- Home

- United States Colorectal Cancer Drugs Market

United States Colorectal Cancer Drugs Market Analysis 2023

- Published Date: June, 2023 | Report ID: CLS-1944 | No of pages: 250 | Format:

U.S. Colorectal Cancer Drugs Market Analysis by Type (Vascular Endothelial Growth Factor (VEGF) Inhibitors, Epidermal Growth Factor Receptor (EGFR) Inhibitors, Programmed Cell Death Protein I/PDI Ligand 1 (PDI/PDLI) Inhibitors, BRAF or MEK Inhibitors, Tyrosine Kinase (TKI) Inhibitors and Immunomodulators), by Class (Immunotherapy, Chemotherapy and Other Classes), by Distribution Channels (Hospitals Pharmacies, Retail Pharmacies and Other Distribution Channels): Global Opportunity Analysis and Industry Forecast, 2022-2031

The U.S. Colorectal Cancer Drugs market was valued at $5,500 million in 2022. It is projected to grow at a CAGR of XX% from 2023 to 2031 and reach more than $8,200 million by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

Analysts have a positive outlook on the U.S. colorectal cancer drugs market due to the increasing prevalence of colorectal cancer, particularly among the aging population. According to the American Cancer Society, colorectal cancer is the third most common cancer diagnosed in both men and women in the United States. This rising prevalence is a significant driver of market growth as it creates a higher demand for effective treatment options.

Improved screening and diagnostic practices have contributed to the early detection of colorectal cancer, further fueling the demand for treatments. Screening programs, such as colonoscopies and fecal occult blood tests, have become more widespread, leading to earlier diagnoses and better treatment outcomes. This has increased the need for advanced and targeted therapies to address the specific needs of colorectal cancer patients.

Targeted therapies, such as VEGF inhibitors and EGFR inhibitors, have shown promising efficacy in inhibiting tumor growth and improving patient outcomes. The demand for these therapies has increased as healthcare providers and patients recognize their potential benefits in treating colorectal cancer. With favorable reimbursement policies and a well-established healthcare infrastructure in the United States, patients have better access to colorectal cancer drugs through various distribution channels. Hospitals and retail pharmacies play a vital role in ensuring the availability of these drugs to meet the increasing demand driven by the rising prevalence of colorectal cancer.

U.S. Colorectal Cancer Drugs Overview

The U.S. colorectal cancer drugs market is a significant segment within the pharmaceutical industry, focused on developing and providing effective treatments for colorectal cancer patients. Colorectal cancer, which affects the colon or rectum, is one of the leading causes of cancer-related deaths in the United States.

The American Society of Clinical Oncology (ASCO) and other organizations play a crucial role in shaping the landscape of the colorectal cancer drugs industry. One significant influence is the guidelines and recommendations provided by the U.S. Food and Drug Administration (FDA). These guidelines are outlined in the Code of Federal Regulations (CFR), specifically in Title 21, Part 312, which contains various sub-parts related to the development, evaluation, and marketing of drugs.

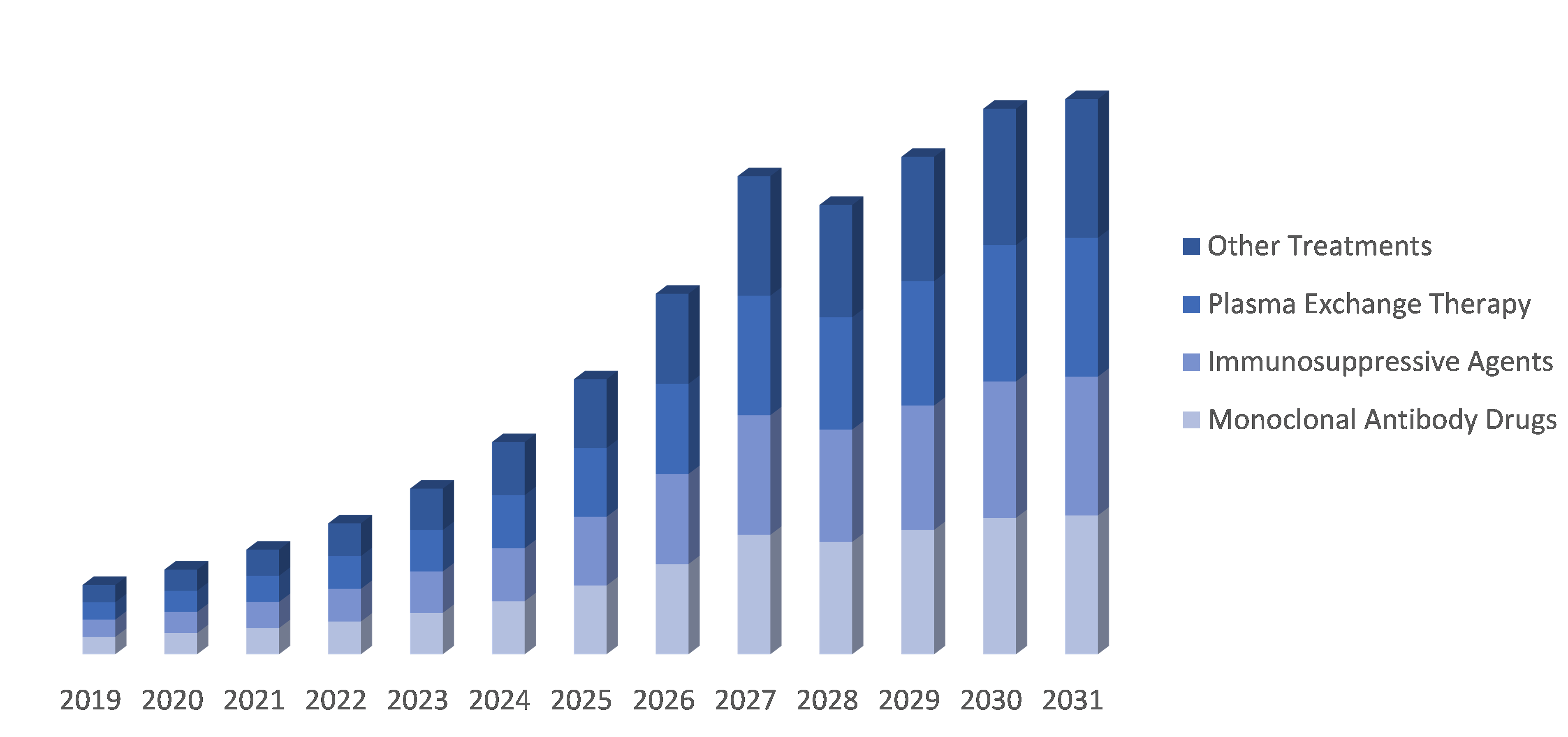

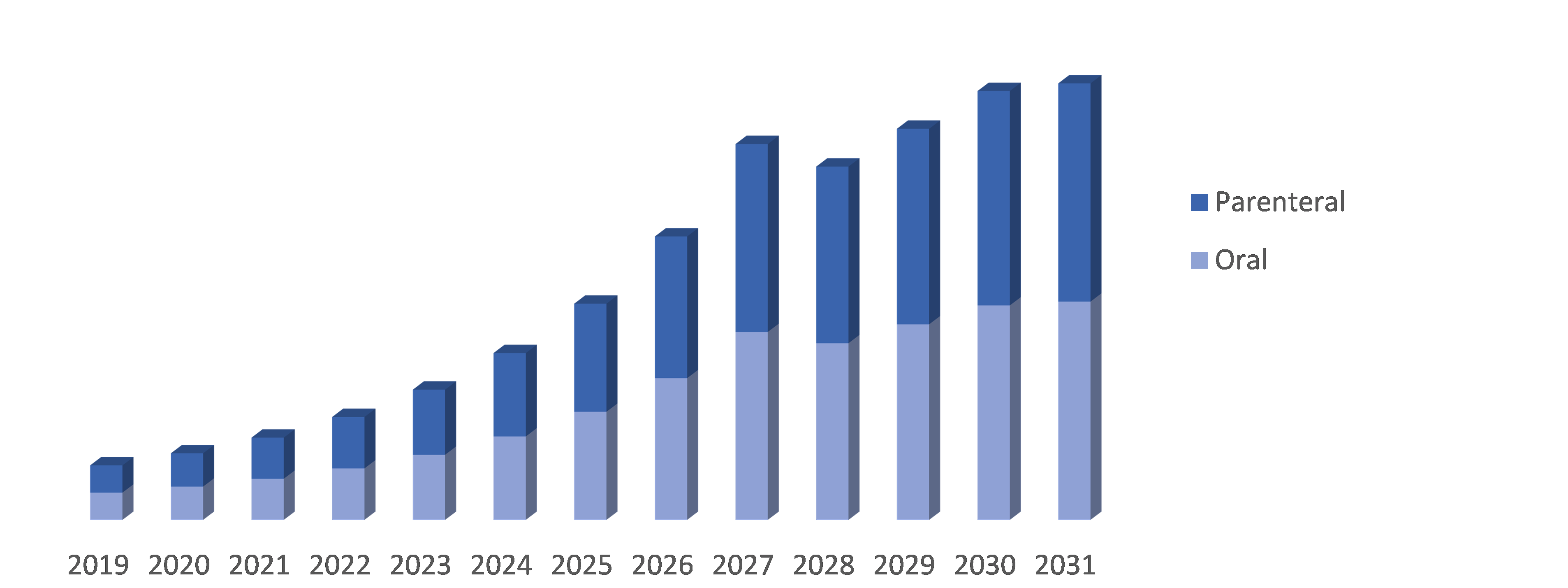

The market offers a range of treatment options, including chemotherapy, immunotherapy, targeted therapies, and other supportive care drugs. Chemotherapy drugs are commonly used to kill or inhibit the growth of cancer cells, and they are often administered systemically. Immunotherapies aim to enhance the body's immune response against cancer cells, and they include immune checkpoint inhibitors and immunomodulators. Targeted therapies focus on specific molecular targets associated with colorectal cancer, such as Vascular Endothelial Growth Factor (VEGF) inhibitors, Epidermal Growth Factor Receptor (EGFR) inhibitors, and BRAF or MEK inhibitors.

The market is driven by factors such as the increasing prevalence of colorectal cancer, particularly among the aging population, and improved screening and diagnostic practices leading to early detection. Advancements in treatment modalities, including targeted therapies and immunotherapies, have expanded the treatment options available to patients. Personalized treatment approaches, targeting specific genetic mutations, are also gaining traction.

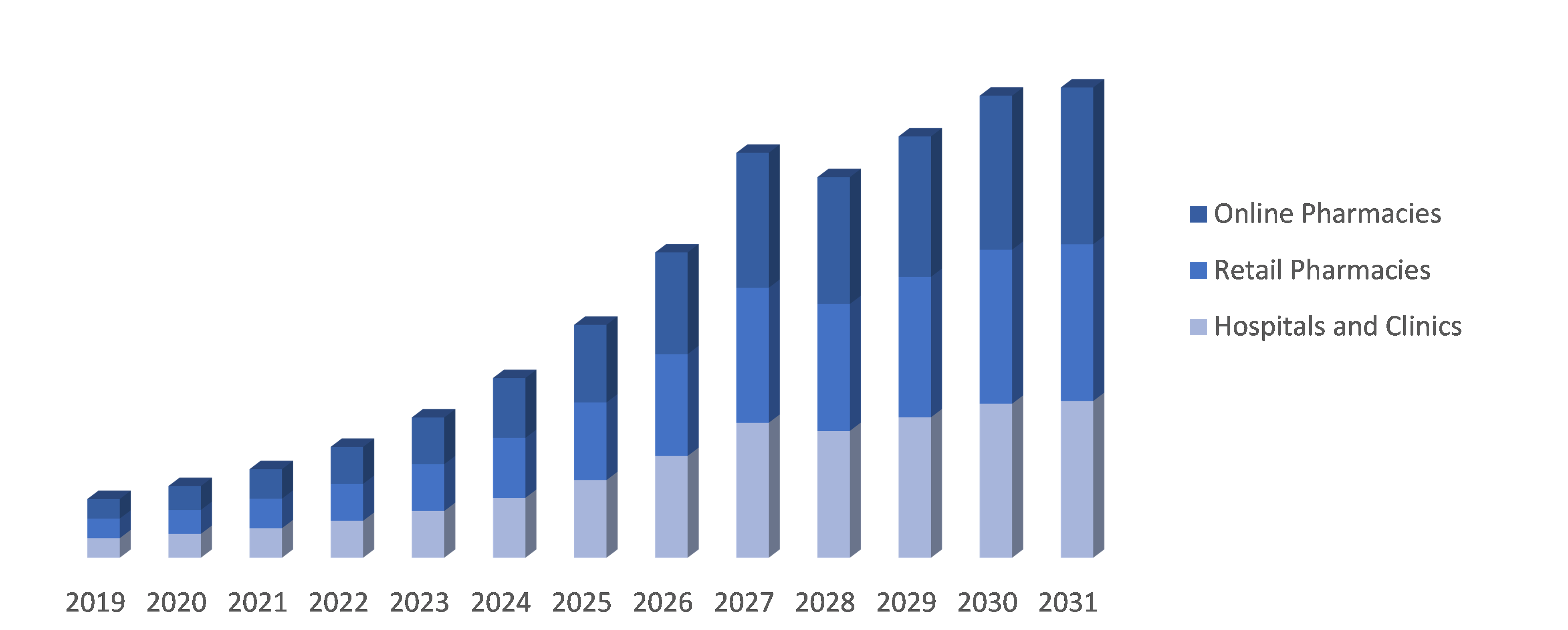

In the United States, the market benefits from favorable reimbursement policies and a well-established healthcare infrastructure. Patients have access to colorectal cancer drugs through various distribution channels, including hospitals, retail pharmacies, and specialty pharmacies. The U.S. colorectal cancer drugs market is highly competitive, with several pharmaceutical companies actively involved in research and development to improve treatment options and patient outcomes. Clinical trials and collaborations between industry players, academic institutions, and research organizations continue to drive innovation in the field.

Overall, the U.S. colorectal cancer drugs market plays a crucial role in addressing the needs of colorectal cancer patients, offering a range of treatment options to improve survival rates and enhance quality of life. Ongoing advancements in research and development are expected to further shape the landscape and bring new therapeutic possibilities to patients in the future.

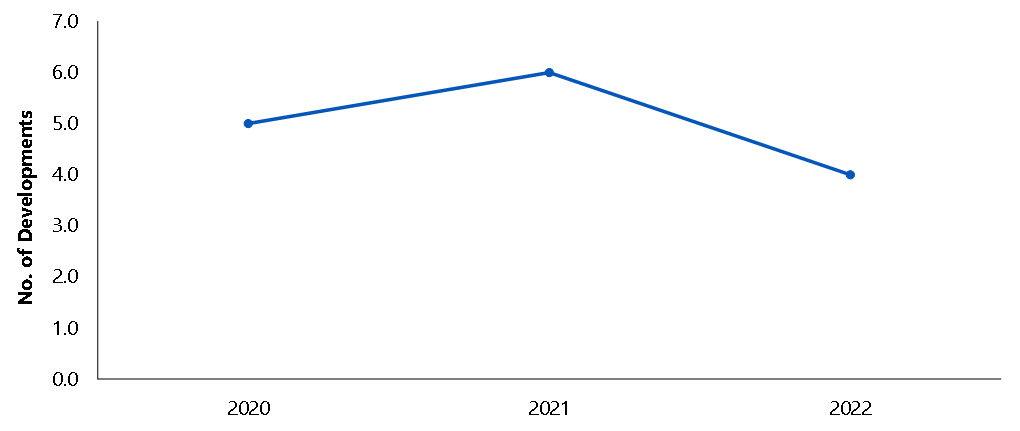

New product launches to flourish in the market

The U.S. Colorectal Cancer Market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Telemedicine market are:

- In May 2022, Bruker, a leading company in preclinical magnetic resonance imaging (MRI) systems, introduced a new line of conduction-cooled Maxwell magnets for its portfolio. The 7 Tesla and 9.4 Tesla magnets offer high-field sensitivity and resolution for advanced preclinical MRI and PET/MR research. Notably, these magnets eliminate the need for liquid Helium or Nitrogen refills, providing a more convenient and efficient solution for researchers.

- In January 2022, Amgen, a global biopharmaceutical company, and Generate Biomedicines announced a research collaboration agreement. The collaboration aims to discover and develop protein therapeutics for five clinical targets spanning various therapeutic areas and modalities. By combining their expertise, the two companies aim to enhance drug discovery efforts and generate novel protein sequences with optimal therapeutic properties. This collaboration has the potential to lead to the development of innovative treatments across a range of diseases.

Segment Overview:

By Type: The U.S. Colorectal Cancer Drugs market is divided into Vascular Endothelial Growth Factor (VEGF) Inhibitors, Epidermal Growth Factor Receptor (EGFR) Inhibitors, Programmed Cell Death Protein I/PDI Ligand 1 (PDI/PDLI) Inhibitors, BRAF or MEK Inhibitors, Tyrosine Kinase (TKI) Inhibitors and Immunomodulators. These categories represent different types of drugs used in the treatment of colorectal cancer, targeting specific biological pathways or genetic mutations associated with the disease.

By Class: The U.S. Colorectal Cancer Drugs market is segmented into Immunotherapy, Chemotherapy and Other Classes. Immunotherapy includes drugs that enhance the immune system's response against cancer cells. Chemotherapy consists of drugs that directly kill or inhibit the growth of cancer cells. The Other Classes category encompasses additional drug classes used in the treatment of colorectal cancer, such as targeted therapies and supportive care drugs.

By Distribution Channel: The Telemedicine market is segmented into Hospitals Pharmacies, Retail Pharmacies and Other Distribution Channels. Hospitals Pharmacies refer to drug dispensing and administration within hospital settings. Retail Pharmacies encompass drug dispensing through retail pharmacy outlets. The Other Distribution Channels category may include specialty pharmacies, online pharmacies, and other non-traditional channels for the distribution of colorectal cancer drugs.

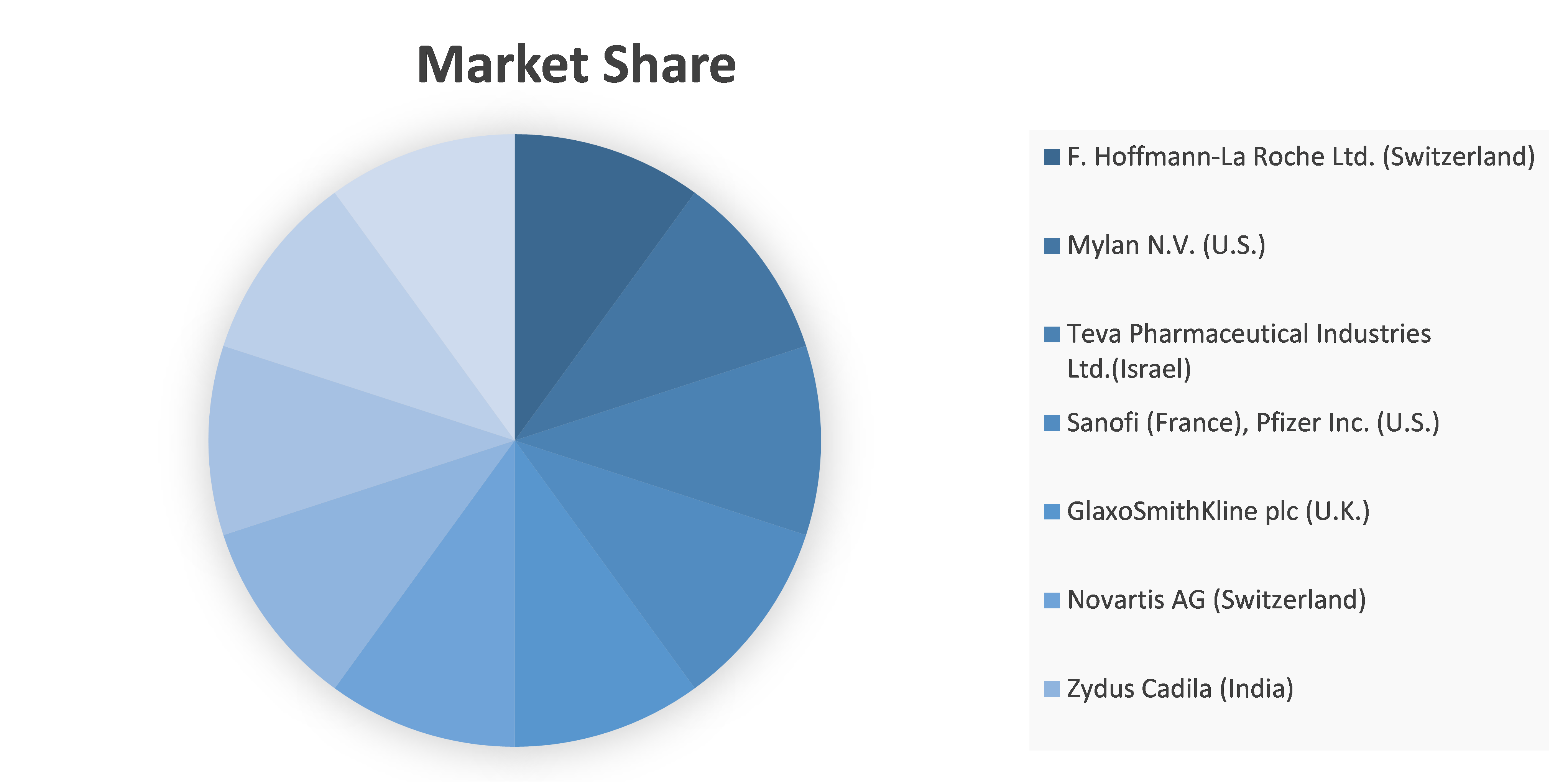

Competitive analysis and profiles of the major players in the U.S. Colorectal Cancer Drugs market, such as F. Hoffmann-La Roche AG, Epigenomics AG, Novigenix SA, Abbott Laboratories, Amgen Inc., Volitionrx, EDP Biotech, Clinical Genomics Technologies Pvt Ltd, Bruker and Quest Diagnostics Incorporated. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the U.S. Colorectal Cancer Drugs market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Type, Class, Distribution Channel and Region |

|

Regions Covered |

U.S. |

|

Companies Covered |

|

Key Segments Covered

By Type:

- Vascular Endothelial Growth Factor (VEGF) Inhibitors

- Epidermal Growth Factor Receptor (EGFR) Inhibitors

- Programmed Cell Death Protein I/PDI Ligand 1 (PDI/PDLI) Inhibitors

- BRAF or MEK Inhibitors

- Tyrosine Kinase (TKI) Inhibitors

- Immunomodulators

By Distribution Channels:

- Hospitals Pharmacies

- Retail Pharmacies

- Other Distribution Channels

By Class:

- Immunotherapy

- Chemotherapy

- Other Classes

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Type trends

- By Class trends

- By Distribution Channel trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- U.S. Colorectal Cancer Drugs Market, by Type

- Vascular Endothelial Growth Factor (VEGF) Inhibitors

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Epidermal Growth Factor Receptor (EGFR) Inhibitors

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Programmed Cell Death Protein I/PDI Ligand 1 (PDI/PDLI) Inhibitors

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- BRAF or MEK Inhibitors

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Tyrosine Kinase (TKI) Inhibitors

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Immunomodulators

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Vascular Endothelial Growth Factor (VEGF) Inhibitors

- U.S. Colorectal Cancer Drugs Market, by Class

- Immunotherapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Chemotherapy

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Immunotherapy

- U.S. Colorectal Cancer Drugs Market, by Distribution Channel

- Hospitals Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Retail Pharmacies

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospitals Pharmacies

- Company profiles

- F. Hoffmann-La Roche AG

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Epigenomics AG

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novigenix SA

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Abbott Laboratories

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Amgen Inc.

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Volitionrx

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- EDP Biotech

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Clinical Genomics Technologies Pvt Ltd

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Bruker

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Quest Diagnostics Incorporated

- Business overview

- Financial performance

- Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- F. Hoffmann-La Roche AG

Segmentation

Key Segments Covered

By Type:

- Vascular Endothelial Growth Factor (VEGF) Inhibitors

- Epidermal Growth Factor Receptor (EGFR) Inhibitors

- Programmed Cell Death Protein I/PDI Ligand 1 (PDI/PDLI) Inhibitors

- BRAF or MEK Inhibitors

- Tyrosine Kinase (TKI) Inhibitors

- Immunomodulators

By Distribution Channels:

- Hospitals Pharmacies

- Retail Pharmacies

- Other Distribution Channels

By Class:

- Immunotherapy

- Chemotherapy

- Other Classes

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.