- Home

- United States Rheumatoid Arthritis Drugs Market

United States Rheumatoid Arthritis Drugs Market Research Report 2023

- Published Date: June, 2023 | Report ID: CLS-1940 | No of pages: 250 | Format:

U.S. Rheumatoid Arthritis Drugs Market Analysis by Drug Class Type (Disease-modifying Anti-rheumatic Drugs (DMARDs), Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Corticosteroids, Uric Acid Drugs and Others), by Route Of Administration (Oral, Parenteral), by Sales Channel (Prescription-based Drugs and Over-the-counter Drugs): Global Opportunity Analysis and Industry Forecast, 2022-2031

The U.S. Rheumatoid Arthritis Drugs market was valued at $25,500 million in 2022. It is projected to grow at a CAGR of XX% from 2023 to 2031 and reach more than $30,000 million by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

Rheumatoid arthritis (RA) is a chronic autoimmune disease affecting a significant number of individuals in the U.S. The market for RA drugs is driven by factors such as the high prevalence of the disease, increasing awareness, and the need for effective treatments.

Analysts anticipate steady growth in the U.S. Rheumatoid Arthritis Drugs market due to several factors. Firstly, the introduction of disease-modifying anti-rheumatic drugs (DMARDs) has revolutionized RA treatment. DMARDs, such as methotrexate and biologic therapies like TNF inhibitors, have shown efficacy in managing symptoms, slowing disease progression, and improving patients' quality of life.

Additionally, ongoing research and development efforts focus on the discovery of novel therapies, including targeted synthetic DMARDs and Janus kinase (JAK) inhibitors. These innovative drugs provide new treatment options for patients who do not respond adequately to existing therapies. The market is also influenced by the route of administration. While oral DMARDs are commonly prescribed, the availability of parenteral options like subcutaneous and intravenous formulations provides flexibility and convenience for patients and healthcare providers.

Moreover, the market's sales channel is predominantly prescription-based, as RA drugs require medical supervision. However, some over-the-counter (OTC) nonsteroidal anti-inflammatory drugs (NSAIDs) are available for symptom relief.

U.S. Rheumatoid Arthritis Drugs Overview

Rheumatoid arthritis is a chronic autoimmune disease that affects the joints, causing pain, swelling, stiffness, and reduced mobility. It affects people of all ages, but the onset is most common between the ages of 30 and 60. According to estimates, RA affects around 1% of the global population, with higher prevalence in women. The prevalence of RA varies across different regions, with North America and Europe experiencing a relatively higher burden of the disease.

The Rheumatoid Arthritis Drugs market is driven by several factors that contribute to its growth and expansion. Firstly, rheumatoid arthritis is a common autoimmune disease that affects millions of people worldwide. The high prevalence of the disease creates a significant market demand for effective treatment options. As more individuals are diagnosed with rheumatoid arthritis, the demand for rheumatoid arthritis drugs increases.

Advancements in research and development within the field of rheumatology also drive the Rheumatoid Arthritis Drugs market. Ongoing efforts in research and development have led to the introduction of innovative drugs and treatment approaches. These advancements offer new options for managing rheumatoid arthritis, providing patients with improved therapeutic outcomes and contributing to the expansion of the market.

Growing awareness and improved diagnosis rates are significant drivers of the market as well. Increasing awareness about rheumatoid arthritis among both patients and healthcare professionals has resulted in higher diagnosis rates. Early detection and intervention are crucial in managing the disease and preventing further joint damage. As a result, there is a higher demand for rheumatoid arthritis drugs to effectively control symptoms and slow disease progression.

The efficacy of disease-modifying anti-rheumatic drugs (DMARDs) also drives the market growth. DMARDs are the mainstay of rheumatoid arthritis treatment and have shown effectiveness in reducing symptoms, slowing disease progression, and improving patient outcomes. The growing adoption of DMARDs, along with the development of biologic DMARDs and targeted therapies, has revolutionized the treatment of rheumatoid arthritis and contributed to the market expansion. Biologic DMARDs specifically target components of the immune system involved in the inflammatory process, providing significant efficacy in managing the disease. Moreover, the availability of diverse treatment options and routes of administration contributes to market growth. Rheumatoid arthritis drugs are available in various formulations, including oral, injectable, and intravenous, providing flexibility in managing the disease based on individual patient needs and preferences. This allows healthcare providers to tailor treatment regimens, further driving the demand for rheumatoid arthritis drugs.

New product launches to flourish in the market

The U.S. Rheumatoid Arthritis Drugs Market is expected to see several new product launches in the coming years, driven by increasing popularity, especially as more patients seek out the convenience and cost savings offered by these facilities. Some of the key product launches expected in the Telemedicine market are:

- Unichem Laboratories obtained approval from the US FDA in April 2017 for Piroxicam Capsules, which are indicated for the treatment of osteoarthritis and rheumatoid arthritis.

- A Danish start-up company called ROS Therapeutics is currently developing a targeted methotrexate prodrug to address the toxicity associated with its use in treating rheumatoid arthritis. The aim is to enhance the drug's effectiveness while minimizing its side effects.

Segment Overview:

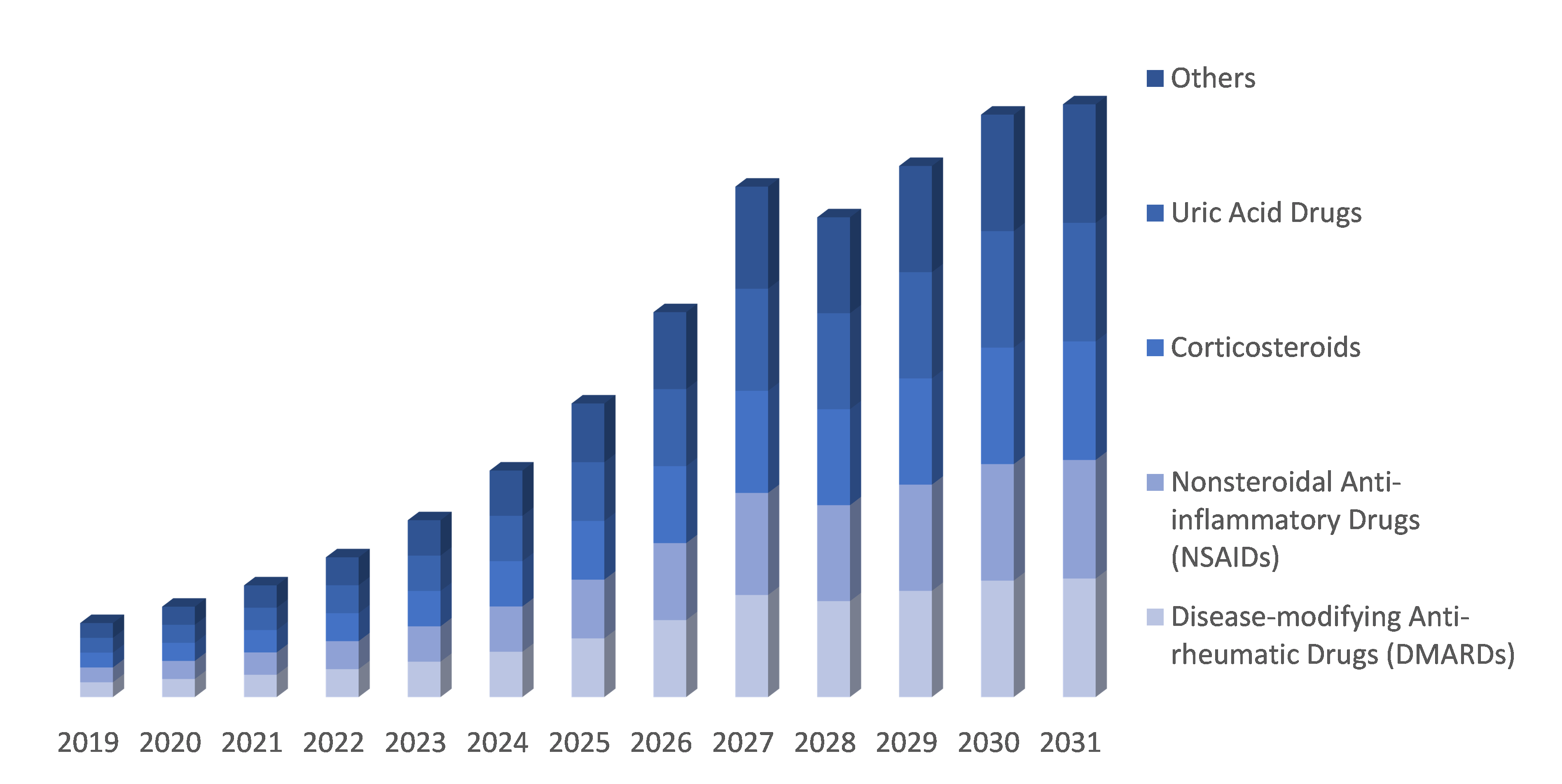

By Drug Class Type: The U.S. Rheumatoid Arthritis Drugs market is divided into (Disease-modifying Anti-rheumatic Drugs (DMARDs), Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Corticosteroids, Uric Acid Drugs and Others. These drug classes offer diverse strategies for the management and treatment of rheumatoid arthritis, providing patients and healthcare professionals with a variety of options. Disease-modifying Anti-rheumatic Drugs (DMARDs) aim to slow disease progression, while Nonsteroidal Anti-inflammatory Drugs (NSAIDs) offer relief from pain and inflammation. Corticosteroids provide potent anti-inflammatory effects, Uric Acid Drugs help manage associated conditions, and the category of "Others" encompasses additional medications used in rheumatoid arthritis management.

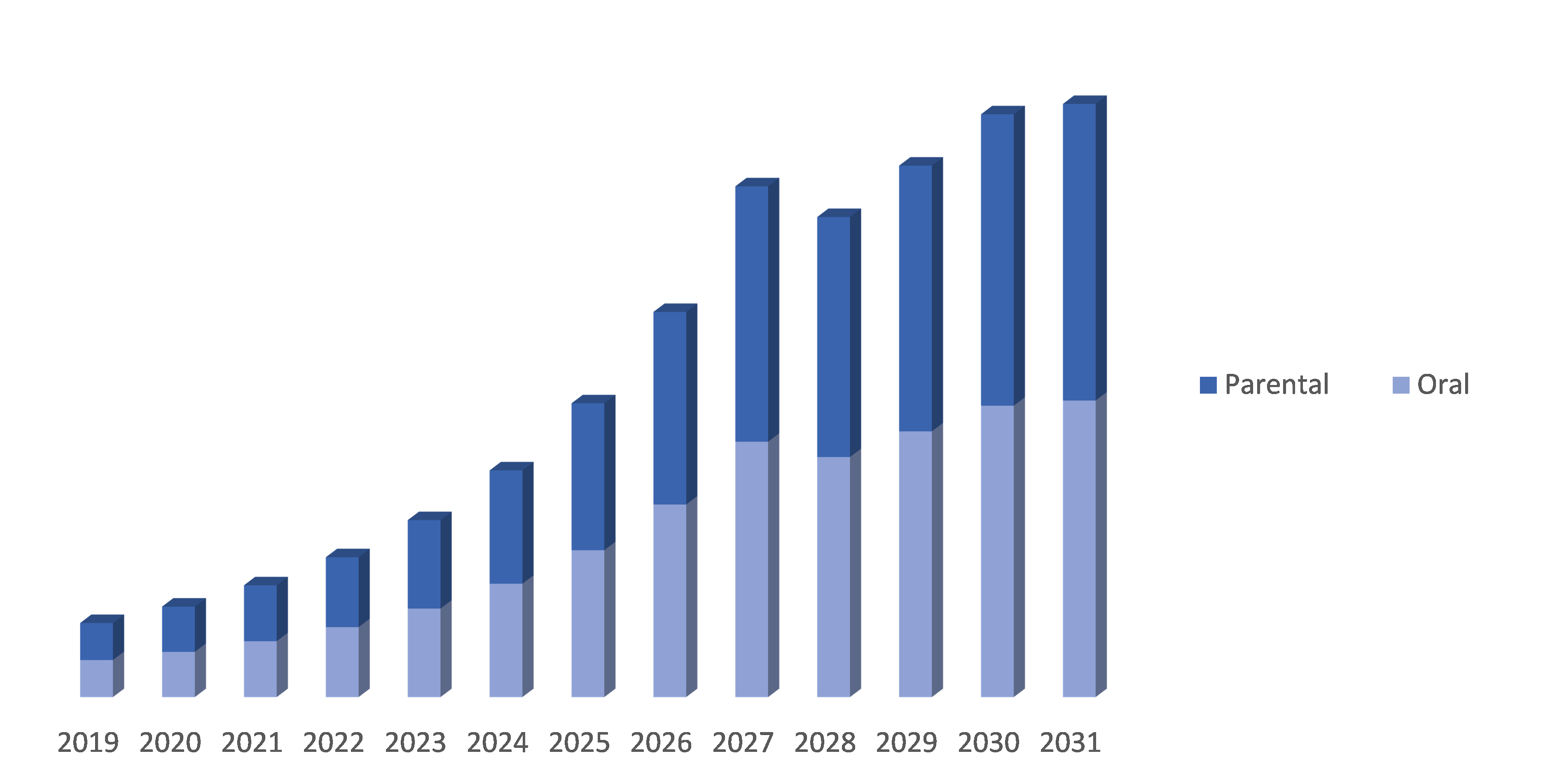

By Route of Administration: The U.S. Rheumatoid Arthritis Drugs market is segmented into Parental and Oral. Parenteral administration refers to the delivery of drugs through injections, either subcutaneously or intravenously. Oral administration involves taking medications in the form of pills, capsules, or tablets by mouth. These different routes of administration offer flexibility in how rheumatoid arthritis drugs are delivered to patients, allowing for personalized treatment approaches.

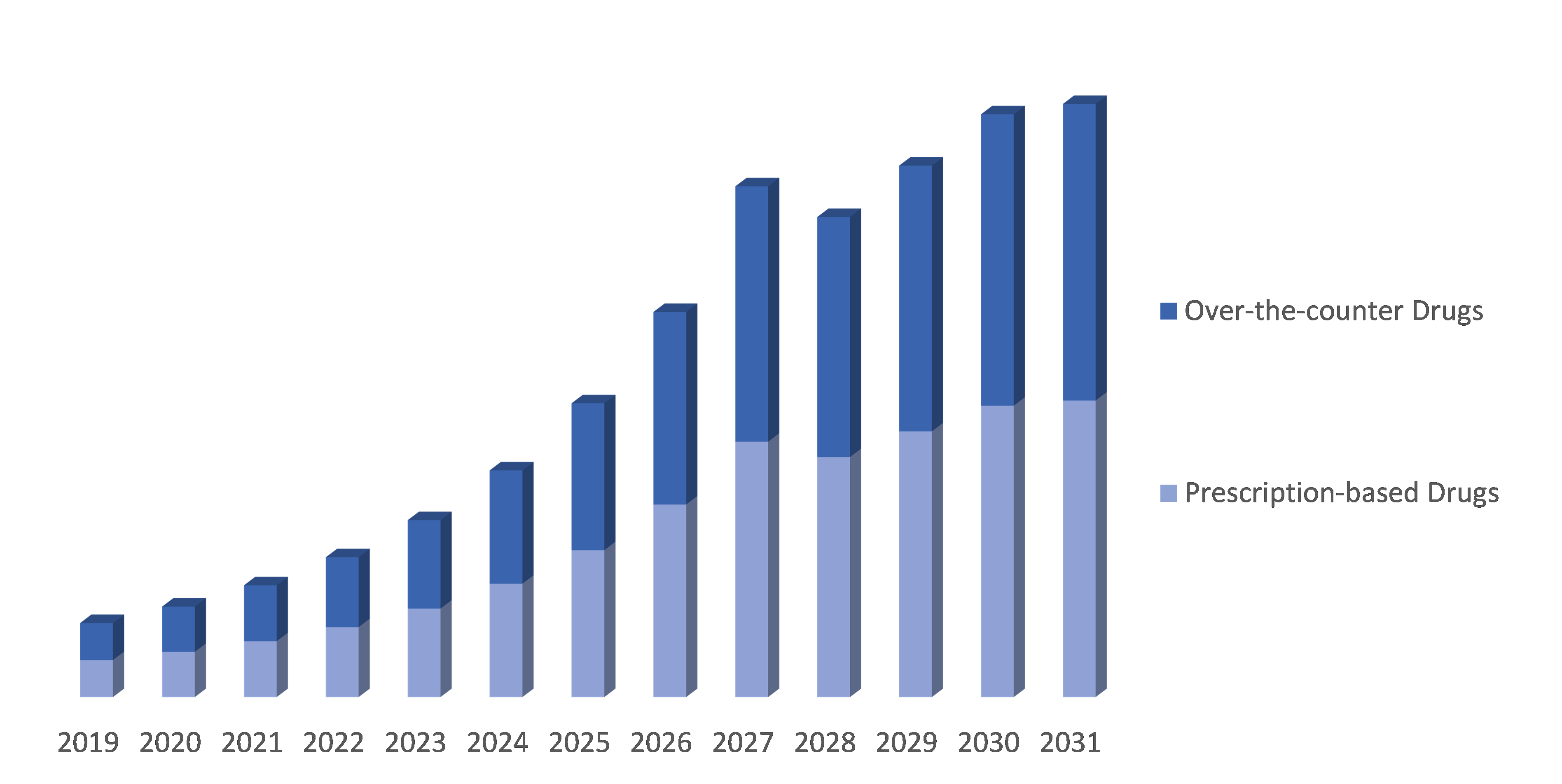

By Distribution Channel: The U.S. Rheumatoid Arthritis Drugs market is segmented into Prescription-based Drugs and Over-the-counter Drugs. Prescription-based drugs are available only with a prescription from a healthcare professional, ensuring proper evaluation and monitoring of patients' condition. Over-the-counter drugs, on the other hand, can be purchased directly by consumers without a prescription. This segmentation provides different options for accessing rheumatoid arthritis medications based on the severity of the condition and healthcare provider's guidance.

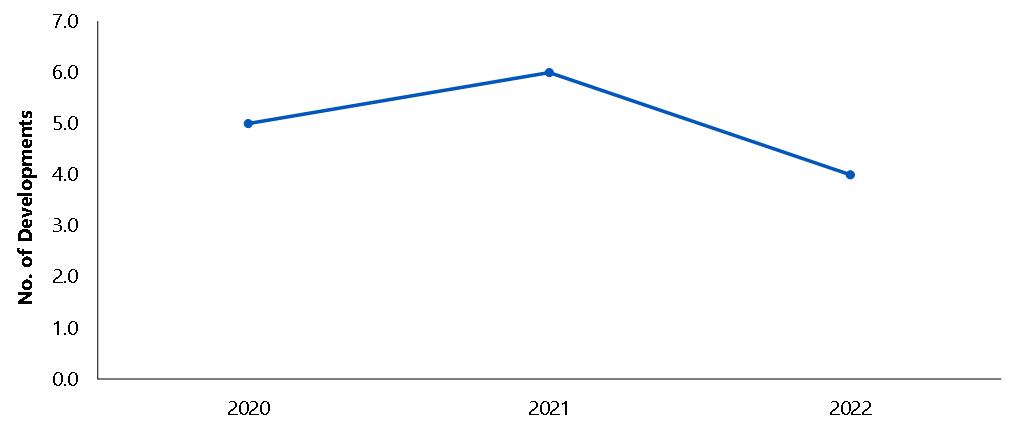

Competitive analysis and profiles of the major players in the U.S. Rheumatoid Arthritis Drugs market, such as AbbVie Inc., Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Johnson & Johnson, Merck & Co., Inc., Novartis AG, Pfizer Inc., and UCB S.A. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the U.S. Rheumatoid Arthritis Drugs market

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By Drug Class, Route of Administration, Sales Channel and Region |

|

Regions Covered |

U.S. |

|

Companies Covered |

|

Key Segments Covered

By Drug Class:

- Disease-modifying Anti-rheumatic Drugs (DMARDs)

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- Corticosteroids

- Uric Acid Drugs

- Others

By Route of Administration:

- Oral

- Parenteral

By Sales Channel:

- Prescription-based Drugs

- Over-the-counter Drugs

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Drug Route of Administration Type trends

- By Route of Administration trends

- By Sales Channel trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- U.S. Rheumatoid Arthritis Drugs Market, by Drug Class Type

- Disease-modifying Anti-rheumatic Drugs (DMARDs)

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Corticosteroids

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Uric Acid Drugs

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Disease-modifying Anti-rheumatic Drugs (DMARDs)

- U.S. Rheumatoid Arthritis Drugs Market, by Route of Administration

- Oral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Parenteral

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Oral

- U.S. Rheumatoid Arthritis Drugs Market, by Sales Channel

- Prescription-based Drugs

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Over-the-counter Drugs

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Prescription-based Drugs

- Company profiles

- AbbVie Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Amgen Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Bristol-Myers Squibb Company

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Eli Lilly and Company

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- F. Hoffmann-La Roche Ltd

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Johnson & Johnson

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Merck & Co., Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Novartis AG

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- Pfizer Inc.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- UCB S.A.

- Business overview

- Financial performance

- Drug Route of Administration Type portfolio

- Recent strategic moves & developments

- SWOT analysis

- AbbVie Inc.

Segmentation

Key Segments Covered

By Drug Class:

- Disease-modifying Anti-rheumatic Drugs (DMARDs)

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- Corticosteroids

- Uric Acid Drugs

- Others

By Route of Administration:

- Oral

- Parenteral

By Sales Channel:

- Prescription-based Drugs

- Over-the-counter Drugs

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2025 Cognate Lifesciences. All Rights Reserved.