, and improve patients' quality of life. The U.S. Alzheimer's drugs market has experienced significant growth and evolution over the years. Currently, there are several FDA-approved drugs available for Alzheimer's treatment. These drugs primarily fall into two categories: cholinesterase inhibitors and N-methyl-D-aspartate (NMDA) receptor antagonists.

The U.S. Alzheimer's drugs market is driven by several key factors that contribute to its growth and development. One of the primary drivers is the increasing prevalence of Alzheimer's disease in the United States. As the population ages, the number of individuals diagnosed with Alzheimer's disease continues to rise. According to the Alzheimer's Association, an estimated 6.2 million Americans aged 65 and older were living with Alzheimer's dementia in 2021, and this number is projected to reach 13.8 million by 2050. This growing prevalence creates a higher demand for drugs that can effectively manage the symptoms and slow down the progression of the disease.

Another driver is the growing awareness and emphasis on early diagnosis of Alzheimer's disease. Healthcare providers and the general public have become more informed about the signs and symptoms of Alzheimer's, leading to improved early detection rates. Early diagnosis allows for timely interventions and treatment strategies, including the use of Alzheimer's drugs. The awareness campaigns conducted by organizations such as the Alzheimer's Association have played a significant role in increasing public knowledge about the disease and the importance of early diagnosis, thereby driving the demand for Alzheimer's drugs.

Advancements in research and development (R&D) efforts are also driving the U.S. Alzheimer's drugs market. Pharmaceutical companies and research institutions are investing heavily in discovering new drugs and treatment options for Alzheimer's disease. The focus of R&D is on developing disease-modifying drugs that target the underlying mechanisms of the disease, aiming to slow down or halt disease progression. Immunotherapies and therapies targeting amyloid plaques and tau protein tangles are among the innovative approaches being explored. These advancements in R&D contribute to the expansion of the market by bringing new and more effective drugs to patients.

The supportive regulatory environment in the United States is another important driver for the market. Regulatory bodies, such as the Food and Drug Administration (FDA), provide a clear pathway for the development and approval of Alzheimer's drugs. The FDA has implemented expedited review processes and regulatory pathways for potential breakthrough therapies, recognizing the urgent need for effective treatments for Alzheimer's disease. This supportive regulatory environment encourages pharmaceutical companies to invest in Alzheimer's drug R&D, as it provides a favorable framework for bringing new drugs to market efficiently.

Furthermore, technological advancements have significantly impacted the U.S. Alzheimer's drugs market. Advanced imaging techniques, such as positron emission tomography (PET) scans and magnetic resonance imaging (MRI), have improved the early detection and diagnosis of Alzheimer's disease. These imaging technologies allow for the visualization of amyloid plaques and neurofibrillary tangles, which are hallmark indicators of Alzheimer's pathology. Additionally, biomarker identification and genetic testing have aided in the early identification of individuals at risk for developing Alzheimer's disease. These technological advancements enhance the understanding of disease progression and facilitate the development of targeted drugs and personalized treatment approaches.

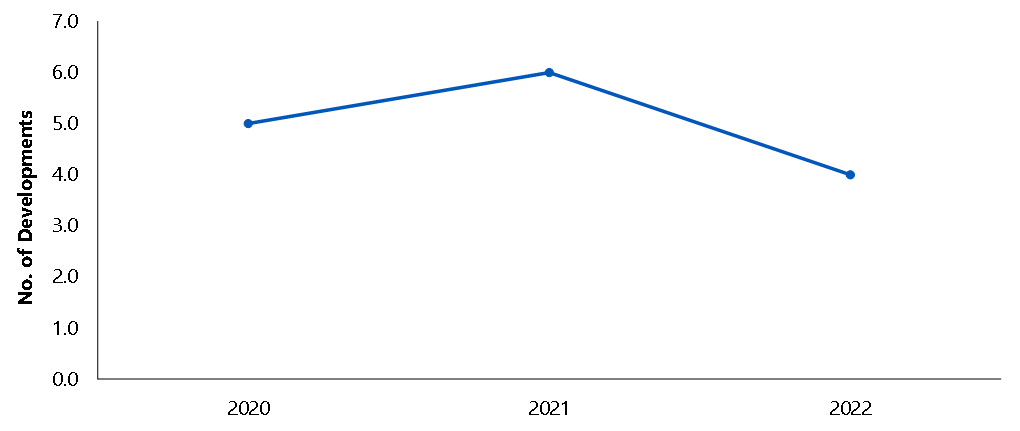

New product launches to flourish in the market

The U.S. Alzheimer Drugs Market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Telemedicine market are:

- In April 2019, the Alzheimer's Drug Discovery Foundation (ADDF) launched the Diagnostics Accelerator program. This initiative aims to support and track the development of digital tools for Alzheimer's disease and dementia. The program focuses on accelerating the validation and regulatory approval of innovative diagnostic technologies, such as blood tests, imaging tools, and digital biomarkers, that can aid in early detection, monitoring, and management of Alzheimer's disease and related dementias.

- In December 2018, Eli Lilly and Company, a pharmaceutical company, announced a collaboration with AC Immune, a Swiss-based biopharmaceutical company. The partnership aimed to develop new treatments for Alzheimer's disease using AC Immune's Morphomer platform. The Morphomer platform focuses on developing small molecule drugs that target the aggregation of abnormal proteins, such as amyloid-beta and tau, which are key pathological features of Alzheimer's disease.

Segment Overview:

By Drug Class: The U.S. Alzheimer Drugs market is divided into Donepezil, Galantamine, Rivastigmine, Memantine and Others. These drug classes encompass the medications commonly prescribed for the management of Alzheimer's disease. Donepezil, Galantamine, Rivastigmine, and Memantine are specific drugs that target different aspects of the disease and help alleviate symptoms. The "Others" category includes additional drugs used for Alzheimer's treatment that may not fall under the specific named drug classes.

By Distribution Channel: The U.S. Alzheimer Drugs market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Stores and Others. These distribution channels serve as avenues for patients to access Alzheimer's drugs. Hospital pharmacies are typically located within healthcare facilities, while retail pharmacies are standalone or chain pharmacies. Online stores provide the convenience of purchasing medications through digital platforms. The "Others" category may encompass additional channels for drug distribution, such as specialty clinics or long-term care facilities.

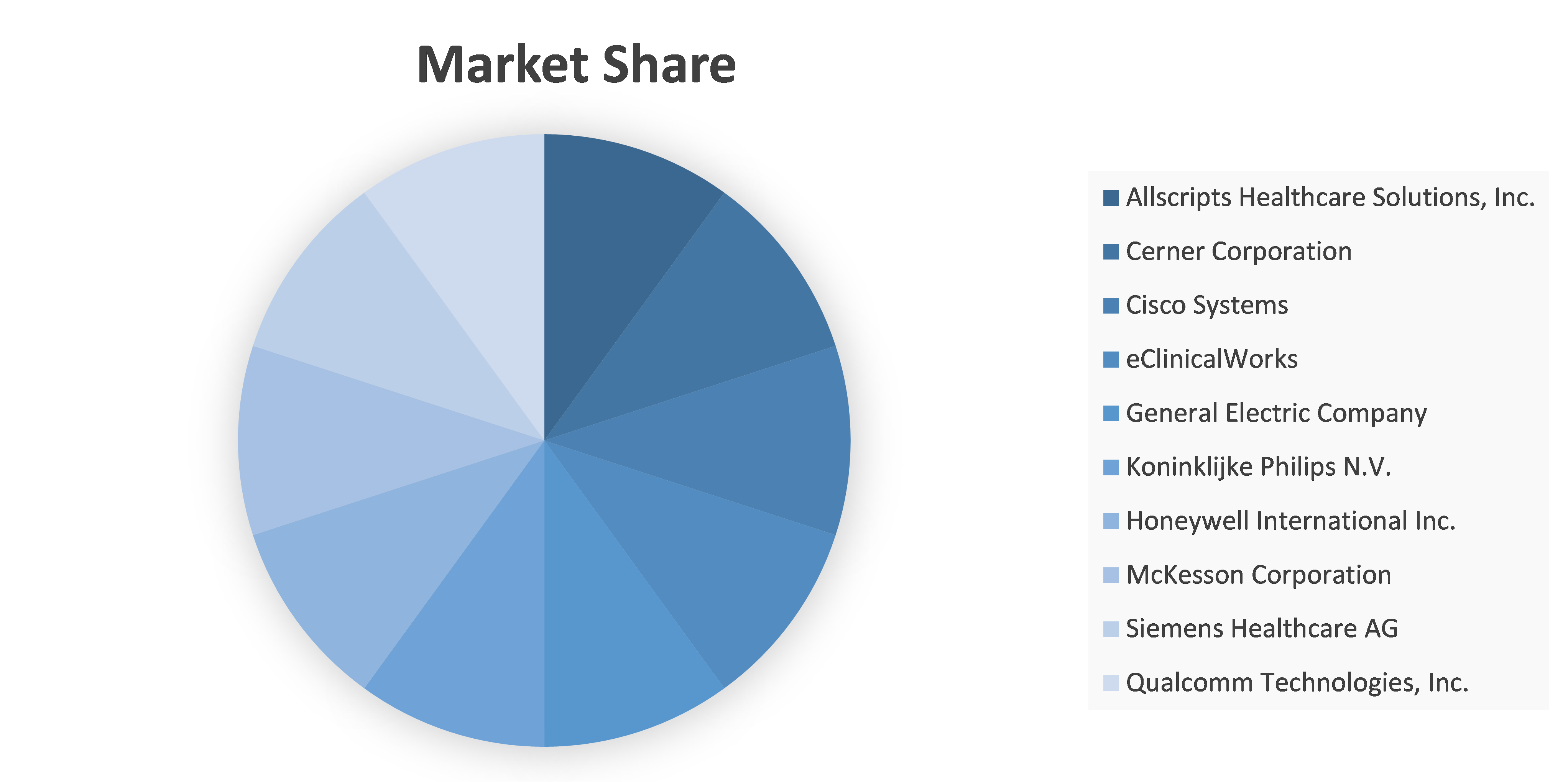

Competitive analysis and profiles of the major players in the U.S. Alzheimer Drugs market, such as AbbVie Inc., AstraZeneca PLC, Biogen Inc., Daiichi Sankyo Company Limited, Eisai Co. Ltd., Eli Lilly and Company, H. Lundbeck A/S, F. Hoffmann-La Roche AG, Merck & Co. Inc. and Novartis AG. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the U.S. Alzheimer Drugs market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Drug Type, Distribution Channel, and Region |

|

Regions Covered |

South Korea |

|

Companies Covered |

|

Key Segments Covered

Drug Class

- Donepezil

- Galantamine

- Rivastigmine

- Memantine

- Others

Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Stores

- Others

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Drug Class trends

- By Distribution Channel trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- U.S. Alzheimer Drugs Market, by Drug Class

- Donepezil

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Galantamine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rivastigmine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Memantine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Donepezil

- U.S. Alzheimer Drugs Market, by Distribution Channel

- Hospital Pharmacy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Retail Pharmacy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Online Stores

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospital Pharmacy

- Company profiles

- AbbVie Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- AstraZeneca PLC

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Biogen Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Daiichi Sankyo Company Limited

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Eisai Co. Ltd.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Eli Lilly and Company

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- H. Lundbeck A/S

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- F. Hoffmann-La Roche AG

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Merck & Co. Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novartis AG

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- AbbVie Inc.

Segmentation

Key Segments Covered

Drug Class

- Donepezil

- Galantamine

- Rivastigmine

- Memantine

- Others

Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Stores

- Others

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.